Please answer all parts and show your work. If you do both, I will give a rating.

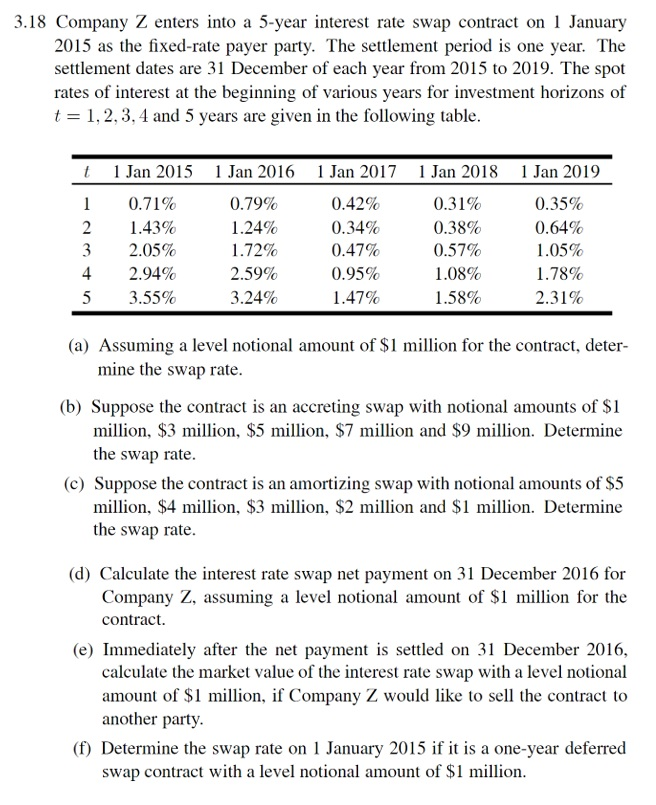

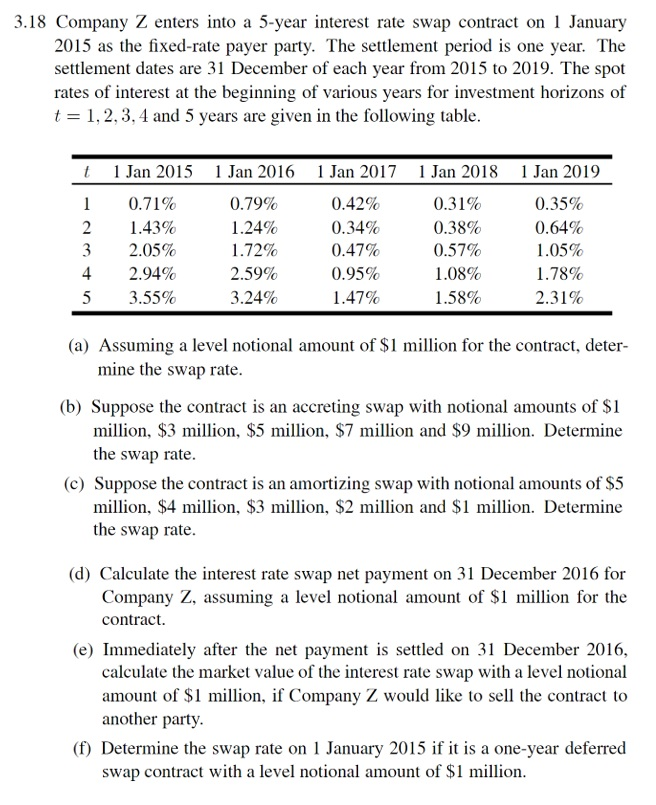

3.18 Company Z enters into a 5-year interest rate swap contract on 1 January 2015 as the fixed-rate payer party. The settlement period is one year. The settlement dates are 31 December of each year from 2015 to 2019. The spot rates of interest at the beginning of various years for investment horizons of t = 1, 2, 3, 4 and 5 years are given in the following table. t 1 Jan 2015 1 Jan 2016 1 Jan 2017 1 Jan 2018 1 Jan 2019 0.71% 0.79% 0.42% 0.31% 0.35% 2 1.43% 1.24% 0.34% 0.38% 0.64% 3 2.05% 1.72% 0.47% 0.57% 1.05% 4 2.94% 2.59% 0.95% 1.08% 1.78% 5 3.55% 3.24% 1.47% 1.58% 2.31% (a) Assuming a level notional amount of $1 million for the contract, deter- mine the swap rate. (b) Suppose the contract is an accreting swap with notional amounts of $1 million, $3 million, $5 million, $7 million and $9 million. Determine the swap rate. (c) Suppose the contract is an amortizing swap with notional amounts of $5 million, $4 million, $3 million, $2 million and $1 million. Determine the swap rate. (d) Calculate the interest rate swap net payment on 31 December 2016 for Company Z, assuming a level notional amount of $1 million for the contract. (e) Immediately after the net payment is settled on 31 December 2016, calculate the market value of the interest rate swap with a level notional amount of $1 million, if Company Z would like to sell the contract to another party. (f) Determine the swap rate on 1 January 2015 if it is a one-year deferred swap contract with a level notional amount of $1 million. 3.18 Company Z enters into a 5-year interest rate swap contract on 1 January 2015 as the fixed-rate payer party. The settlement period is one year. The settlement dates are 31 December of each year from 2015 to 2019. The spot rates of interest at the beginning of various years for investment horizons of t = 1, 2, 3, 4 and 5 years are given in the following table. t 1 Jan 2015 1 Jan 2016 1 Jan 2017 1 Jan 2018 1 Jan 2019 0.71% 0.79% 0.42% 0.31% 0.35% 2 1.43% 1.24% 0.34% 0.38% 0.64% 3 2.05% 1.72% 0.47% 0.57% 1.05% 4 2.94% 2.59% 0.95% 1.08% 1.78% 5 3.55% 3.24% 1.47% 1.58% 2.31% (a) Assuming a level notional amount of $1 million for the contract, deter- mine the swap rate. (b) Suppose the contract is an accreting swap with notional amounts of $1 million, $3 million, $5 million, $7 million and $9 million. Determine the swap rate. (c) Suppose the contract is an amortizing swap with notional amounts of $5 million, $4 million, $3 million, $2 million and $1 million. Determine the swap rate. (d) Calculate the interest rate swap net payment on 31 December 2016 for Company Z, assuming a level notional amount of $1 million for the contract. (e) Immediately after the net payment is settled on 31 December 2016, calculate the market value of the interest rate swap with a level notional amount of $1 million, if Company Z would like to sell the contract to another party. (f) Determine the swap rate on 1 January 2015 if it is a one-year deferred swap contract with a level notional amount of $1 million