Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all of these questions, theres only 4!!! Thanks!!! Chapter 14: The Pioneer Corporation has a target capital structure that consists of 55% debt

please answer all of these questions, theres only 4!!! Thanks!!!

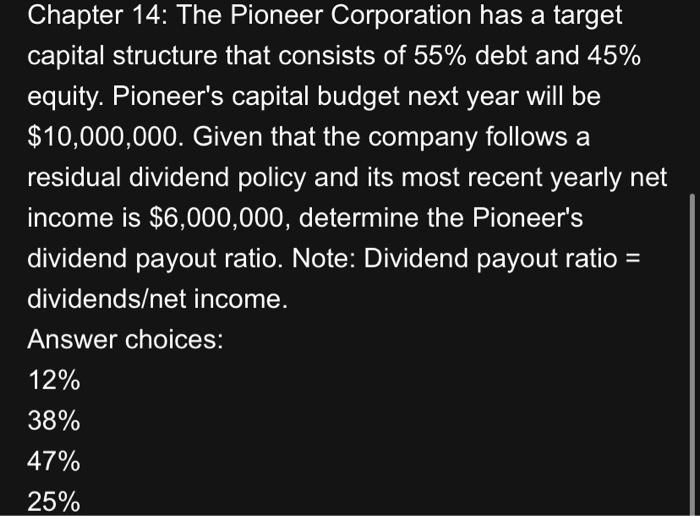

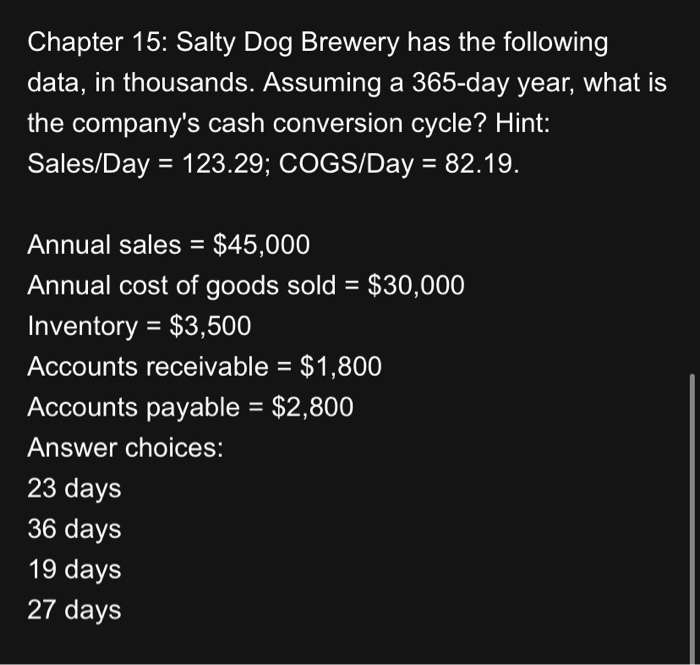

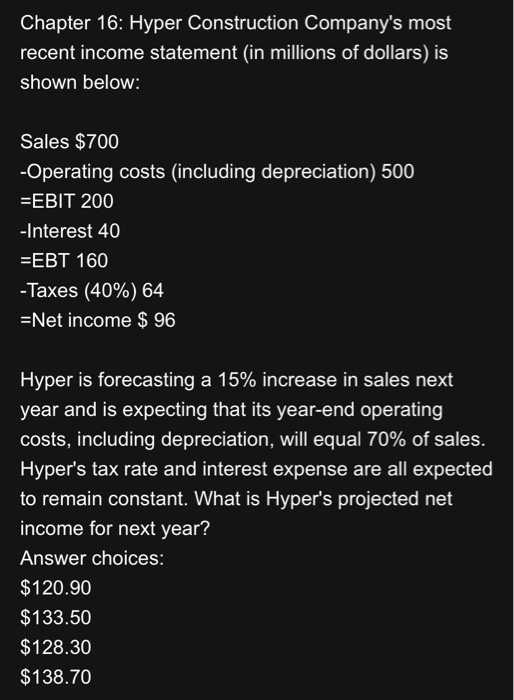

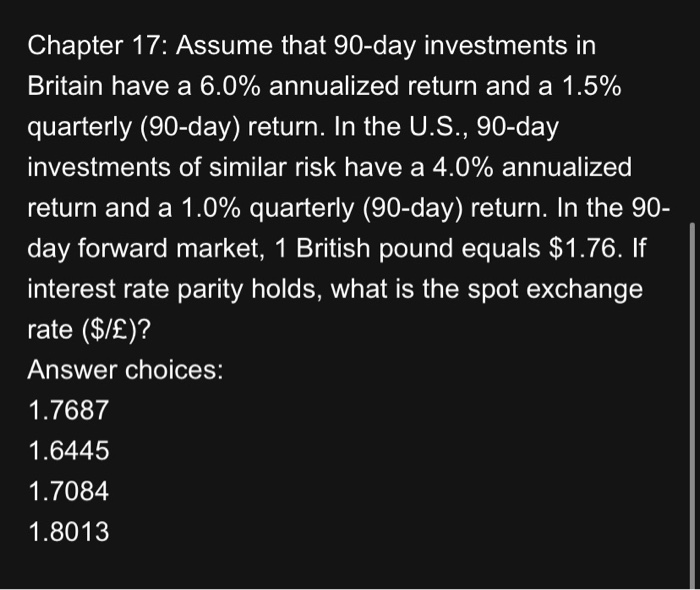

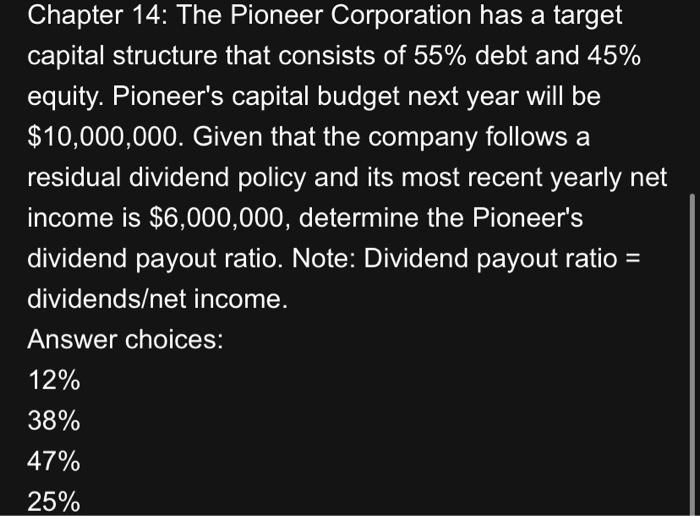

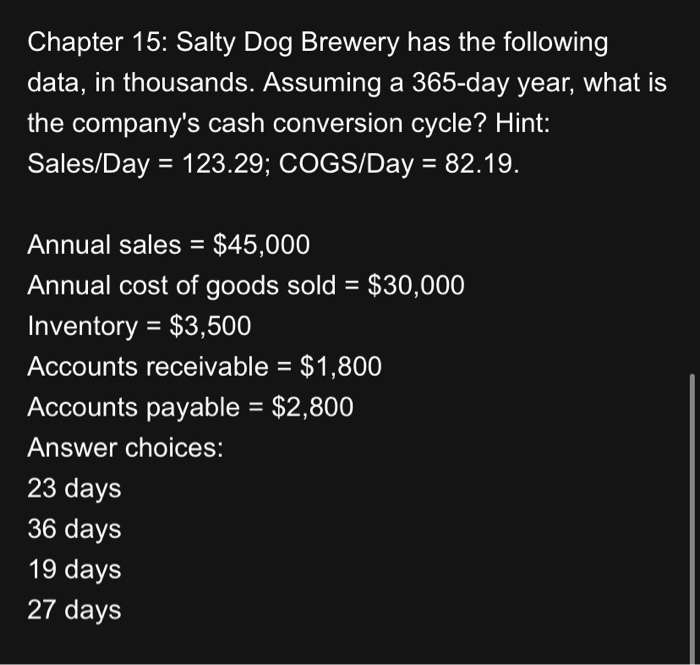

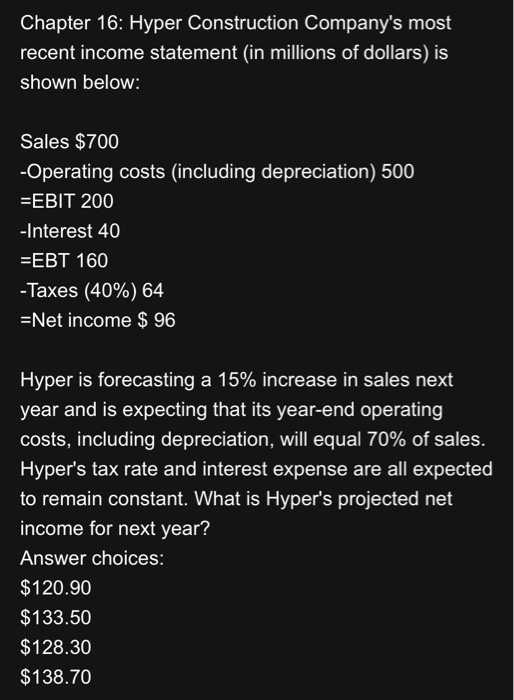

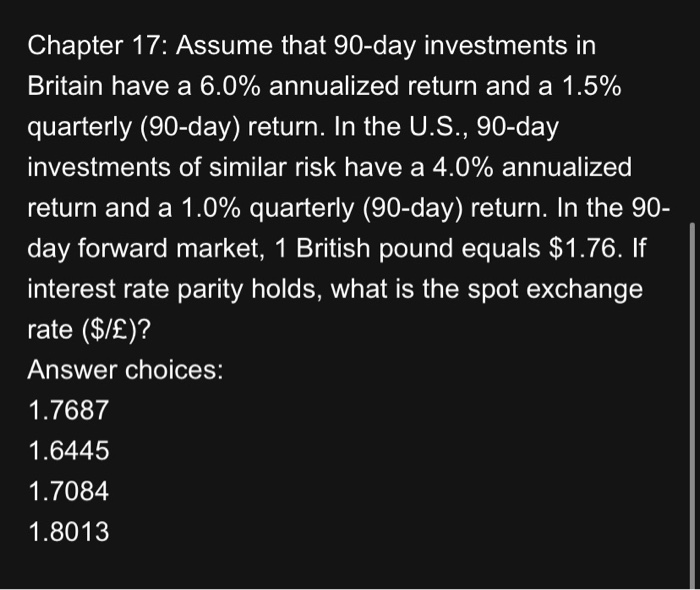

Chapter 14: The Pioneer Corporation has a target capital structure that consists of 55% debt and 45% equity. Pioneer's capital budget next year will be $10,000,000. Given that the company follows a residual dividend policy and its most recent yearly net income is $6,000,000, determine the Pioneer's dividend payout ratio. Note: Dividend payout ratio dividendset income. Answer choices: 12% 38% 47% 25% Chapter 15: Salty Dog Brewery has the following data, in thousands. Assuming a 365-day year, what is the company's cash conversion cycle? Hint: Sales/Day = 123.29; COGS/Day = 82.19. Annual sales = $45,000 Annual cost of goods sold = $30,000 Inventory = $3,500 Accounts receivable = $1,800 Accounts payable = $2,800 Answer choices: 23 days 36 days 19 days 27 days Chapter 16: Hyper Construction Company's most recent income statement (in millions of dollars) is shown below: Sales $700 -Operating costs (including depreciation) 500 =EBIT 200 -Interest 40 =EBT 160 -Taxes (40%) 64 =Net income $ 96 Hyper is forecasting a 15% increase in sales next year and is expecting that its year-end operating costs, including depreciation, will equal 70% of sales. Hyper's tax rate and interest expense are all expected to remain constant. What is Hyper's projected net income for next year? Answer choices: $120.90 $133.50 $128.30 $138.70 Chapter 17: Assume that 90-day investments in Britain have a 6.0% annualized return and a 1.5% quarterly (90-day) return. In the U.S., 90-day investments of similar risk have a 4.0% annualized return and a 1.0% quarterly (90-day) return. In the 90- day forward market, 1 British pound equals $1.76. If interest rate parity holds, what is the spot exchange rate ($/)? Answer choices: 1.7687 1.6445 1.7084 1.8013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started