Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts Chegg makes the quality of the photo horrible, so i had to tyoe it out Financial Learning Dynas 23 milion shares

Please answer all parts

Chegg makes the quality of the photo horrible, so i had to tyoe it out

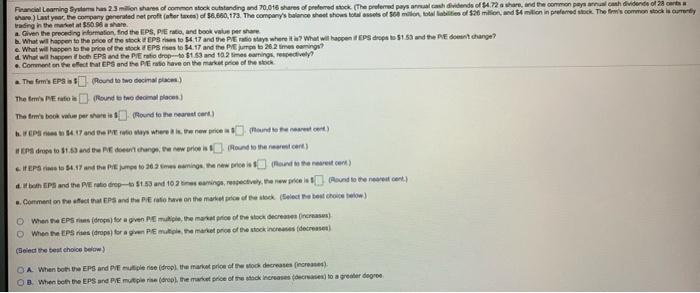

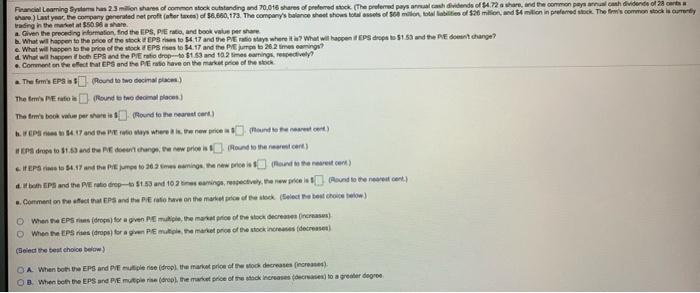

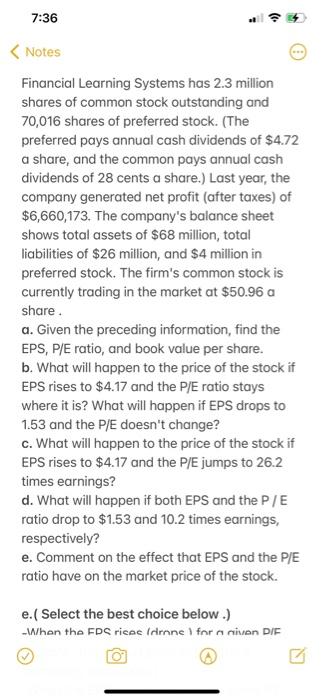

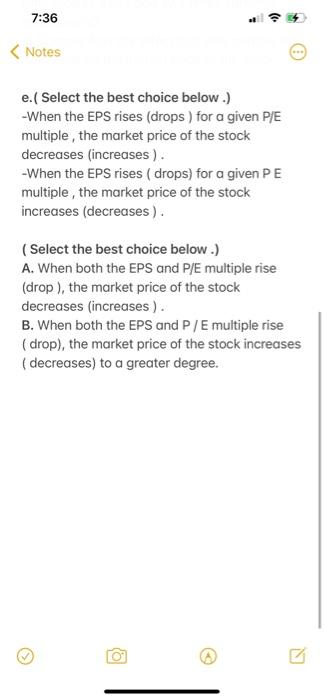

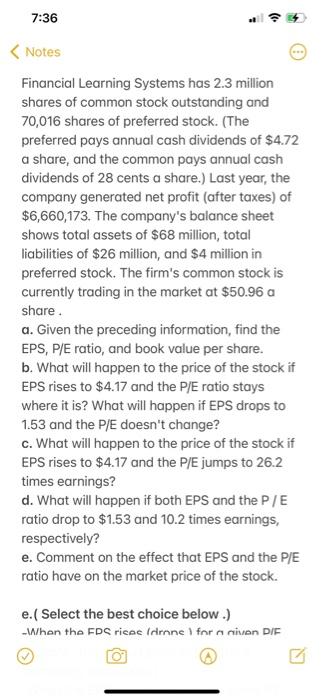

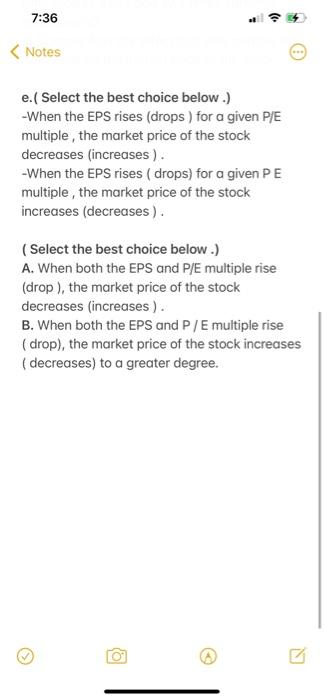

Financial Learning Dynas 23 milion shares of common stock outstanding and 70,016 shares of preferred stock (The preferred pays a cash dividends of $4.72 a share, and the common paylash dividende of ware) Last year, the company generated at prot(atter af 36,600,173. The company's be the shows totales of motor, toalbio $20 million, and 54 milion in preferred ock. The firm's common och le currently trading in the $569 where Given the preceding normation find the EPS, PE, and book value per share What will happen to the price of the stock EPS is to 54 17 and the Pays where it? What will happen EPS drop to 155 and the PE don't change? e What will happen to the price of the EPS to 54.17 and the PET to 262 times carns? What wil heb EPS and the PE ratio drop-10 1.53 and 102 times carings, evely . Comment on the effects and the personave on the market price of the stock The firm's EPS (Round to two decimal) The Perfil (round two decals The tow' book valu perware Pourd to the newest cert) 1. WP 4.17 onde estoy where it, we mund te na cest EPS drop to $1.59 and the one twice is Round to the recent) EPS to 54.17 and the ones aming the new studenterventer) EPS and the ratio dep 13 and 10 scaming, respectively. The new prices and to the cent) .. Comment on the sett EPS and PE to have on the market book (elect the best choice ) When EPS rs (drogo) for a given Emil, the man of the stock decrease in When the Prope) for a PE multiple, the more pre of the stock in decrease (Selede best choice below) OA When both the EPS and PE multiple rodrol the market price of the decreases (nor) OB When both the EPS und Pemutiple rool, the price of the stock rose to agrer deg 7:36 Notes Financial Learning Systems has 2.3 million shares of common stock outstanding and 70,016 shares of preferred stock. (The preferred pays annual cash dividends of $4.72 a share, and the common pays annual cash dividends of 28 cents a share.) Last year, the company generated net profit (after taxes) of $6,660,173. The company's balance sheet shows total assets of $68 million, total liabilities of $26 million, and $4 million in preferred stock. The firm's common stock is currently trading in the market at $50.96 a share a. Given the preceding information, find the EPS, P/E ratio, and book value per share. b. What will happen to the price of the stock it EPS rises to $4.17 and the P/E ratio stays where it is? What will happen if EPS drops to 1.53 and the P/E doesn't change? c. What will happen to the price of the stock if EPS rises to $4.17 and the P/E jumps to 26.2 times earnings? d. What will happen if both EPS and the P/E ratio drop to $1.53 and 10.2 times earnings, respectively? e. Comment on the effect that EPS and the PIE ratio have on the market price of the stock. e.( Select the best choice below.) When the FDS ricec (drone I for a niven DIF 7:36 Notes e.( Select the best choice below.) -When the EPS rises (drops ) for a given PE multiple, the market price of the stock decreases (increases). -When the EPS rises (drops) for a given PE multiple, the market price of the stock increases (decreases). (Select the best choice below.) A. When both the EPS and P/E multiple rise (drop ), the market price of the stock decreases (increases). B. When both the EPS and P/E multiple rise (drop), the market price of the stock increases (decreases) to a greater degree. a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started