Answered step by step

Verified Expert Solution

Question

1 Approved Answer

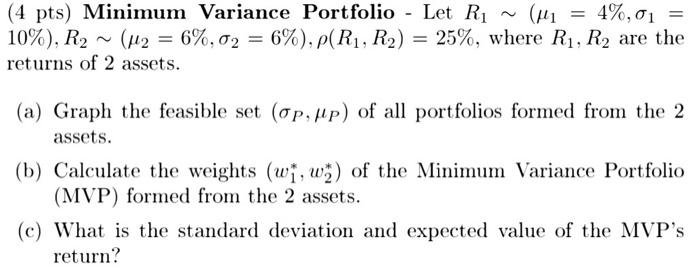

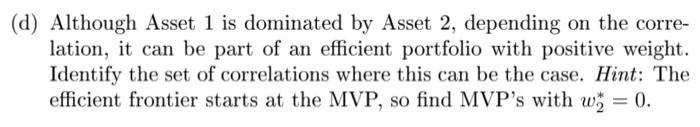

Please answer all parts (a)-(d), especially (d). (4 pts) Minimum Variance Portfolio - Let Ri ~ (ui = 4%,01 = 10%), R2 ~ (u2 =

Please answer all parts (a)-(d), especially (d).

(4 pts) Minimum Variance Portfolio - Let Ri ~ (ui = 4%,01 = 10%), R2 ~ (u2 = 6%,02 = 6%), P(R1, R2) = 25%, where R1, R2 are the returns of 2 assets. (a) Graph the feasible set (opilp) of all portfolios formed from the 2 assets. (b) Calculate the weights (wi, w) of the Minimum Variance Portfolio (MVP) formed from the 2 assets. (c) What is the standard deviation and expected value of the MVP's return? (d) Although Asset 1 is dominated by Asset 2, depending on the corre- lation, it can be part of an efficient portfolio with positive weight. Identify the set of correlations where this can be the case. Hint: The efficient frontier starts at the MVP, so find MVP's with w = 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started