please answer all parts asap for a like!

also show formulas/formula text

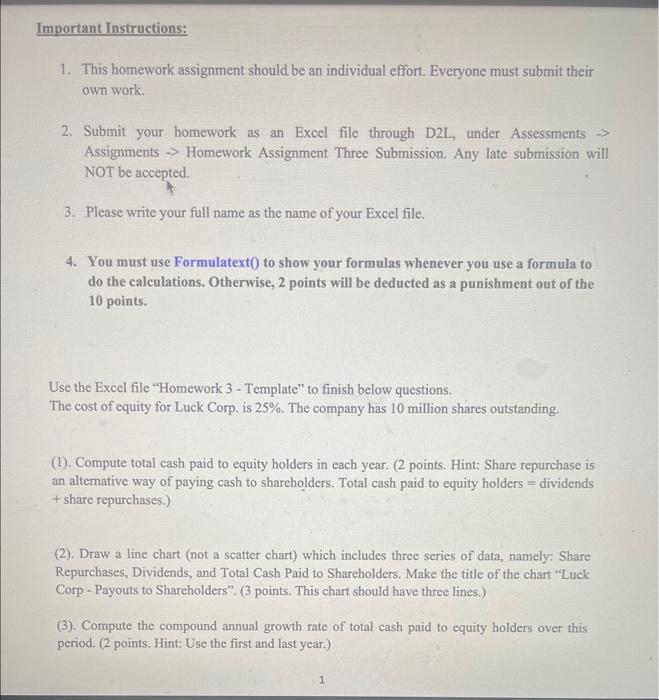

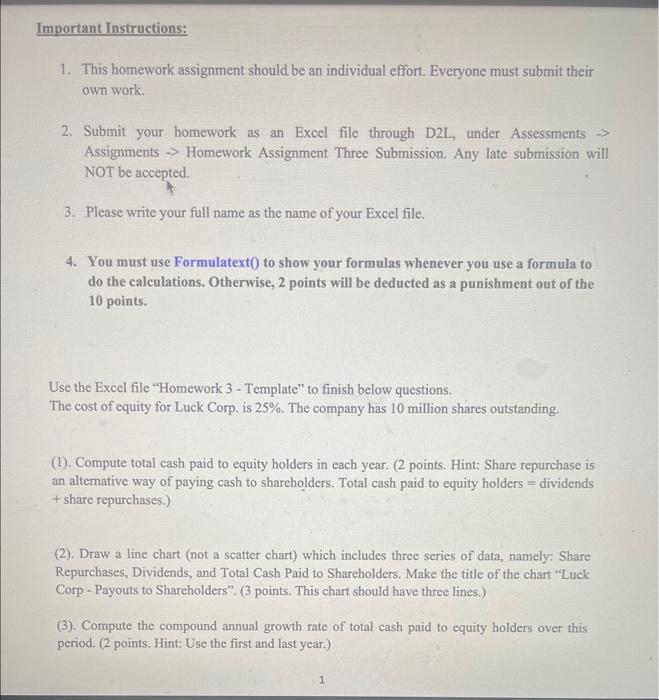

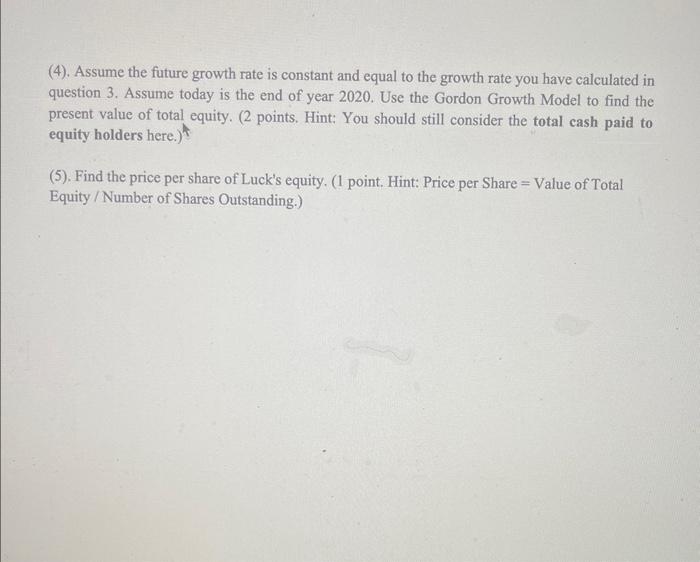

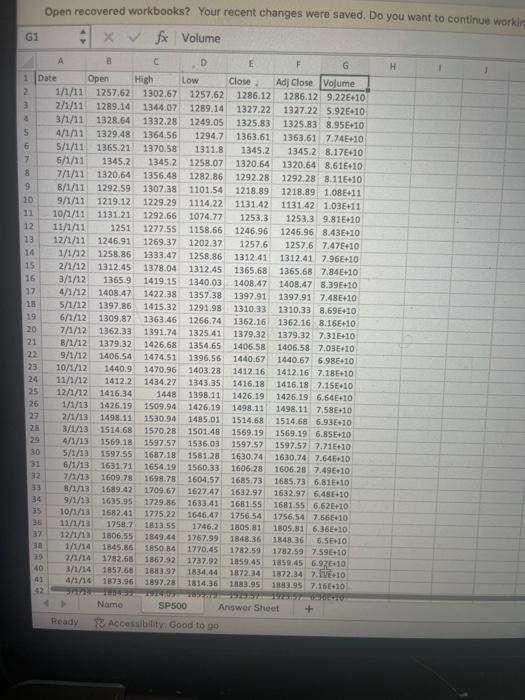

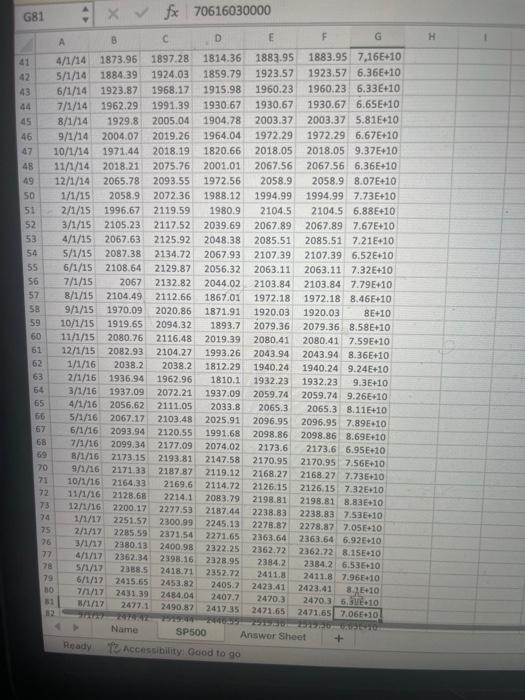

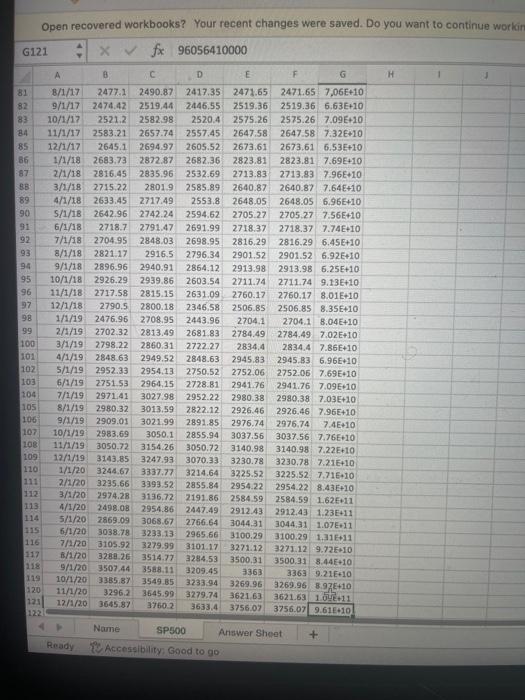

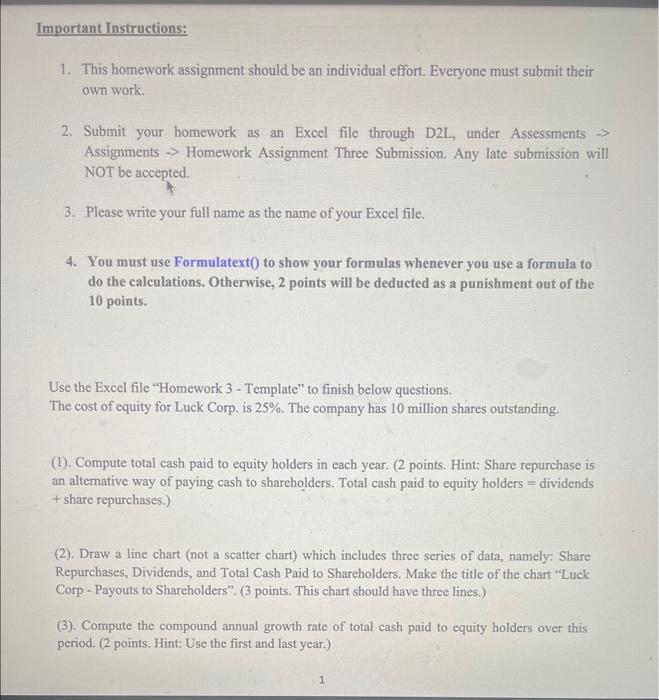

Important Instructions: 1. This homework assignment should be an individual effort. Everyone must submit their own work. 2. Submit your homework as an Excel file through D2L, under Assessments Assignments Homework Assignment Three Submission. Any late submission will NOT be accepted. 3. Please write your full name as the name of your Excel file. 4. You must use Formulatext(0 to show your formulas whenever you use a formula to do the calculations. Otherwise, 2 points will be deducted as a punishment out of the 10 points. Use the Excel file "Homework 3 - Template" to finish below questions. The cost of equity for Luck Corp. is 25%. The company has 10 million shares outstanding. (1). Compute total cash paid to equity holders in each year. (2 points. Hint: Share repurchase is an alternative way of paying cash to shareholders. Total cash paid to equity holders = dividends + share repurchases.) (2). Draw a line chart (not a scatter chart) which includes three series of data, namely: Share Repurchases, Dividends, and Total Cash Paid to Shareholders. Make the title of the chart "Luck Corp - Payouts to Shareholders". ( 3 points. This chart should have three lines.) (3). Compute the compound annual growth rate of total cash paid to equity holders over this period. ( 2 points. Hint: Use the first and last year.) (4). Assume the future growth rate is constant and equal to the growth rate you have calculated in question 3. Assume today is the end of year 2020. Use the Gordon Growth Model to find the present value of total equity. ( 2 points. Hint: You should still consider the total cash paid to equity holders here.) (5). Find the price per share of Luck's equity. (1 point. Hint: Price per Share = Value of Total Equity / Number of Shares Outstanding.) Open recovered workbooks? Your recent changes were saved. Do you want to continue worki Open recovered workbooks? Your recent changes were saved. Do you want to continue worki Important Instructions: 1. This homework assignment should be an individual effort. Everyone must submit their own work. 2. Submit your homework as an Excel file through D2L, under Assessments Assignments Homework Assignment Three Submission. Any late submission will NOT be accepted. 3. Please write your full name as the name of your Excel file. 4. You must use Formulatext(0 to show your formulas whenever you use a formula to do the calculations. Otherwise, 2 points will be deducted as a punishment out of the 10 points. Use the Excel file "Homework 3 - Template" to finish below questions. The cost of equity for Luck Corp. is 25%. The company has 10 million shares outstanding. (1). Compute total cash paid to equity holders in each year. (2 points. Hint: Share repurchase is an alternative way of paying cash to shareholders. Total cash paid to equity holders = dividends + share repurchases.) (2). Draw a line chart (not a scatter chart) which includes three series of data, namely: Share Repurchases, Dividends, and Total Cash Paid to Shareholders. Make the title of the chart "Luck Corp - Payouts to Shareholders". ( 3 points. This chart should have three lines.) (3). Compute the compound annual growth rate of total cash paid to equity holders over this period. ( 2 points. Hint: Use the first and last year.) (4). Assume the future growth rate is constant and equal to the growth rate you have calculated in question 3. Assume today is the end of year 2020. Use the Gordon Growth Model to find the present value of total equity. ( 2 points. Hint: You should still consider the total cash paid to equity holders here.) (5). Find the price per share of Luck's equity. (1 point. Hint: Price per Share = Value of Total Equity / Number of Shares Outstanding.) Open recovered workbooks? Your recent changes were saved. Do you want to continue worki Open recovered workbooks? Your recent changes were saved. Do you want to continue worki