Please answer all parts and show work.

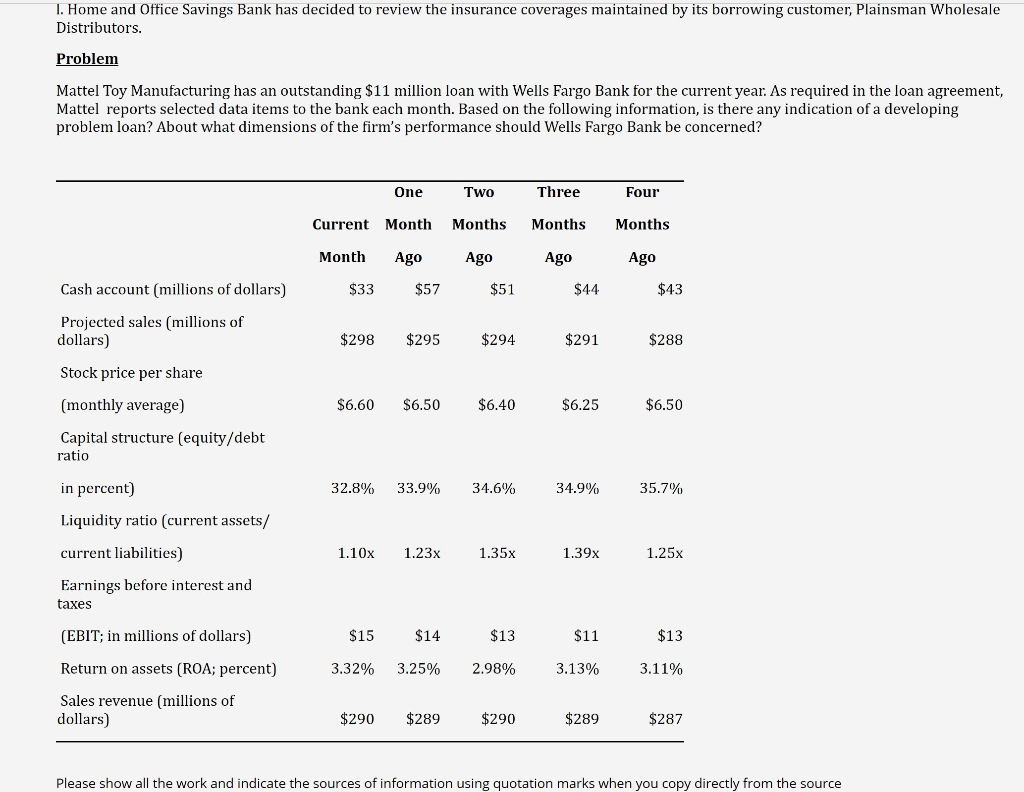

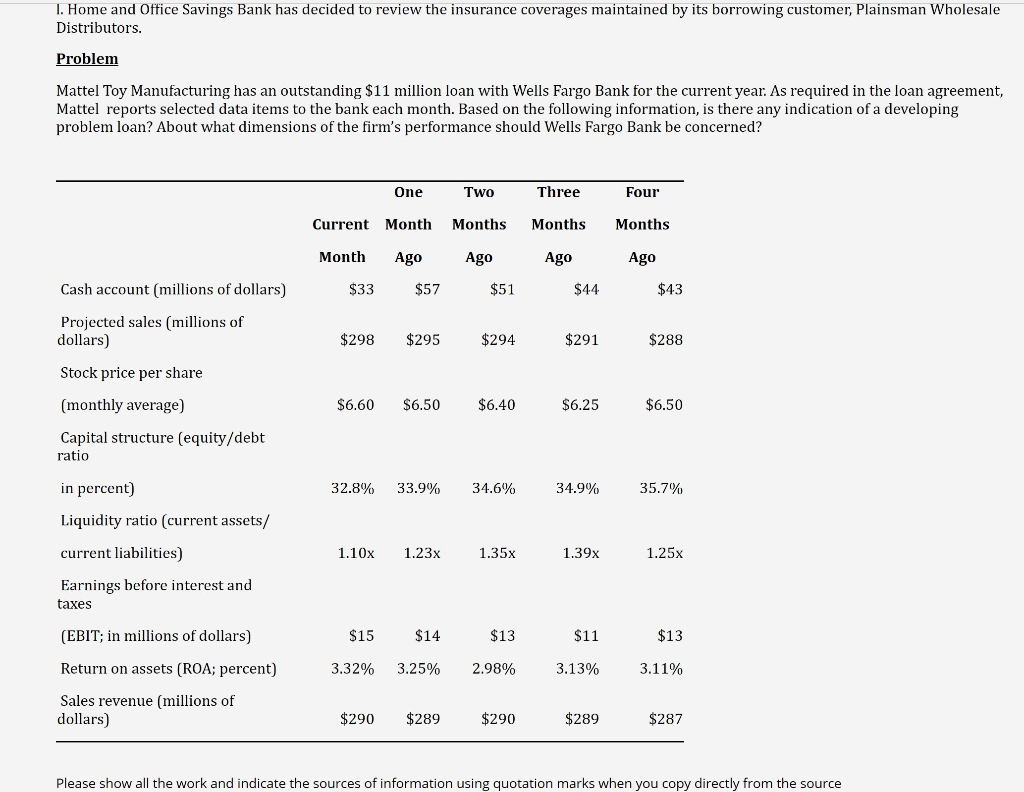

1. You have been hired as the new Loan Department Manager in a bank that has been having troubles in the loan department as identified by the federal auditors. You task is to clean the procedures, the lending policies and reduce the problematic loans so that profitability is restored and the CAMELS score improves. Please take me through the process and set up clear policies and procedures 2. Under which of the six Cs of credit discussed in this chapter does each of the following pieces of information belong? a. First National Bank discovers there is already a lien against the fixed assets of one of its customers asking for a loan b. Xron Corporation has asked for a type of loan its lender normally refuses to make. c. John Selman has an excellent credit rating, d. Smithe Manufacturing Company has achieved higher earnings each year for the past six years. e. Consumers Savings Association's auto loan officer asks a prospective customer, Harold Ikels, for his driver's license. f. Merchants Center National Bank is concerned about extending a loan for another year to Corrin Motors because a recession is predicted in the economy. g. Wes Velman needs an immediate cash loan and has gotten his brother, Charles, to volunteer to cosign the note should the loan be approved. h. ABC Finance Company checks out Mary Earl's estimate of her monthly take-home pay with Mary's employer, Bryan Sims Doors and Windows. i. Hillsoro Bank and Trust would like to make a loan to Pen-Tab Oil and Gas Company but fears a long-term decline in oil and gas prices. j. First State Bank of Jackson seeks the opinion of an expert on the economic outlook in Mexico before granting a loan to a Mexican manufacturer of auto parts. k. The history of Membres Manufacture and Distributing Company indicates the firm has been through several recent changes of ownership and there has been a substantial shift in its principal suppliers and customers in recent years. 1. Home and Office Savings Bank has decided to review the insurance coverages maintained by its borrowing customer, Plainsman Wholesale Distributors. 1. Home and Office Savings Bank has decided to review the insurance coverages maintained by its borrowing customer, Plainsman Wholesale Distributors. Problem Mattel Toy Manufacturing has an outstanding $11 million loan with Wells Fargo Bank for the current year. As required in the loan agreement, Mattel reports selected data items to the bank each month. Based on the following information, is there any indication of a developing problem loan? About what dimensions of the firm's performance should Wells Fargo Bank be concerned? Four Months One Two Three Current Month Months Months Month Ago Ago Ago $33 $57 $51 $44 Ago Cash account (millions of dollars) $43 Projected sales (millions of dollars) $298 $295 $294 $291 $288 Stock price per share (monthly average) $6.60 $6.50 $6.40 $6.25 $6.50 Capital structure (equity/debt ratio in percent) 32.8% 33.9% 34.6% 34.9% 35.7% Liquidity ratio (current assets/ current liabilities) 1.10x 1.23x 1.35x 1.39x 1.25x Earnings before interest and taxes (EBIT; in millions of dollars) Return on assets (ROA; percent) Sales revenue (millions of dollars) $15 3.32% $14 3.25% $13 2.98% $11 3.13% $13 3.11% $290 $289 $290 $289 $287 Please show all the work and indicate the sources of information using quotation marks when you copy directly from the source