please answer all parts for finding each table with the right numbers in columns A-E. i will leave a good rating

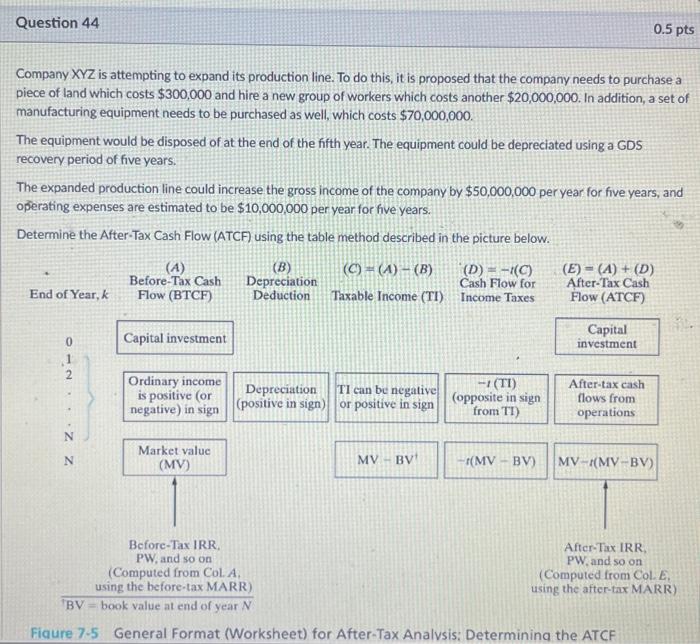

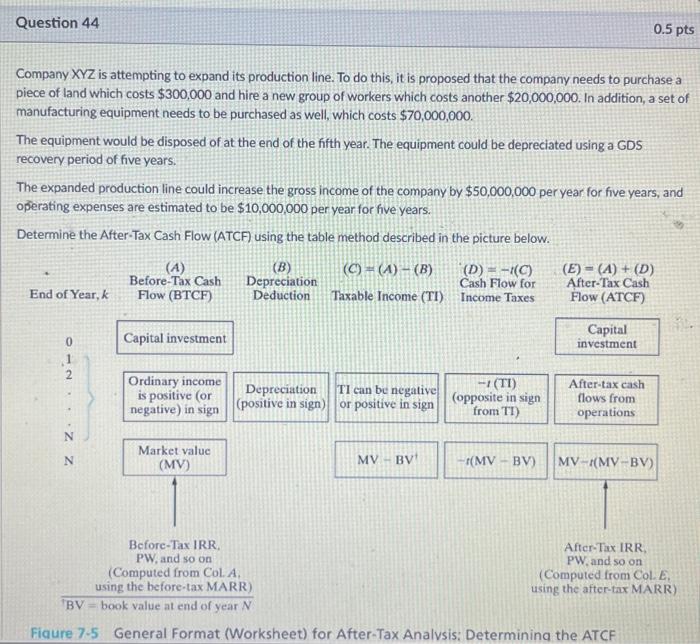

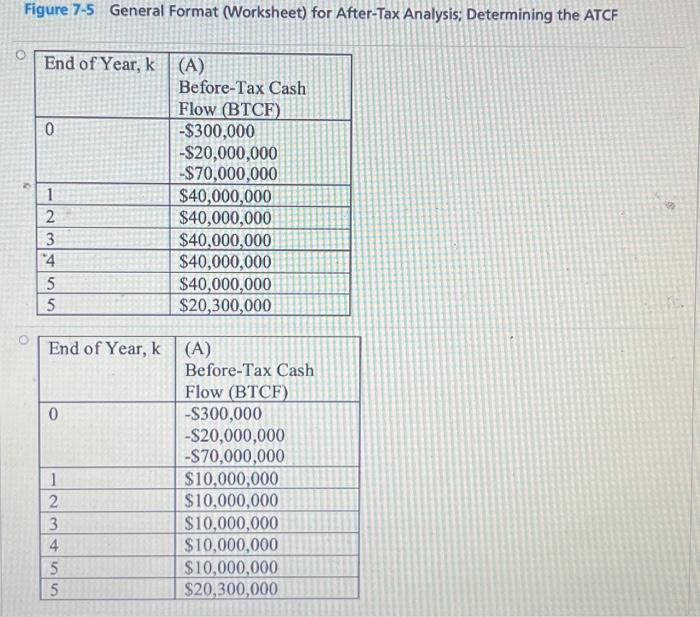

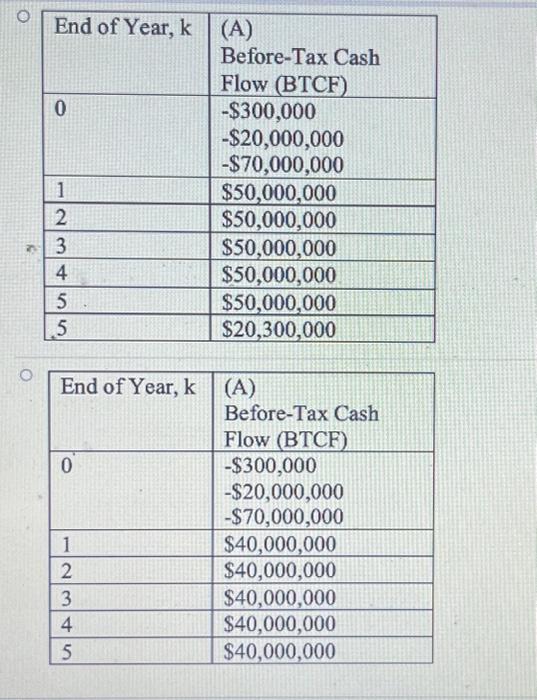

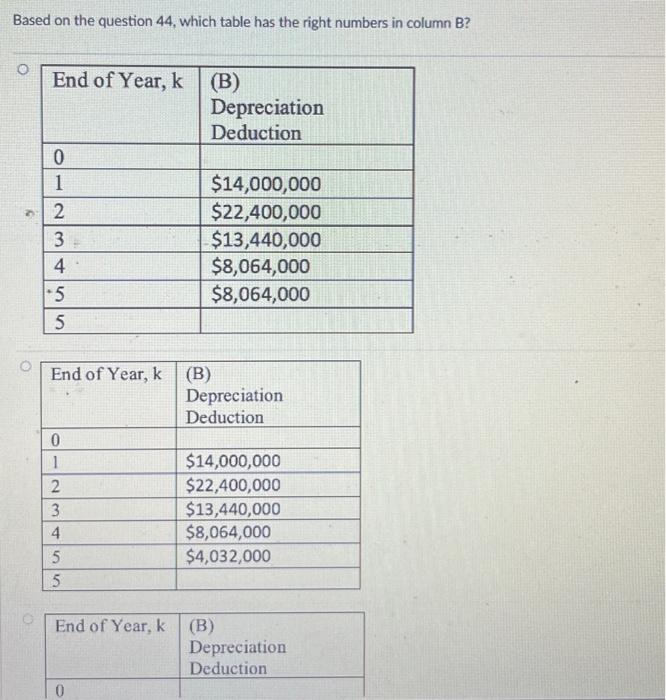

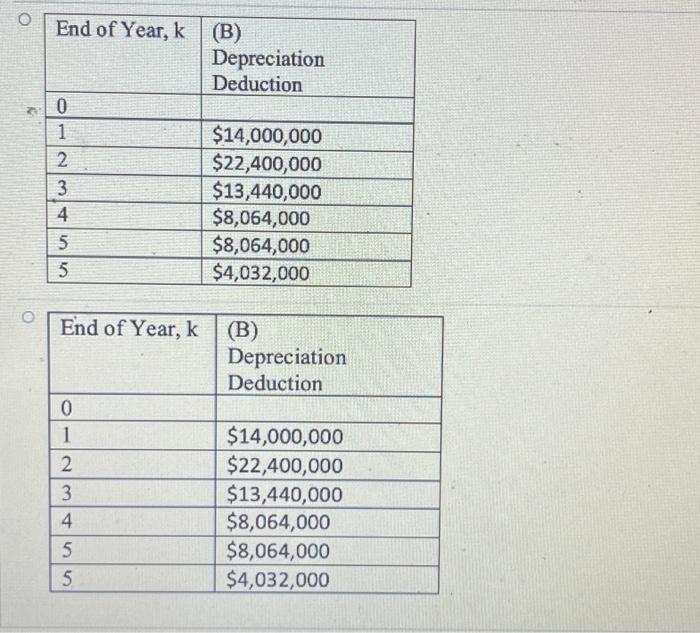

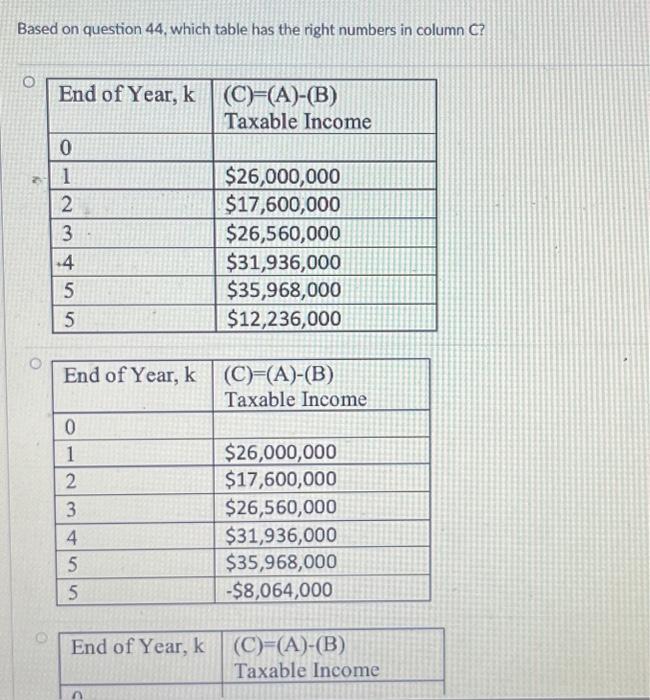

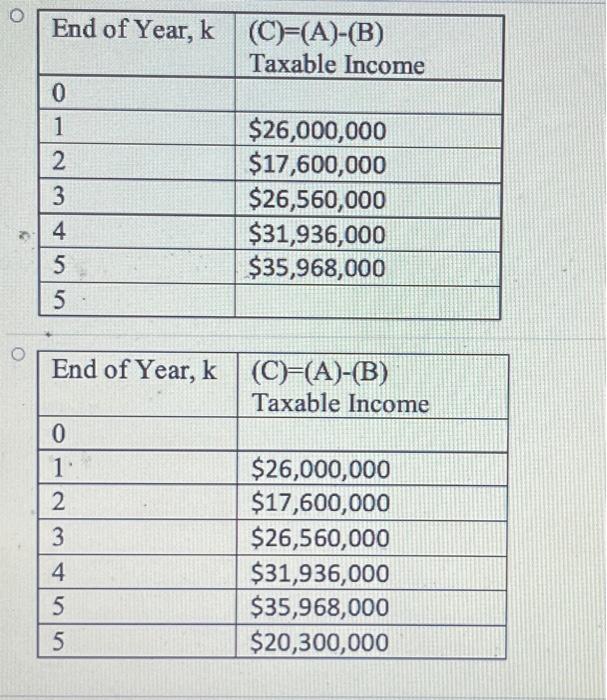

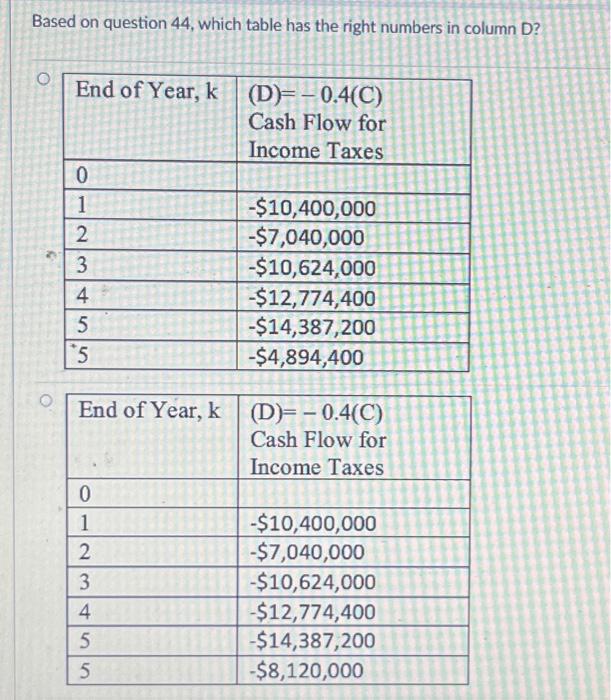

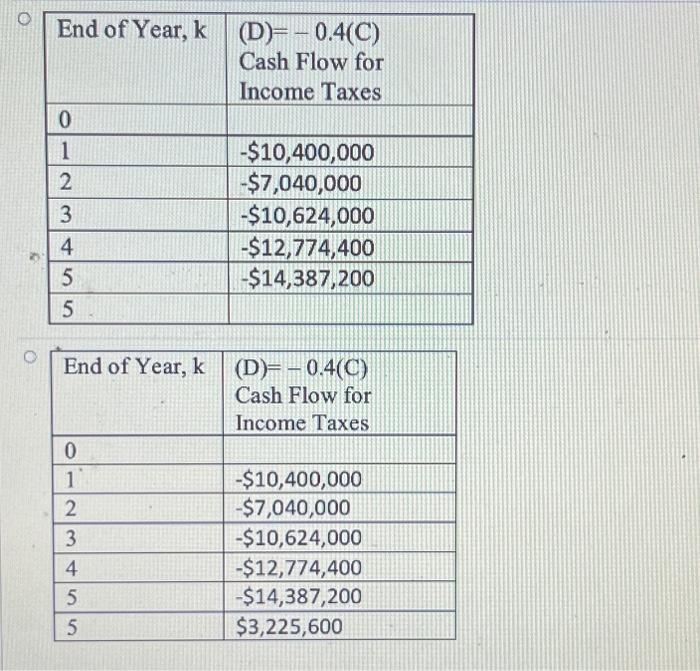

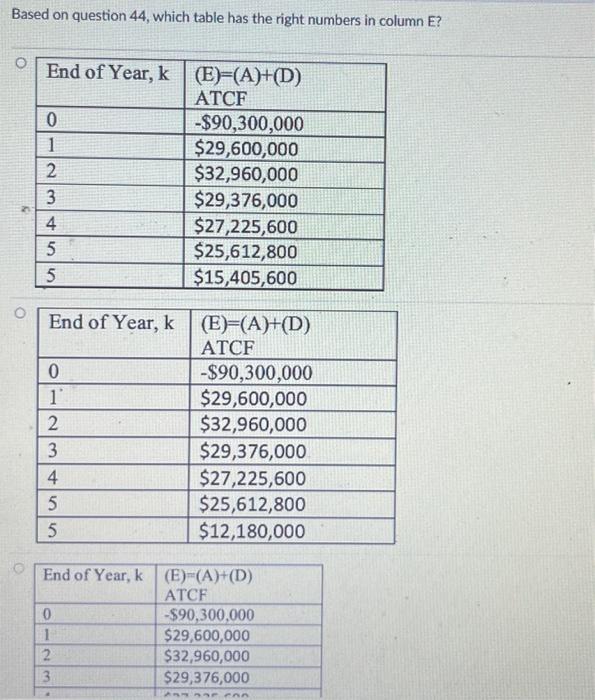

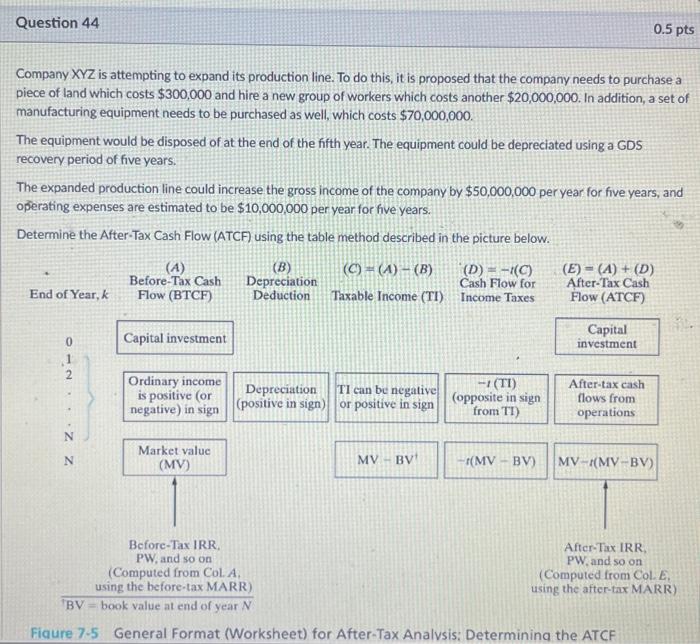

Company XYZ is attempting to expand its production line. To do this, it is proposed that the company needs to purchase a piece of land which costs $300,000 and hire a new group of workers which costs another $20,000,000. In addition, a set of manufacturing equipment needs to be purchased as well, which costs $70,000,000. The equipment would be disposed of at the end of the fifth year. The equipment could be depreciated using a GDS recovery period of five years. The expanded production line could increase the gross income of the company by $50,000,000 per year for five years, and operating expenses are estimated to be $10,000,000 per year for five years. Determine the After-Tax Cash Flow (ATCF) using the table method described in the picture below. Figure 7-5 General Format (Worksheet) for After-Tax Analysis; Determining the ATCF \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (A) \\ Before-Tax Cash \\ Flow (BTCF) \end{tabular} \\ \hline 0 & \begin{tabular}{l} $300,000 \\ $20,000,000 \\ $70,000,000 \end{tabular} \\ \hline 1 & $50,000,000 \\ \hline 2 & $50,000,000 \\ \hline 3 & $50,000,000 \\ \hline 4 & $50,000,000 \\ \hline 5 & $50,000,000 \\ \hline 5 & $20,300,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (A) \\ Before-Tax Cash \\ Flow (BTCF) \end{tabular} \\ \hline 0 & \begin{tabular}{l} $300,000 \\ $20,000,000 \\ $70,000,000 \end{tabular} \\ \hline 1 & $40,000,000 \\ \hline 2 & $40,000,000 \\ \hline 3 & $40,000,000 \\ \hline 4 & $40,000,000 \\ \hline 5 & $40,000,000 \\ \hline \end{tabular} Based on the question 44 , which table has the right numbers in column B ? \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (B) \\ Depreciation \\ Deduction \end{tabular} \\ \hline 0 & $14,000,000 \\ \hline 1 & $22,400,000 \\ \hline 2 & $13,440,000 \\ \hline 3 & $8,064,000 \\ \hline 4 & $8,064,000 \\ \hline 5 & $4,032,000 \\ \hline 5 & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (B) \\ Depreciation \\ Deduction \end{tabular} \\ \hline 0 & $14,000,000 \\ \hline 1 & $22,400,000 \\ \hline 2 & $13,440,000 \\ \hline 3 & $8,064,000 \\ \hline 4 & $8,064,000 \\ \hline 5 & $4,032,000 \\ \hline 5 & \\ \hline \end{tabular} Based on question 44 , which table has the right numbers in column C ? \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (C)=(A)(B) \\ Taxable Income \end{tabular} \\ \hline 0 & $26,000,000 \\ \hline 1 & $17,600,000 \\ \hline 2 & $26,560,000 \\ \hline 3 & $31,936,000 \\ \hline 4 & $35,968,000 \\ \hline 5 & \\ \hline 5 & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (C)=(A)(B) \\ Taxable Income \end{tabular} \\ \hline 0 & $26,000,000 \\ \hline 1 & $17,600,000 \\ \hline 2 & $26,560,000 \\ \hline 3 & $31,936,000 \\ \hline 4 & $35,968,000 \\ \hline 5 & $20,300,000 \\ \hline 5 & \end{tabular} Based on question 44 , which table has the right numbers in column D ? \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (D)=0.4(C) \\ Cash Flow for \\ Income Taxes \end{tabular} \\ \hline 0 & $10,400,000 \\ \hline 1 & $7,040,000 \\ \hline 2 & $10,624,000 \\ \hline 3 & $12,774,400 \\ \hline 4 & $14,387,200 \\ \hline 5 & \\ \hline 5 & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline End of Year, k & \begin{tabular}{l} (D)=0.4(C) \\ Cash Flow for \\ Income Taxes \end{tabular} \\ \hline 0 & $10,400,000 \\ \hline 1 & $7,040,000 \\ \hline 2 & $10,624,000 \\ \hline 3 & $12,774,400 \\ \hline 4 & $14,387,200 \\ \hline 5 & $3,225,600 \\ \hline 5 & \end{tabular} Based on question 44 , which table has the right numbers in column E