please answer all parts clearly

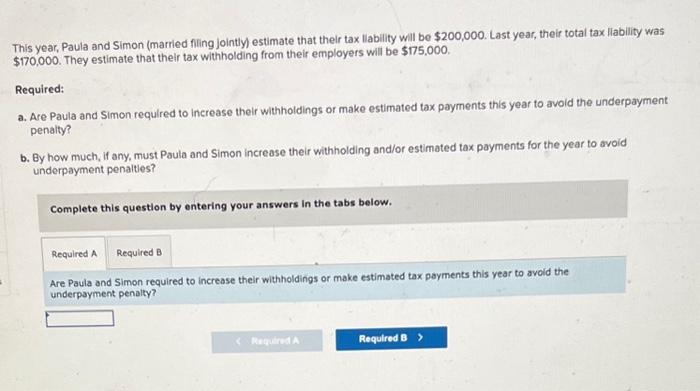

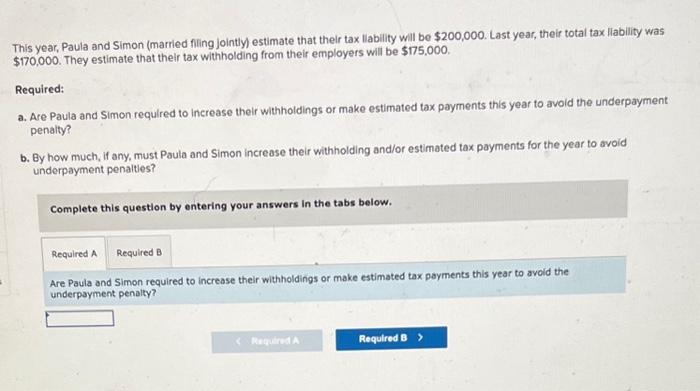

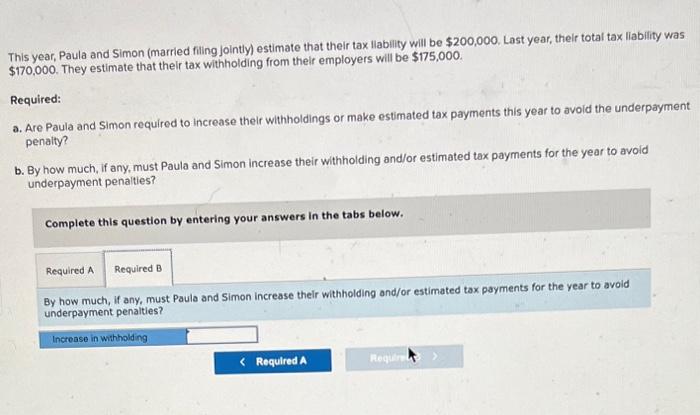

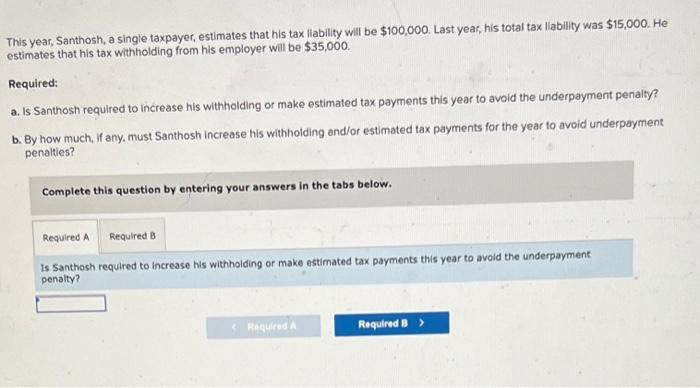

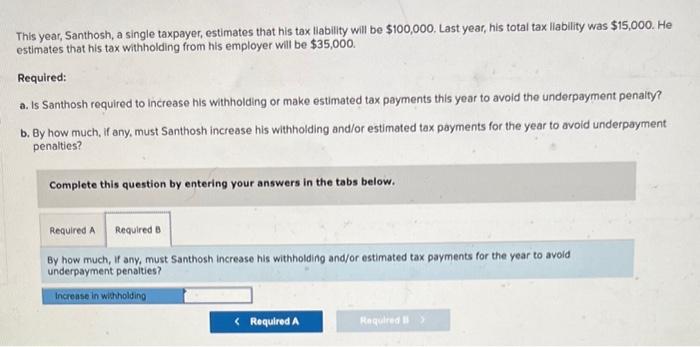

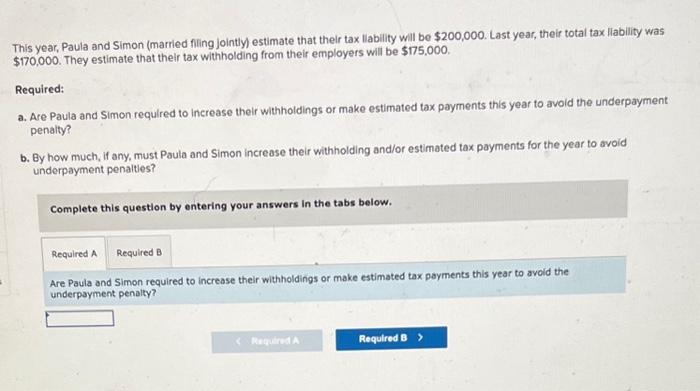

This year, Paula and Simon (married fling jointly) estimate that their tax liability will be $200,000. Last year, their total tax llability was $170,000. They estimate that their tax withholding from their employers will be $175,000 Required: a. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? b. By how much, if any, must Paula and Simon increase their withholding and/or estimated tax payments for the year to avoid underpayment penalties? Complete this question by entering your answers in the tabs below. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? This year, Paula and Simon (married filing jointly) estimate that their tax llability will be $200,000. Last year, their total tax llability was $170,000. They estimate that their tax withholding from their employers will be $175,000. Required: a. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? b. By how much, if any, must Paula and Simon increase their withhoiding and/or estimated tax payments for the year to avold underpayment penalties? Complete this question by entering your answers in the tabs below. By how much, if any, must Paula and Simon increase their withholding and/or estimated tax payments for the year to avoid underpayment penaities? This year, Santhosh, a single taxpayer, estimates that his tax liability will be $100,000. Last year, his total tax liability was $15,000. He 2stimates that his tax withholding from his employer will be $35,000. Required: a. Is Santhosh required to increase his withholding or make estimated tax payments this year to avoid the underpayment penalty? b. By how much, if any, must Santhosh increase his withhoiding and/or estimated tax payments for the year to avoid underpayment penalties? Complete this question by entering your answers in the tabs below. is Santhosh required to increase his withholding or make estimated tax payments this year to avoid the underpayment penalty? This year, Santhosh, a single taxpayer, estimates that his tax liability will be $100,000. Last year, his total tax llability was $15,000. He estimates that his tax withholding from his employer will be $35,000. Required: a. Is Santhosh required to increase his withholding or make estimated tax payments this year to avold the underpayment penalty? b. By how much, if any, must Santhosh increase his withholding and/or estimated tax payments for the year to avoid underpayment penalies? Complete this question by entering your answers in the tabs below. By how much, If any, must Santhosh increase his withholding and/or estimated tax payments for the year to avold underpayment penaities