Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all or don't answer at all. thank you 7. Due to expectations of lower inflation in the future, we would typically expect the

Please answer all or don't answer at all. thank you

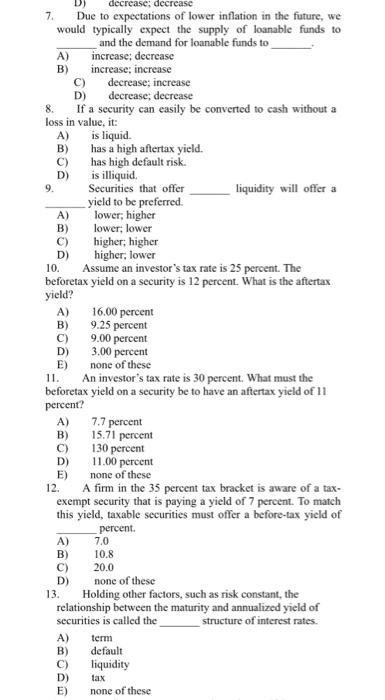

7. Due to expectations of lower inflation in the future, we would typically expect the supply of loanable funds to and the demand for loanable funds to A) increase; decrease B) increase; increase C) decrease; increase D) decrease; decrease 8. If a security can easily be converted to cash without a loss in value, it: A) is liquid. B) has a high aftertax yield. C) has high default risk. D) is illiquid. 9. Securities that offer liquidity will offer a yield to be preferred. A) lower; higher B) lower; lower C) higher; higher D) higher; lower 10. Assume an investor's tax rate is 25 percent. The beforetax yield on a security is 12 percent. What is the aftertax yield? A) 16.00 percent B) 9.25 percent C) 9.00 percent D) 3.00 percent E) none of these 11. An investor's tax rate is 30 percent. What must the beforetax yield on a security be to have an aftertax yield of 11 percent? A) 7.7 percent B) 15.71 percent C) 130 pereent D) 11.00 percent E) none of these 12. A firm in the 35 percent tax bracket is aware of a taxexempt security that is paying a yield of 7 percent. To match this yield, taxable securities must offer a before-tax yicld of percent. A) 7.0 B) 10.8 C) 20.0 D) none of these 13. Holding other factors, such as risk constant, the relationship between the maturity and annualized yield of securities is called the structure of interest rates. A) term B) default C) liquidity D) tax E) none of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started