Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer All of them Use the following to answer questions 23 - 26 1.T Corporation was organized on January 3, 20XE. The firm was

please answer All of them

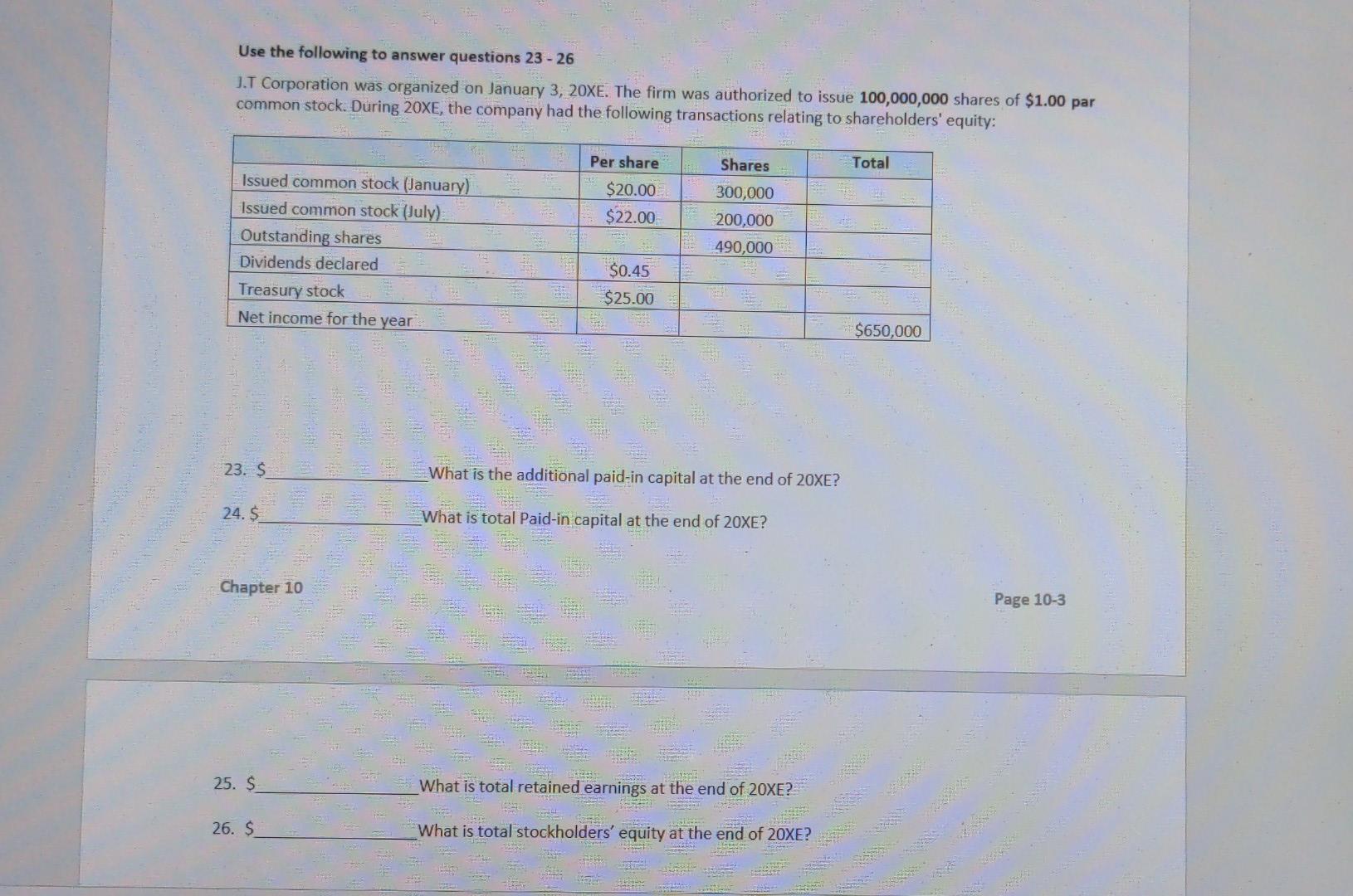

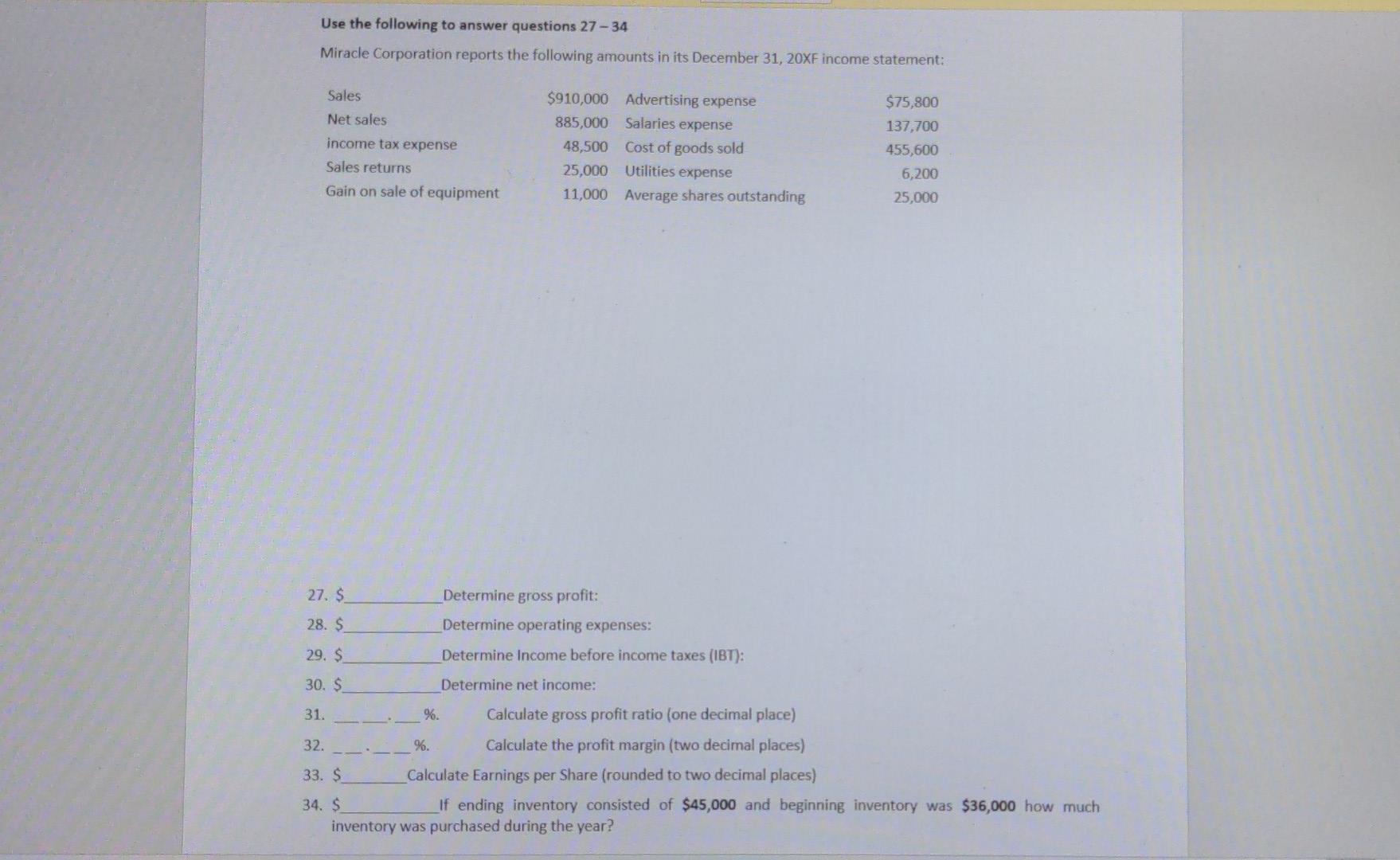

Use the following to answer questions 23 - 26 1.T Corporation was organized on January 3, 20XE. The firm was authorized to issue 100,000,000 shares of $1.00 par common stock. During 20XE, the company had the following transactions relating to shareholders' equity: Per share Total $20.00 $22.00 Issued common stock (January) Issued common stock (July). Outstanding shares Dividends declared Treasury stock Net income for the year Shares 300,000 200,000 490,000 $0.45 $25.00 $650,000 23. $ What is the additional paid-in capital at the end of 20XE? 24. $ What is total Paid-in capital at the end of 20XE? Chapter 10 Page 10-3 25. $ What is total retained earnings at the end of 20XE? 26. $ What is total stockholders' equity at the end of 20XE? Use the following to answer questions 27 - 34 Miracle Corporation reports the following amounts in its December 31, 20XF income statement: Sales Net sales income tax expense Sales returns Gain on sale of equipment $910,000 Advertising expense 885,000 Salaries expense 48,500 Cost of goods sold 25,000 Utilities expense 11,000 Average shares outstanding $75,800 137,700 455,600 6,200 25,000 27. $ Determine gross profit: Determine operating expenses: 28. $ 29. $ Determine Income before income taxes (IBT): 30. $ Determine net income: 31. %. Calculate gross profit ratio (one decimal place) 32. %. Calculate the profit margin (two decimal places) 33. $ Calculate Earnings per Share (rounded to two decimal places) 34. S If ending inventory consisted of $45,000 and beginning inventory was $36,000 how much inventory was purchased during the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started