Answered step by step

Verified Expert Solution

Question

1 Approved Answer

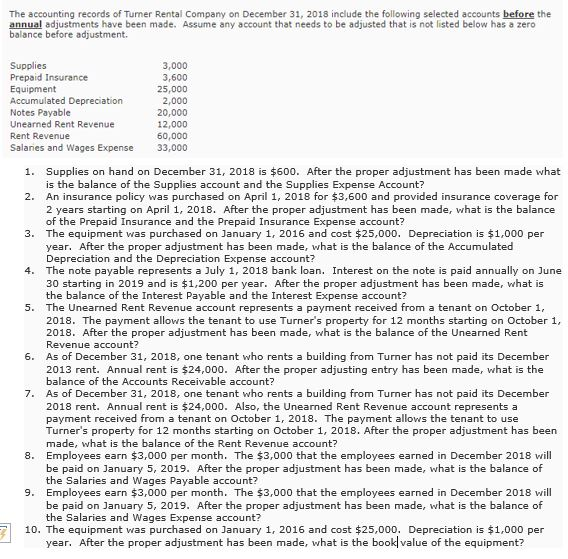

Please answer all parts about adjusting entries The accounting records of Turner Rental Company on December 31, 2018 include the following selected accounts before the

Please answer all parts about adjusting entries

The accounting records of Turner Rental Company on December 31, 2018 include the following selected accounts before the annual adjustments have been made. Assume any account that needs to be adjusted that is not listed below has a zero balance before adjustment. Supplies Prepaid Insurance Equipment Accumulated Depreciation Notes Payable Unearned Rent Revenue Rent Revenue Salanes and Wages Expense 3,000 3,600 25,000 2,000 20,000 12,000 60,000 33,000 1. Supplies on hand on December 31, 2018 is $600. After the proper adjustment has been made what is the balance of the Supplies account and the Supplies Expense Account? 2. An insurance policy was purchased on April 1, 2018 for $3,600 and provided insurance coverage for 2 years starting on April 1, 2018. After the proper adjustment has been made, what is the balance of the Prepaid Insurance and the Prepaid Insurance Expense account? The equipment was purchased on January 1, 2016 and cost $25,000. Depreciation is $1,000 per year. After the proper adjustment has been made, what is the balance of the Accumulated Depreciation and the Depreciation Expense account? The note payable represents a July 1, 2018 bank loan. Interest on the note is paid annually on June 30 starting in 2019 and is $1,200 per year. After the proper adjustment has been made, what is the balance of the Interest Payable and the Interest Expense account? 3. 4. 5. The Unearned Rent Revenue account represents a payment received from a tenant on October 1, 2018. The payment allows the tenant to use Turner's property for 12 months starting on October 1, 2018. After the proper adjustment has been made, what is the balance of the Unearned Rent Revenue account? As of December 31, 2018, one tenant who rents a building from Turner has not paid its December 2013 rent. Annual rent is $24,000. After the proper adjusting entry has been made, what is the balance of the Accounts Receivable account? 6. 7. As of December 31, 2018, one tenant who rents a building from Turner has not paid its December 2018 rent. Annual rent is $24,000. Also, the Unearned Rent Revenue account represents a payment received from a tenant on October 1, 2018. The Turner's property for 12 months starting on October 1, 2018. After the proper adjustment has been made, what is the balance of the Rent Revenue account? Employees earn $3,000 per month. The $3,000 that the employees earned in December 2018 will be paid on January 5, 2019. After the proper adjustment has been made, what is the balance of the Salaries and Wages Payable account? Employees earn $3,000 per month. The $3,000 that the employees earned in December 2018 will be paid on January 5, 2019. After the proper adjustment has been made, what is the balance of the Salaries and Wages Expense account? payme ent allows the tenant to use 8. 9. 10. The equipment was purchased on January 1, 2016 and cost $25,000. Depreciation is $1,000 per year. After the proper adjustment has been made, what is the bookl value of the equipmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started