Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts and explain what formula and what exactly was entered in the formula in excel or whichever spredsheet(what rate what pv etc)

please answer all parts and explain what formula and what exactly was entered in the formula in excel or whichever spredsheet(what rate what pv etc) please explain why the certain formula was used and why. thank you i will like if correct.

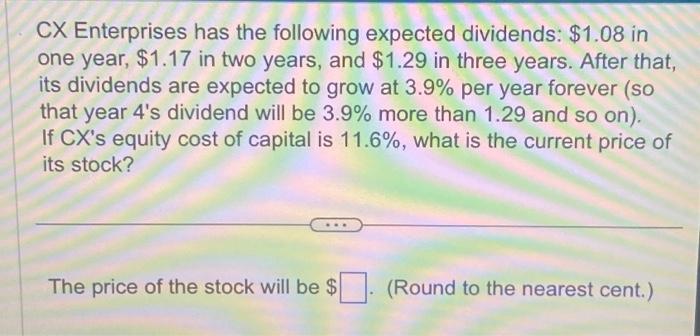

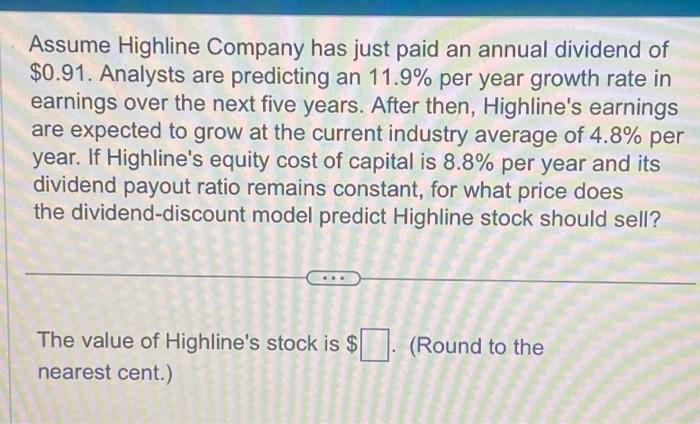

CX Enterprises has the following expected dividends: $1.08 in one year, $1.17 in two years, and $1.29 in three years. After that, its dividends are expected to grow at 3.9% per year forever (so that year 4 's dividend will be 3.9% more than 1.29 and so on). If CX's equity cost of capital is 11.6%, what is the current price of its stock? The price of the stock will be $ (Round to the nearest cent.) Assume Highline Company has just paid an annual dividend of $0.91. Analysts are predicting an 11.9% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 4.8% per year. If Highline's equity cost of capital is 8.8% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is \$ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started