Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts and show work / formulas used. thanks Heve are data on $1.000 par value bonds 15 sued by Microsolt, GE Capital,

please answer all parts and show work / formulas used. thanks

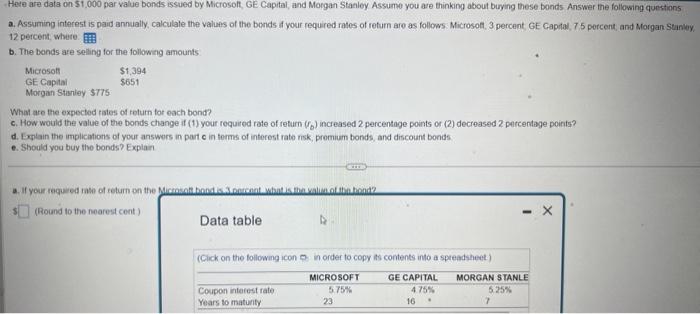

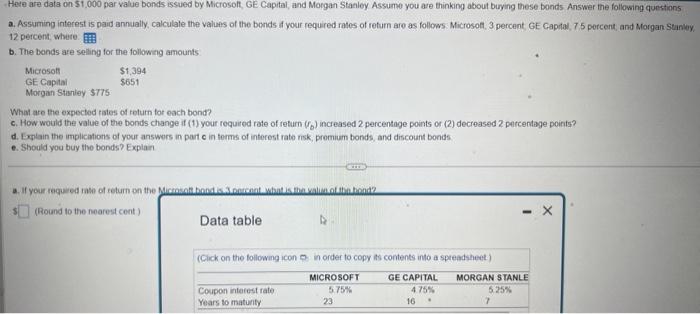

Heve are data on $1.000 par value bonds 15 sued by Microsolt, GE Capital, and Morgan Stanley Assume you are thinking about burying these bonds Answer the following questions a. Assuming interest is paid annually, calculate the values of the bends if your required rates of retum are as follows. Microson, 3 percent GE Captal, 7.5 percent, and Morgan Stankey. 12 percent, whete. b. The bonds are selling for the following amounts What are the expected rates of return for each bond? c. How would the value of the bonds change if (1) your required rate of return (fb) increased 2 percentage points or (2) decreased 2 parcentage points? d. Explain the implications of your answers in part c in terms of interest rate risk, promum bonds, and discount bonis e. Should you buy the bonds? Explan a. If your requed tate of return on the (Round to the nearest cent) Heve are data on $1.000 par value bonds 15 sued by Microsolt, GE Capital, and Morgan Stanley Assume you are thinking about burying these bonds Answer the following questions a. Assuming interest is paid annually, calculate the values of the bends if your required rates of retum are as follows. Microson, 3 percent GE Captal, 7.5 percent, and Morgan Stankey. 12 percent, whete. b. The bonds are selling for the following amounts What are the expected rates of return for each bond? c. How would the value of the bonds change if (1) your required rate of return (fb) increased 2 percentage points or (2) decreased 2 parcentage points? d. Explain the implications of your answers in part c in terms of interest rate risk, promum bonds, and discount bonis e. Should you buy the bonds? Explan a. If your requed tate of return on the (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started