Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts as well as the movement of the graphs 2. Fiscal policy, the loanable funds market, and aggregate demand Consider a hypothetical

Please answer all parts as well as the movement of the graphs

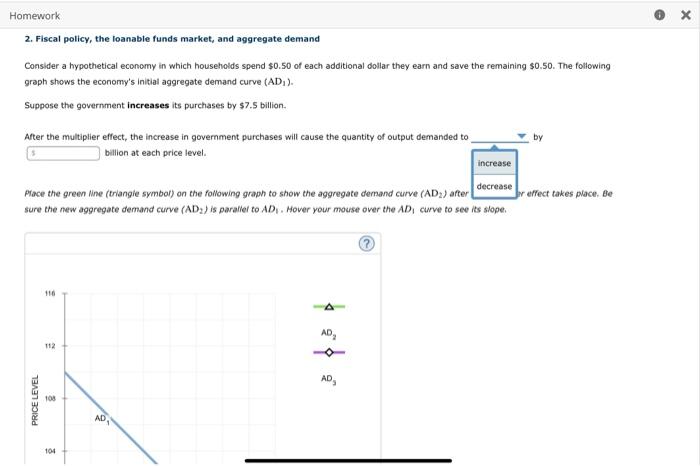

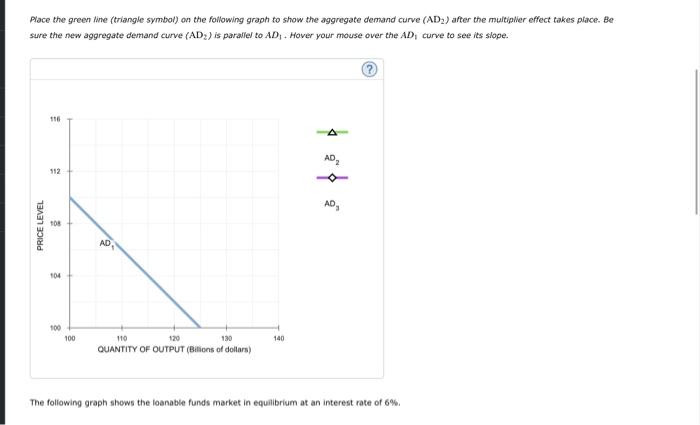

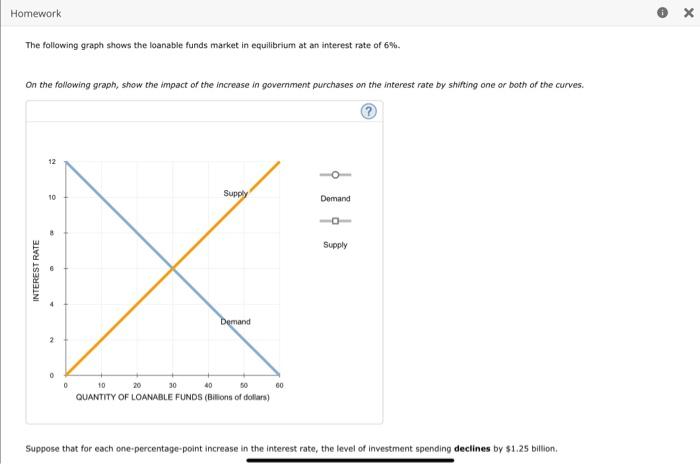

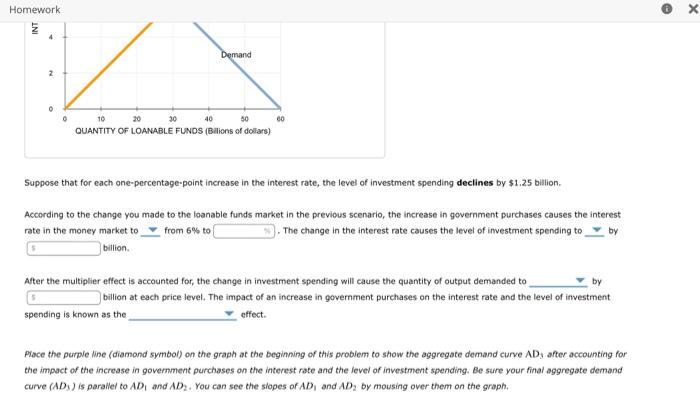

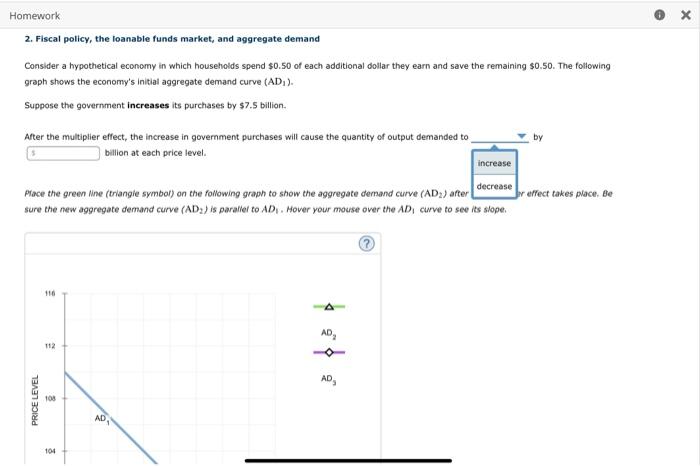

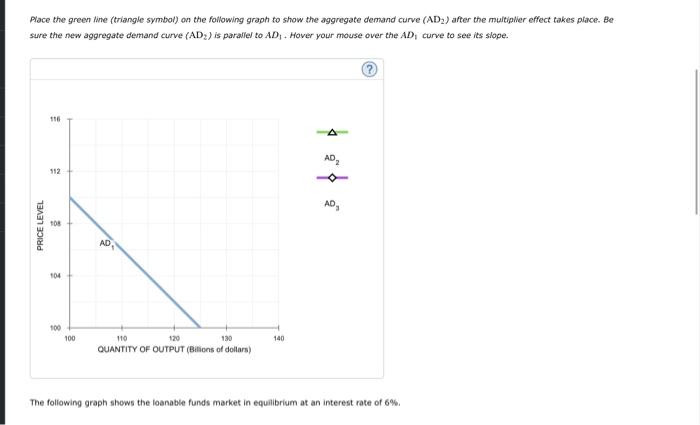

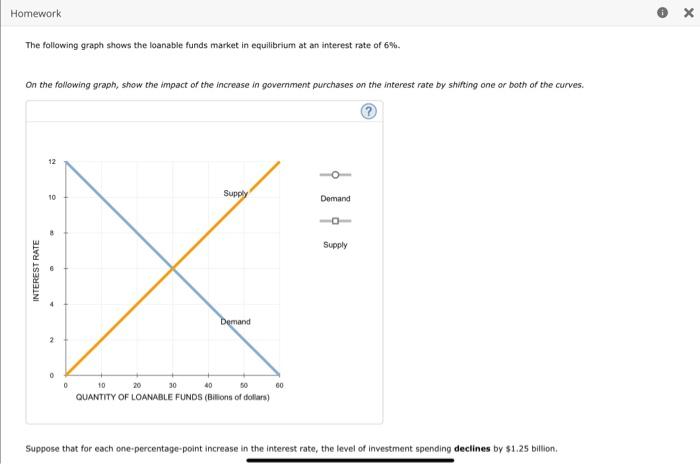

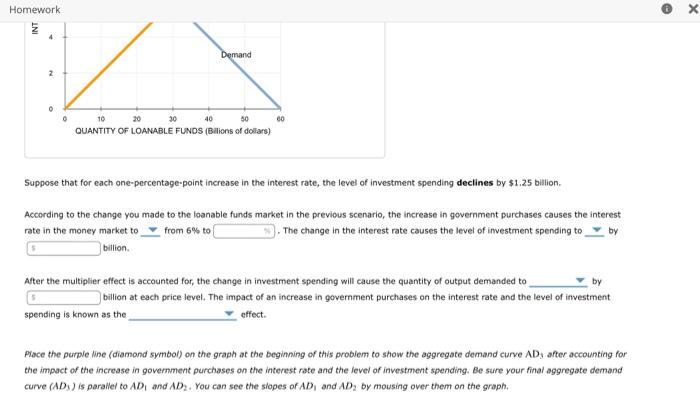

2. Fiscal policy, the loanable funds market, and aggregate demand Consider a hypothetical economy in which households spend $0.50 of each additional dollar they earn and save the remaining $0.50. The following graph shows the economy's initial aggregate demand curve (AD1). Suppose the government increases its purchases by $7.5 billion. After the multiplier effect, the increase in government purchases will cause the quantity of output demanded to by billion at each price level. Place the green line (triangie symbol) on the following graph to show the aggregate demand curve (AD AD2 ) after effect takes place. Be sure the new aggregate demand curve (AD2) is paraliel to AD1. Hover your mouse over the AD1 curve to see its slope. Place the green line (triangle symbol) on the following graph to show the aggregate demand curve ( AD2 ) after the multipler effect takes plice. Be sure the new aggregate demand curve (AD2) is parallel to AD1. Hover your mouse over the AD1 curve to see its slope. The following graph shows the loanable funds market in equilibrium at an interest rate of 6%. The following graph shows the loanable funds market in equilibrium at an interest rate of 6%. On the following graph, show the impact of the increase in government purchases on the interest rate by shifting one or both of the curves. Suppose that for each one-percentage-point increase in the interest rate, the level of investment spending declines by $1.25 biltion. Suppose that for each one-percentage-point increase in the interest rate, the level of investment spending declines by $1.25 billion. According to the change you made to the loanable funds market in the previous scenario, the increase in government purchases causes the interest rate in the money market to from 6% to . The change in the interest rate causes the level of investment spending to by bilion. After the multiplier effect is accounted for, the change in investment spending will cause the quantity of output demanded to by billion at each price level. The impact of an increase in government purchases on the interest rate and the level of investment spending is known as the effect. Ploce the purple line (diamond symbol) on the graph at the begitning of this problem to show the aggregate demand curve ADy after accounting for the impact of the increase in government purchases on the interest rate and the level of investment spending. Be sure your final aggregate demand curve (AD3) is parallel to AD1 and AD2. You can see the siopes of AD1 and AD2 by mousing over them on the groph

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started