please answer all parts

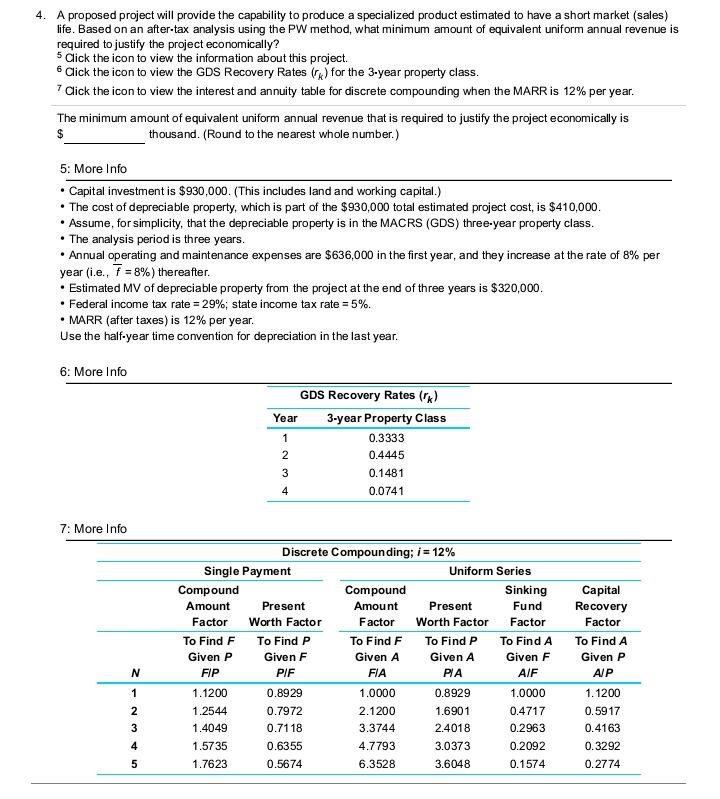

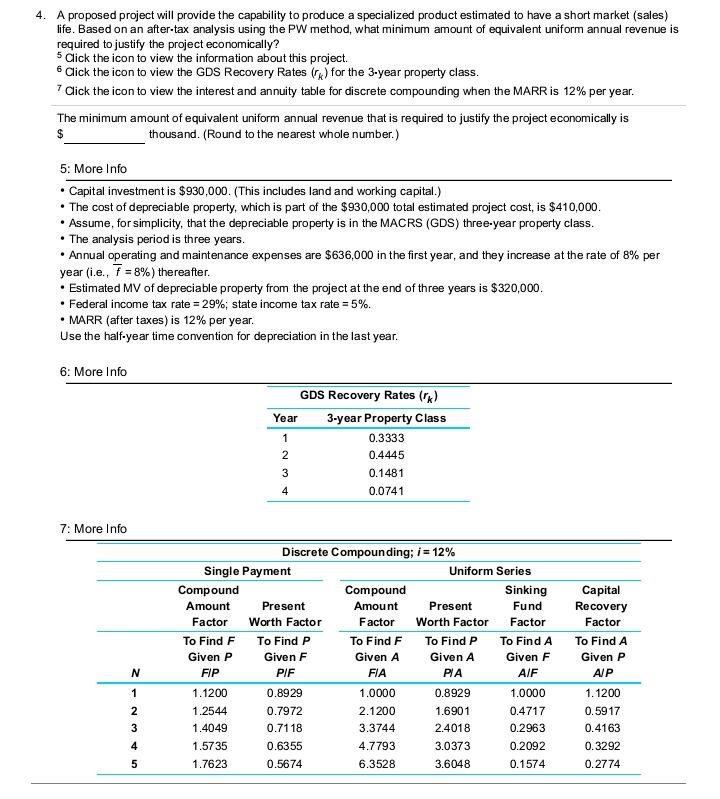

4. A proposed project will provide the capability to produce a specialized product estimated to have a short market (sales) he PW method, what minimum amount of equivalent uniform annual revenue is required to justify the project economically? 5 Click the icon to view the information about this project. 6 Click the icon to view the GDS Recovery Rates (ro) for the 3-year property class. 7 Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The minimum amount of equivalent uniform annual revenue that is required to justify the project economically is thousand. (Round to the nearest whole number.) 5: More Info Capital investment is $930,000. (This includes land and working capital.) The cost of depreciable property, which is part of the $930,000 total estimated project cost, is $410,000. Assume, for simplicity, that the depreciable property is in the MACRS (GDS) three-year property class. The analysis period is three years. Annual operating and maintenance expenses are $636,000 in the first year, and they increase at the rate of 8% per year (i.e., f = 8%) thereafter. Estimated MV of depreciable property from the project at the end of three years is $320,000 Federal income tax rate = 29%; state income tax rate = 5%. MARR (after taxes) is 12% per year. Use the half-year time convention for depreciation in the last year. 6: More Info GDS Recovery Rates (*) Year 3-year Property Class 0.3333 0.4445 0.1481 0.0741 7: More Info Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 Capital Recovery Factor To Find A Given P AP 1.1200 0.5917 0.4163 0.3292 0.2774 AWN 4. A proposed project will provide the capability to produce a specialized product estimated to have a short market (sales) he PW method, what minimum amount of equivalent uniform annual revenue is required to justify the project economically? 5 Click the icon to view the information about this project. 6 Click the icon to view the GDS Recovery Rates (ro) for the 3-year property class. 7 Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The minimum amount of equivalent uniform annual revenue that is required to justify the project economically is thousand. (Round to the nearest whole number.) 5: More Info Capital investment is $930,000. (This includes land and working capital.) The cost of depreciable property, which is part of the $930,000 total estimated project cost, is $410,000. Assume, for simplicity, that the depreciable property is in the MACRS (GDS) three-year property class. The analysis period is three years. Annual operating and maintenance expenses are $636,000 in the first year, and they increase at the rate of 8% per year (i.e., f = 8%) thereafter. Estimated MV of depreciable property from the project at the end of three years is $320,000 Federal income tax rate = 29%; state income tax rate = 5%. MARR (after taxes) is 12% per year. Use the half-year time convention for depreciation in the last year. 6: More Info GDS Recovery Rates (*) Year 3-year Property Class 0.3333 0.4445 0.1481 0.0741 7: More Info Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 Capital Recovery Factor To Find A Given P AP 1.1200 0.5917 0.4163 0.3292 0.2774 AWN