Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts, and show work, i will rate you a good score for the help! 2) You graduated from UTEP and you were

please answer all parts, and show work, i will rate you a good score for the help!

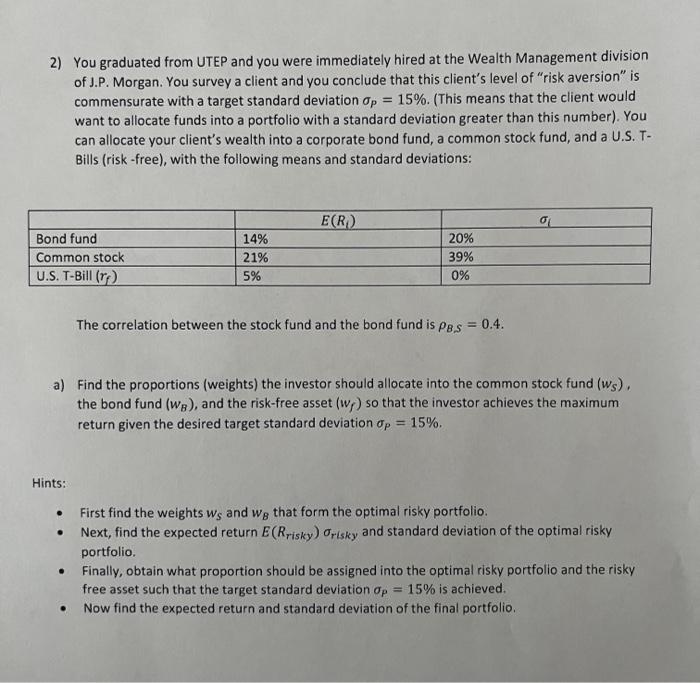

2) You graduated from UTEP and you were immediately hired at the Wealth Management division of J.P. Morgan. You survey a client and you conclude that this client's level of "risk aversion" is commensurate with a target standard deviation P=15%. (This means that the client would want to allocate funds into a portfolio with a standard deviation greater than this number). You can allocate your client's wealth into a corporate bond fund, a common stock fund, and a U.S. TBills (risk -free), with the following means and standard deviations: The correlation between the stock fund and the bond fund is BS=0.4. a) Find the proportions (weights) the investor should allocate into the common stock fund (wS), the bond fund (wB), and the risk-free asset (wf) so that the investor achieves the maximum return given the desired target standard deviation P=15%. Hints: - First find the weights wS and wB that form the optimal risky portfolio. - Next, find the expected return E(Rrisky)risky and standard deviation of the optimal risky portfolio. - Finally, obtain what proportion should be assigned into the optimal risky portfolio and the risky free asset such that the target standard deviation p=15% is achieved. - Now find the expected return and standard deviation of the final portfolio. a) What is the expected return and standard deviation of this target portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started