Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts fully, show all work by hand. 4. Assume that 1) the risk-free rate is 2%, 2) investors require a market risk

Please answer all parts fully, show all work by hand.

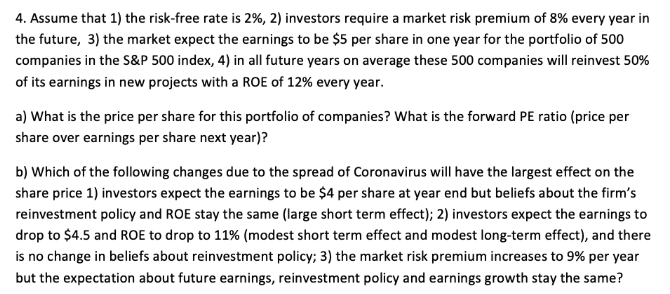

4. Assume that 1) the risk-free rate is 2%, 2) investors require a market risk premium of 8% every year in the future, 3) the market expect the earnings to be $5 per share in one year for the portfolio of 500 companies in the S&P 500 index, 4) in all future years on average these 500 companies will reinvest 50% of its earnings in new projects with a ROE of 12% every year. a) What is the price per share for this portfolio of companies? What is the forward PE ratio (price per share over earnings per share next year)? b) Which of the following changes due to the spread of Coronavirus will have the largest effect on the share price 1) investors expect the earnings to be $4 per share at year end but beliefs about the firm's reinvestment policy and ROE stay the same (large short term effect); 2) investors expect the earnings to drop to $4.5 and ROE to drop to 11% (modest short term effect and modest long-term effect), and there is no change in beliefs about reinvestment policy; 3) the market risk premium increases to 9% per year but the expectation about future earnings, reinvestment policy and earnings growth stay the same? 4. Assume that 1) the risk-free rate is 2%, 2) investors require a market risk premium of 8% every year in the future, 3) the market expect the earnings to be $5 per share in one year for the portfolio of 500 companies in the S&P 500 index, 4) in all future years on average these 500 companies will reinvest 50% of its earnings in new projects with a ROE of 12% every year. a) What is the price per share for this portfolio of companies? What is the forward PE ratio (price per share over earnings per share next year)? b) Which of the following changes due to the spread of Coronavirus will have the largest effect on the share price 1) investors expect the earnings to be $4 per share at year end but beliefs about the firm's reinvestment policy and ROE stay the same (large short term effect); 2) investors expect the earnings to drop to $4.5 and ROE to drop to 11% (modest short term effect and modest long-term effect), and there is no change in beliefs about reinvestment policy; 3) the market risk premium increases to 9% per year but the expectation about future earnings, reinvestment policy and earnings growth stay the sameStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started