Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all or don't answer at all. thank you 14. According to pure expectations theory, if interest rates are expected to decrease, there will

Please answer all or don't answer at all. thank you

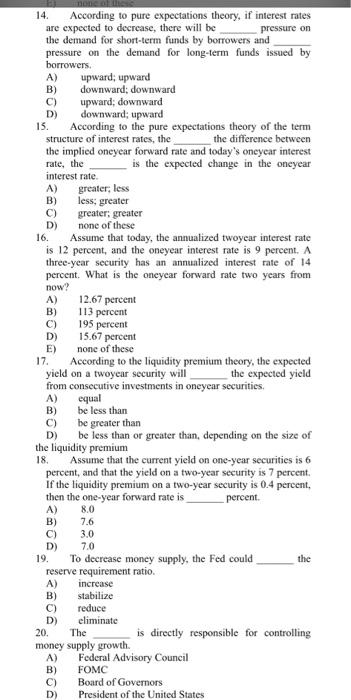

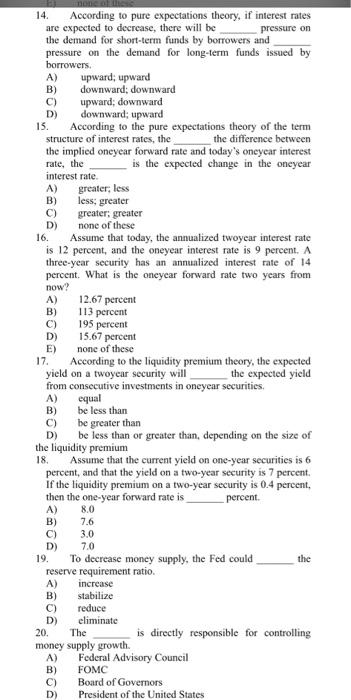

14. According to pure expectations theory, if interest rates are expected to decrease, there will be pressure on the demand for short-term funds by borrowers and pressure on the demand for long-term funds issued by borrowers. A) upward; upward B) downward; downward C) upward; downward D) downward; upward 15. According to the pure expectations theory of the term structure of interest rates, the the difference between the implied oncyear forward rate and today's oncycar interest rate, the is the expected change in the oncyear interest rate. A) greater; less B) less; greater C) greater; greater D) none of these 16. Assume that today, the annualized twoyear interest rate is 12 pereent, and the oneyear interest rate is 9 percent. A three-year security has an annualized interest rate of 14 percent. What is the oncycar forward rate two years from now? A) 12.67 percent B) 113 percent C) 195 percent D) 15.67 percent E) none of these 17. According to the liquidity premium theory, the expected yield on a twoyear security will the expected yield from consecutive investments in oneyear securities. A) equal B) be less than C) be greater than D) be less than or greater than, depending on the size of the liquidity premium 18. Assume that the current yield on one-year securities is 6 pereent, and that the yield on a two-year security is 7 percent. If the liquidity premium on a two-year security is 0.4 percent, then the one-year forward rate is A) 8.0 B) 7.6 C) 3.0 D) 7.0 19. To decrease money supply, the Fed could reserve requirement ratio. A) increase B) stabilize C) reduce D) eliminate 20. The percent. is directly responsible for controlling money supply growth. A) Federal Advisory Council B) FOMC C) Board of Governors D) President of the United States

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started