Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts and show your work. If you do both, I will give a rating. Here is equation 3.18 for part c: Here

Please answer all parts and show your work. If you do both, I will give a rating.

Here is equation 3.18 for part c:

Here is equation 3.14 for part d

Here is Exercise 3.11 for part f:

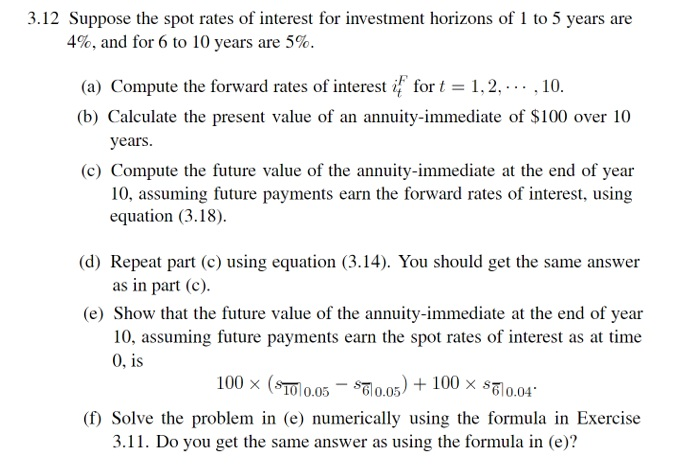

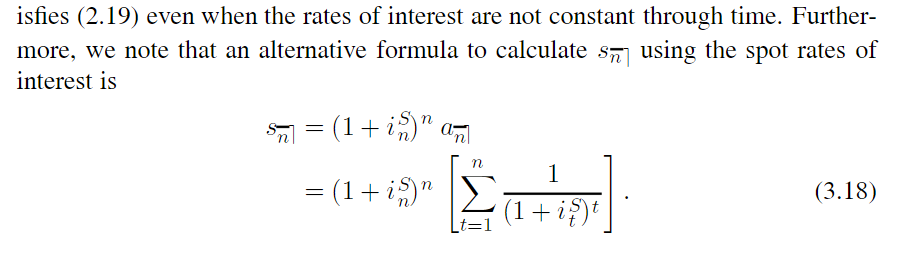

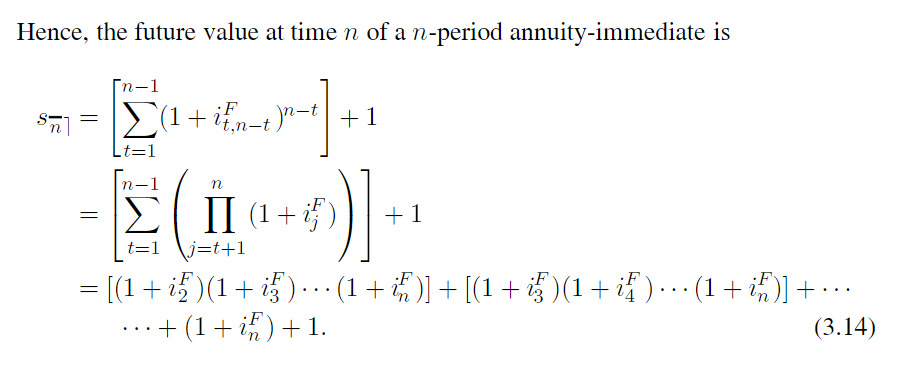

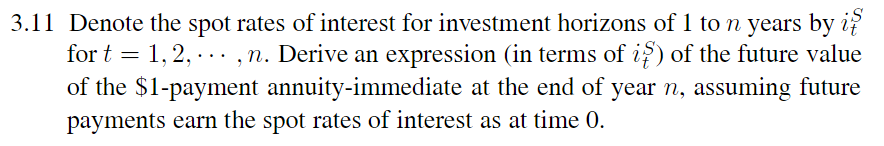

3.12 Suppose the spot rates of interest for investment horizons of 1 to 5 years are 4%, and for 6 to 10 years are 5%. (a) Compute the forward rates of interest if for t = 1, 2, ... , 10. (b) Calculate the present value of an annuity-immediate of $100 over 10 years. (c) Compute the future value of the annuity-immediate at the end of year 10, assuming future payments earn the forward rates of interest, using equation (3.18). (d) Repeat part (c) using equation (3.14). You should get the same answer as in part (c). (e) Show that the future value of the annuity-immediate at the end of year 10, assuming future payments earn the spot rates of interest as at time 0, is 100 x (ST710.05 $70.05) + 100 x 8510.04 (f) Solve the problem in (e) numerically using the formula in Exercise 3.11. Do you get the same answer as using the formula in (e)? isfies (2.19) even when the rates of interest are not constant through time. Further- more, we note that an alternative formula to calculate sn using the spot rates of interest is sa = (1+29)" an 1 = (1+2,9)" Fatto (3.18) (1 + i;) Hence, the future value at time n of a n-period annuity-immediate is (1 + ifin_t)"=t| +1 = II (1+i). +1 j=t+1 - [(1 + i)(1 + i)... (14 %)] + [(1 + i)(1+i... (1++... ..+(1++1. (3.14) S 3.11 Denote the spot rates of interest for investment horizons of 1 to n years by i for t = 1, 2, ... , n. Derive an expression (in terms of i) of the future value of the $1-payment annuity-immediate at the end of year n, assuming future payments earn the spot rates of interest as at time 0. 3.12 Suppose the spot rates of interest for investment horizons of 1 to 5 years are 4%, and for 6 to 10 years are 5%. (a) Compute the forward rates of interest if for t = 1, 2, ... , 10. (b) Calculate the present value of an annuity-immediate of $100 over 10 years. (c) Compute the future value of the annuity-immediate at the end of year 10, assuming future payments earn the forward rates of interest, using equation (3.18). (d) Repeat part (c) using equation (3.14). You should get the same answer as in part (c). (e) Show that the future value of the annuity-immediate at the end of year 10, assuming future payments earn the spot rates of interest as at time 0, is 100 x (ST710.05 $70.05) + 100 x 8510.04 (f) Solve the problem in (e) numerically using the formula in Exercise 3.11. Do you get the same answer as using the formula in (e)? isfies (2.19) even when the rates of interest are not constant through time. Further- more, we note that an alternative formula to calculate sn using the spot rates of interest is sa = (1+29)" an 1 = (1+2,9)" Fatto (3.18) (1 + i;) Hence, the future value at time n of a n-period annuity-immediate is (1 + ifin_t)"=t| +1 = II (1+i). +1 j=t+1 - [(1 + i)(1 + i)... (14 %)] + [(1 + i)(1+i... (1++... ..+(1++1. (3.14) S 3.11 Denote the spot rates of interest for investment horizons of 1 to n years by i for t = 1, 2, ... , n. Derive an expression (in terms of i) of the future value of the $1-payment annuity-immediate at the end of year n, assuming future payments earn the spot rates of interest as at time 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started