please answer all

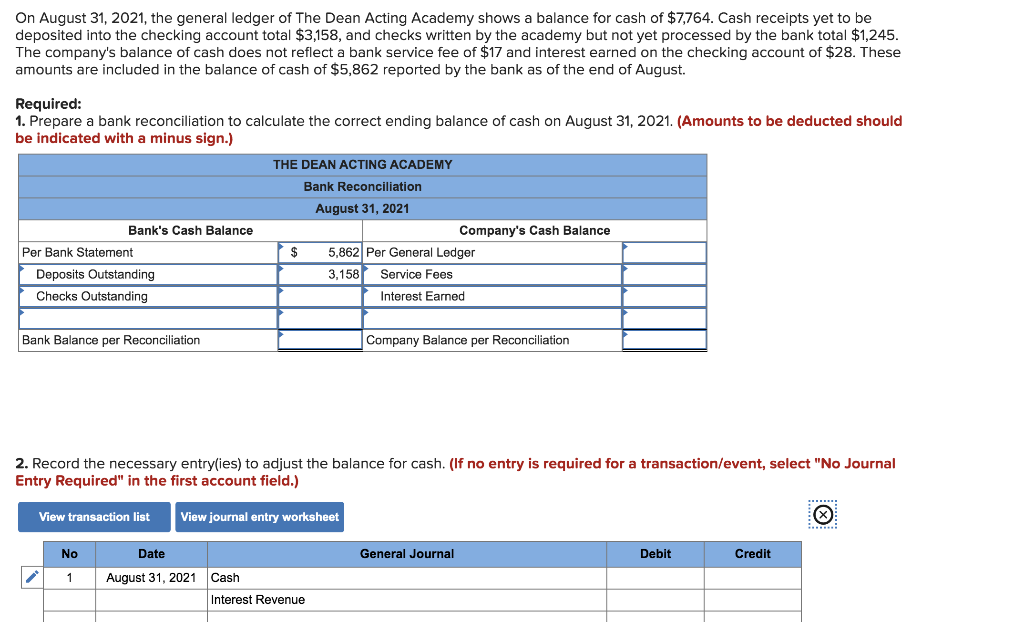

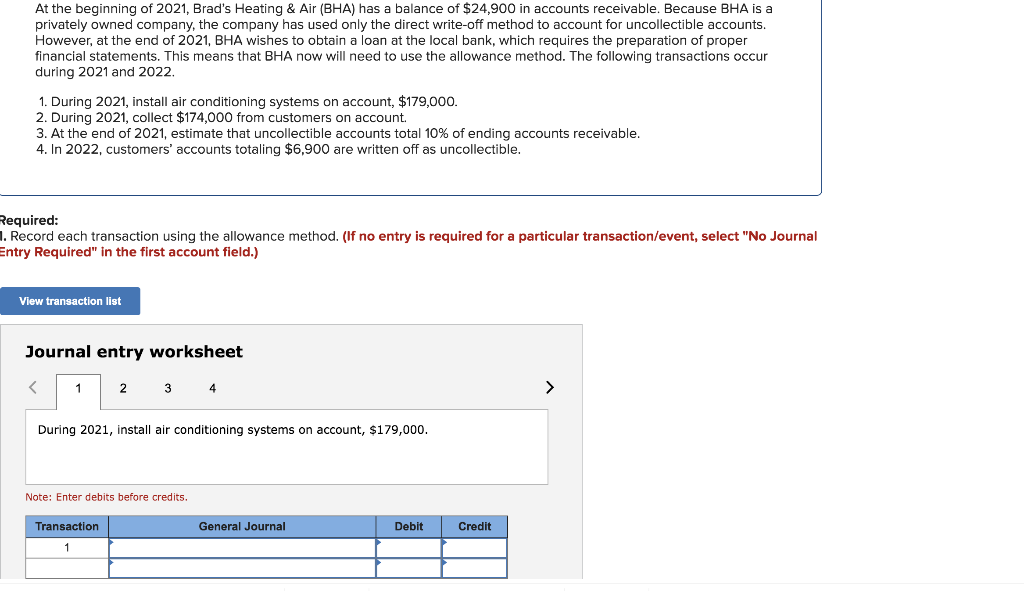

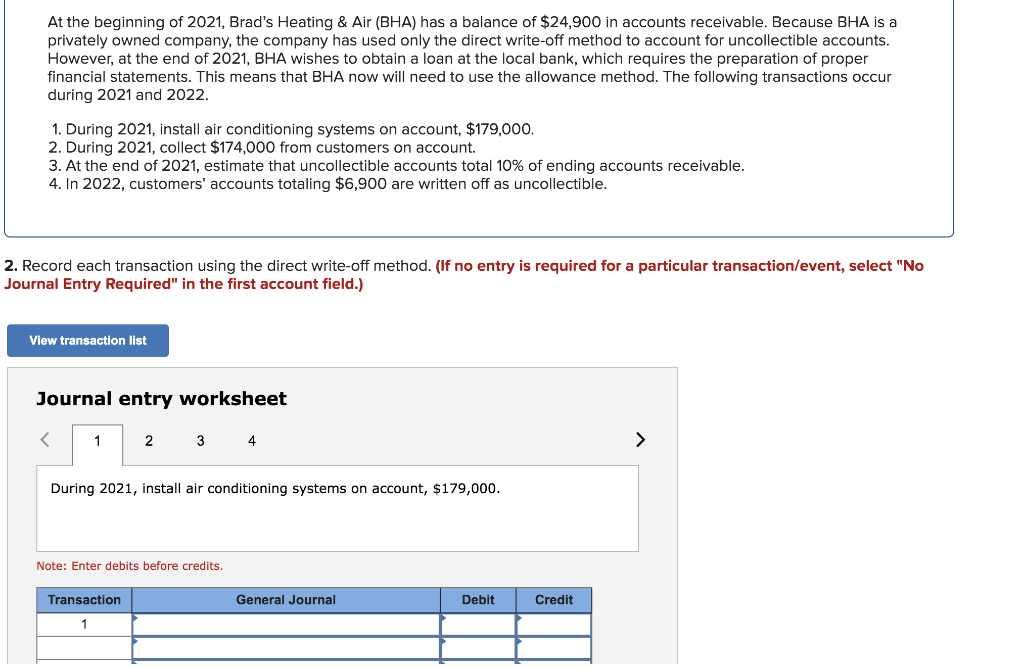

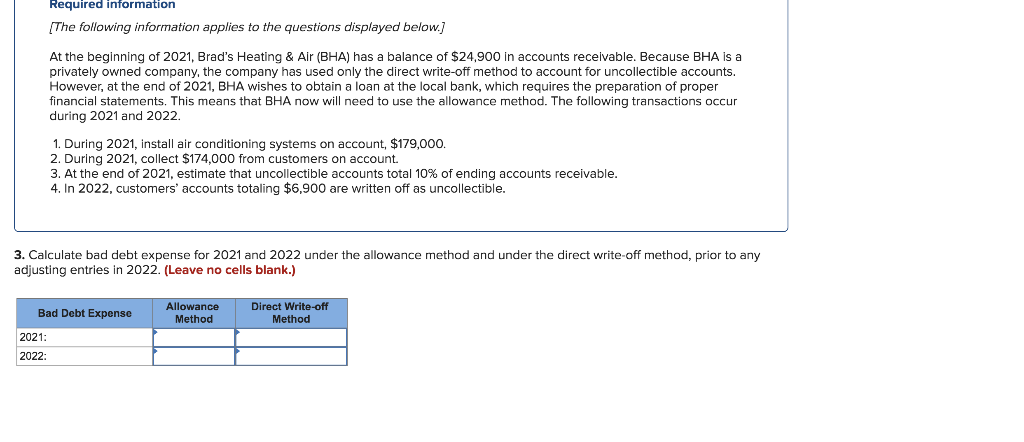

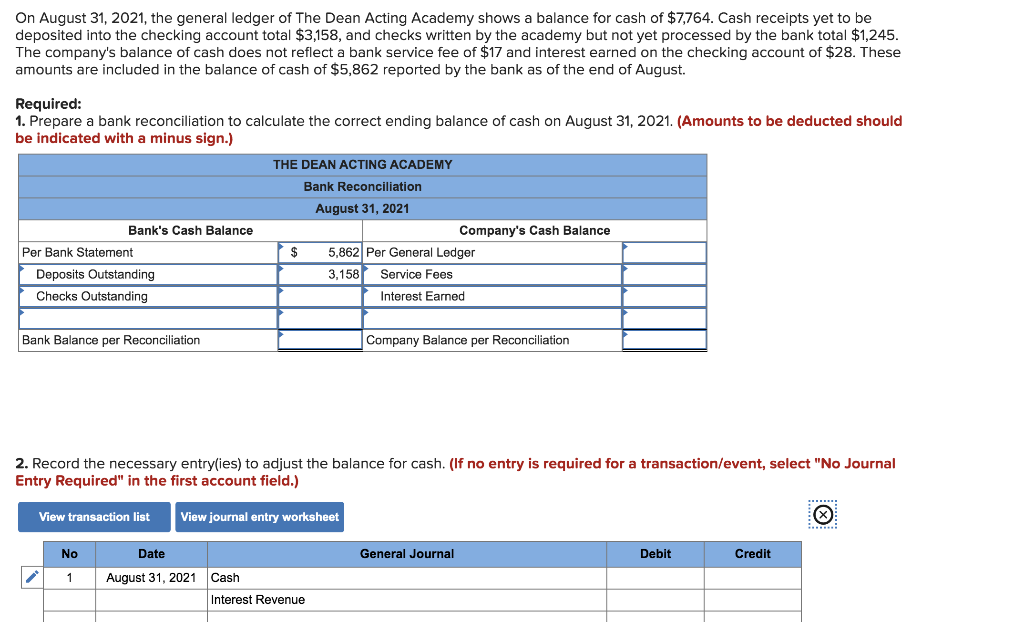

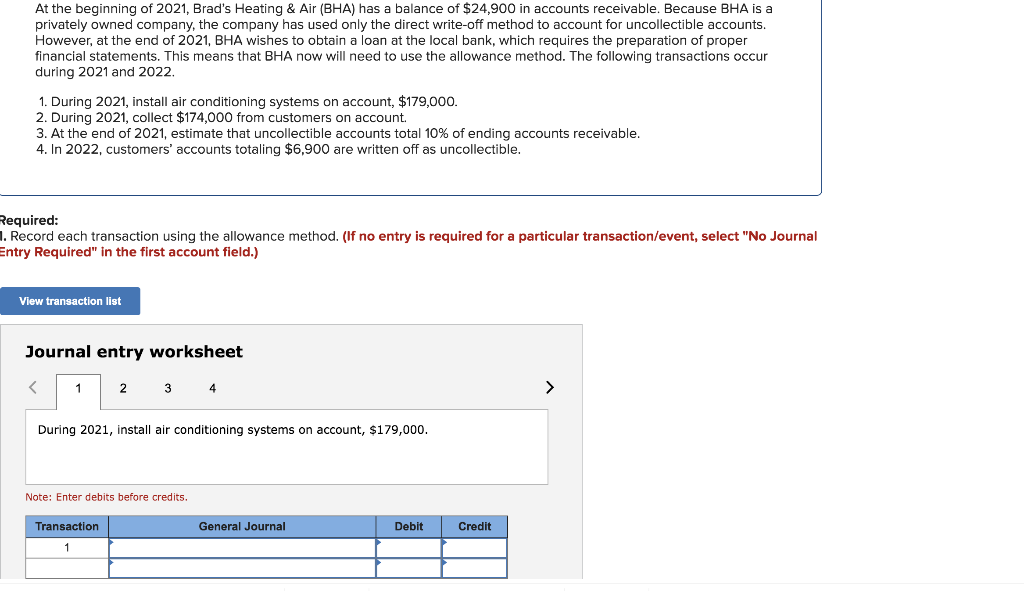

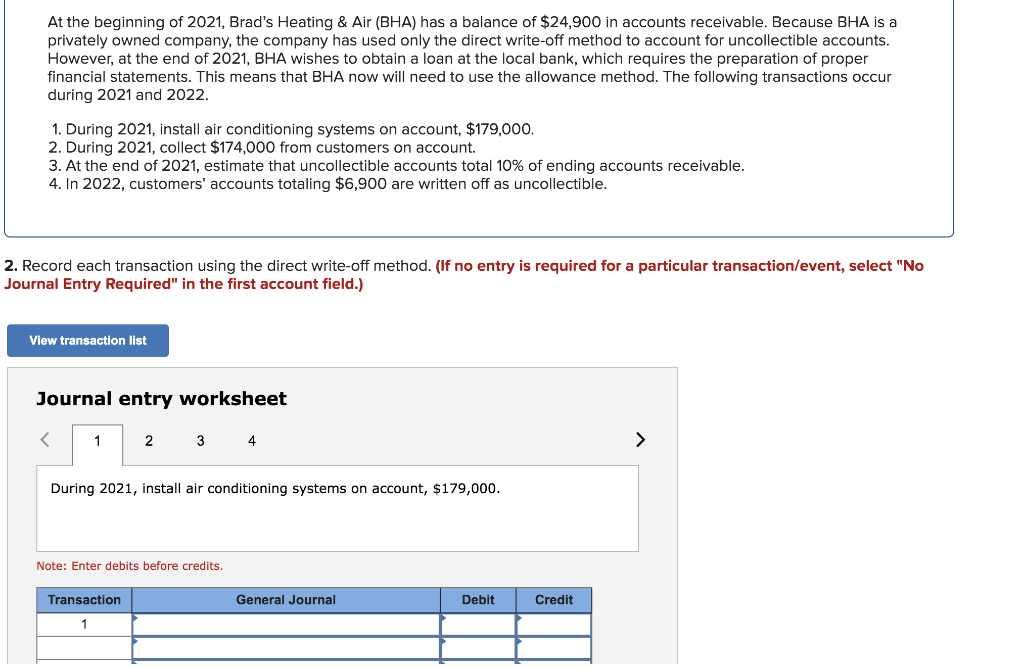

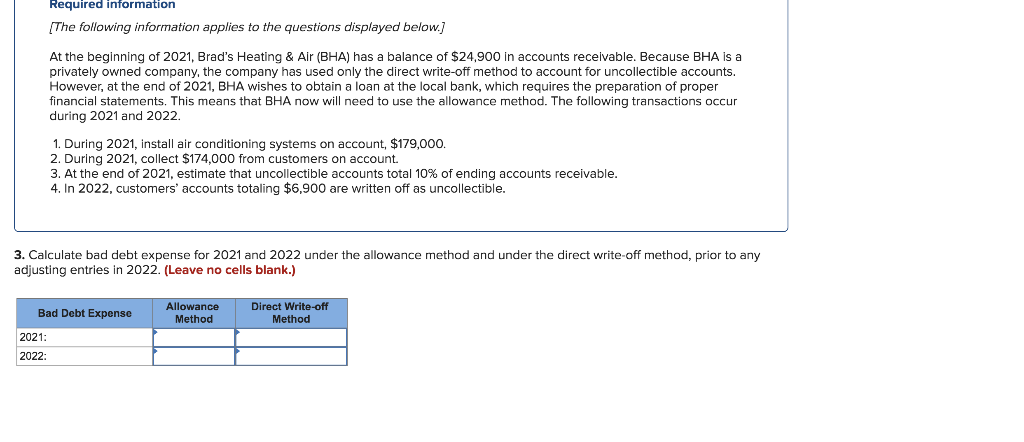

On August 31, 2021, the general ledger of The Dean Acting Academy shows a balance for cash of $7,764. Cash receipts yet to be deposited into the checking account total $3,158, and checks written by the academy but not yet processed by the bank total $1,245. The company's balance of cash does not reflect a bank service fee of $17 and interest earned on the checking account of $28. These amounts are included in the balance of cash of $5,862 reported by the bank as of the end of August. Required: 1. Prepare a bank reconciliation to calculate the correct ending balance of cash on August 31, 2021. (Amounts to be deducted should be indicated with a minus sign.) THE DEAN ACTING ACADEMY Bank Reconciliation August 31, 2021 Bank's Cash Balance Company's Cash Balance Per Bank Statement $ 5,862 Per General Ledger Deposits Outstanding 3,158 Service Fees Checks Outstanding Interest Earned Bank Balance per Reconciliation Company Balance per Reconciliation 2. Record the necessary entry(ies) to adjust the balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 August 31, 2021 Cash Interest Revenue At the beginning of 2021, Brad's Heating & Air (BHA) has a balance of $24,900 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022 1. During 2021, install air conditioning systems on account, $179,000. 2. During 2021, collect $174,000 from customers on account. 3. At the end of 2021, estimate that uncollectible accounts total 10% of ending accounts receivable. 4. In 2022, customers' accounts totaling $6,900 are written off as uncollectible. Required: 1. Record each transaction using the allowance method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet During 2021, install air conditioning systems on account, $179,000. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 At the beginning of 2021, Brad's Heating & Air (BHA) has a balance of $24,900 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022. 1. During 2021, install air conditioning systems on account, $179,000. 2. During 2021, collect $174,000 from customers on account. 3. At the end of 2021, estimate that uncollectible accounts total 10% of ending accounts receivable. 4. In 2022, customers' accounts totaling $6,900 are written off as uncollectible. 2. Record each transaction using the direct write-off method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet During 2021, install air conditioning systems on account, $179,000. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Required information [The following information applies to the questions displayed below.) At the beginning of 2021, Brad's Heating & Air (BHA) has a balance of $24,900 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022. 1. During 2021, install air conditioning systems on account, $179,000. 2. During 2021, collect $174,000 from customers on account. 3. At the end of 2021, estimate that uncollectible accounts total 10% of ending accounts receivable. 4. In 2022, customers' accounts totaling $6,900 are written off as uncollectible. 3. Calculate bad debt expense for 2021 and 2022 under the allowance method and under the direct write-off method, prior to any adjusting entries in 2022. (Leave no cells blank.) Bad Debt Expense Allowance Method Direct Write-off Method 2021: 2022