Please answer all parts of the question and only provide answers if you know how to solve (so that questions are not wasted). The first image provides given information. Thank you.

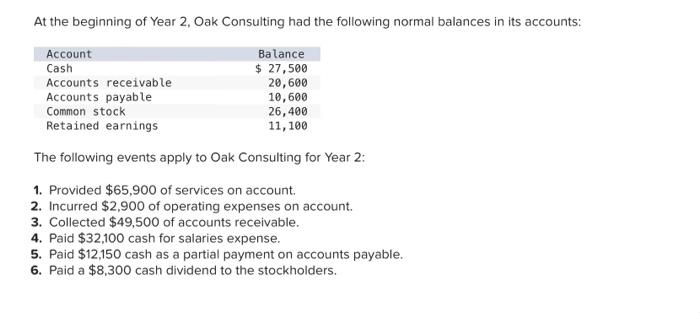

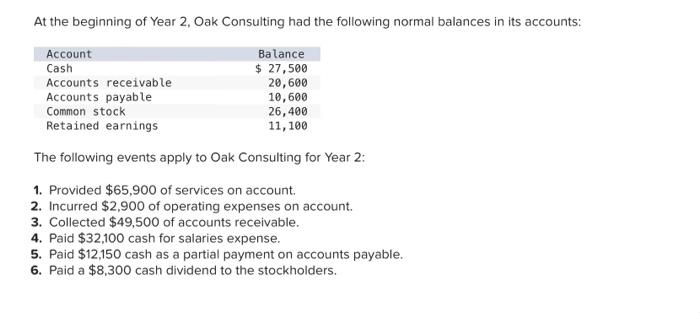

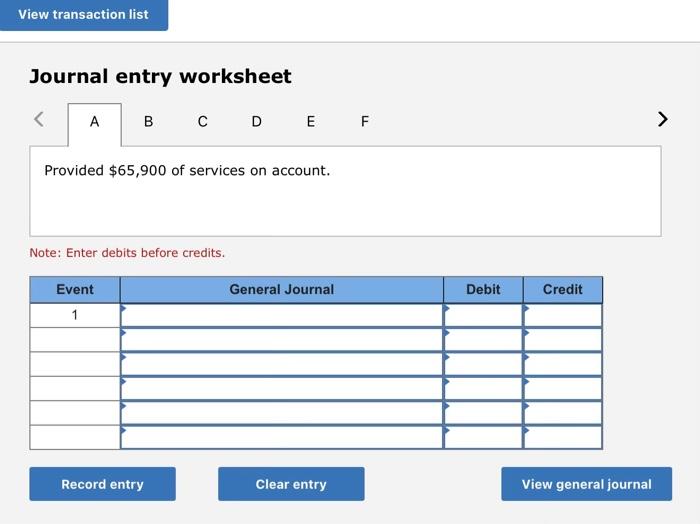

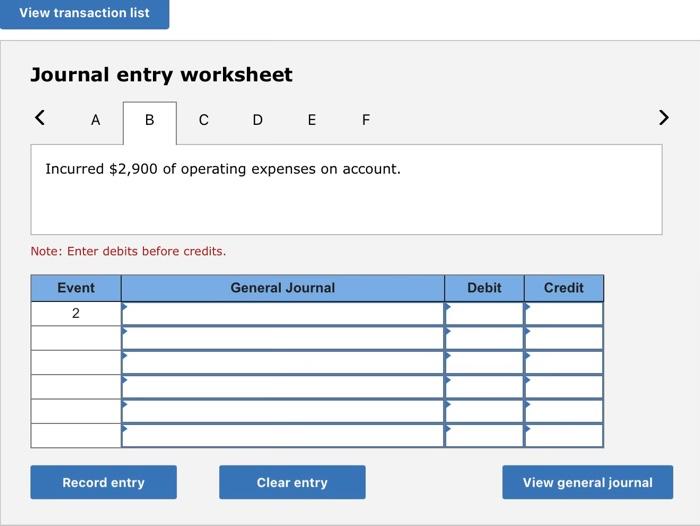

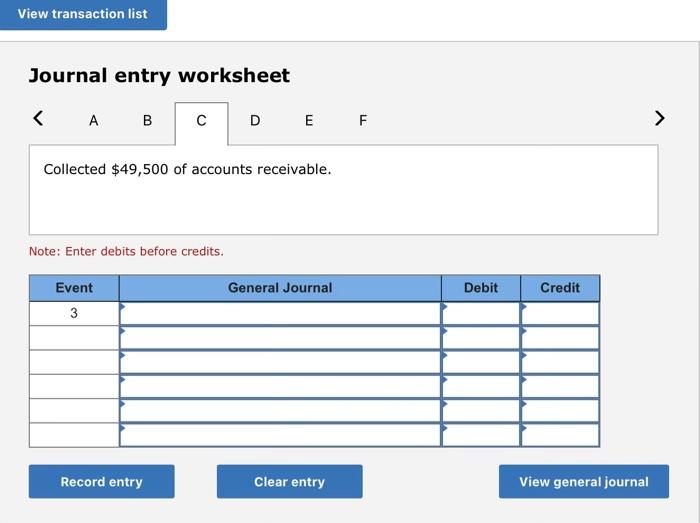

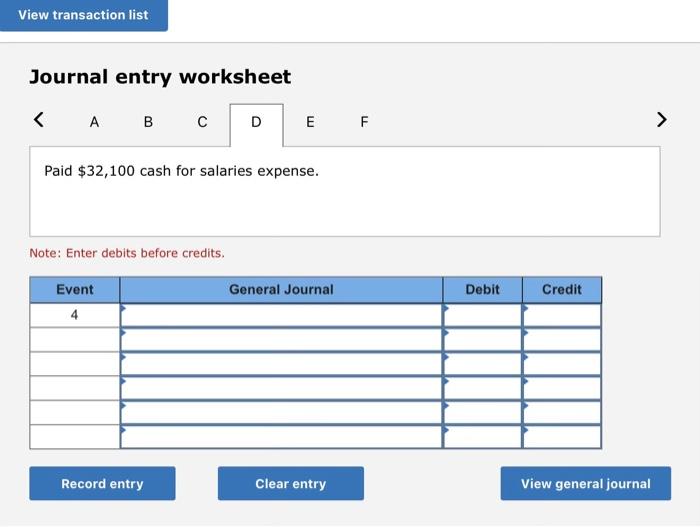

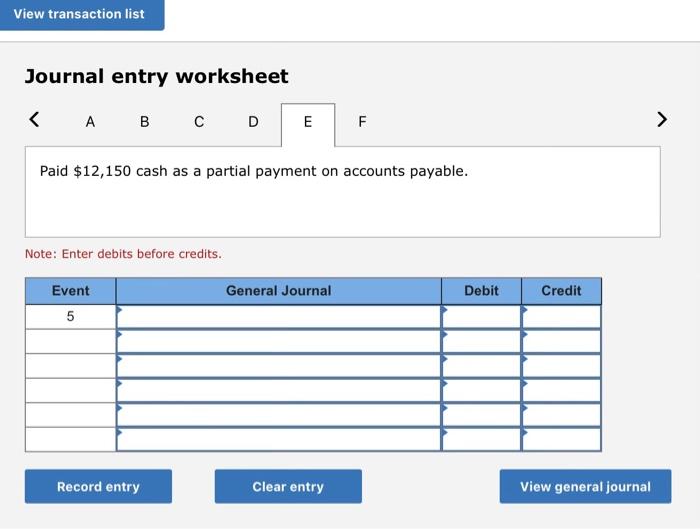

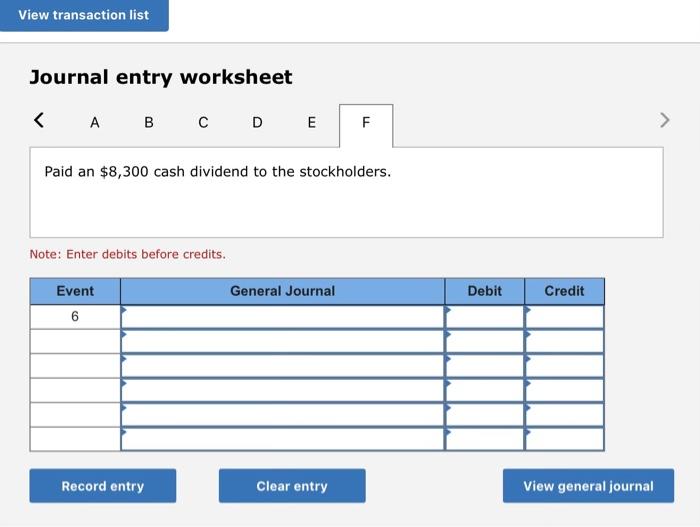

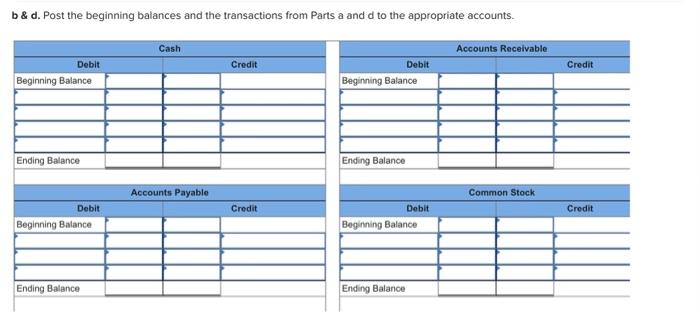

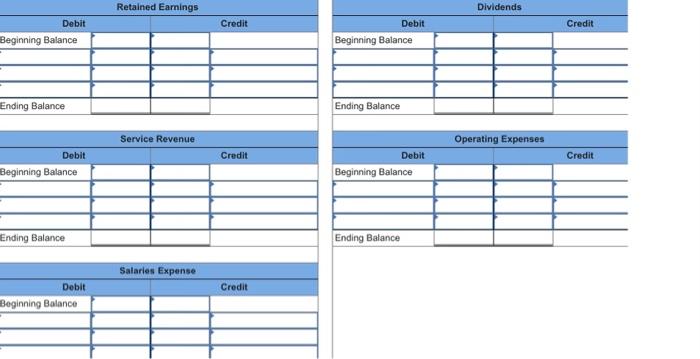

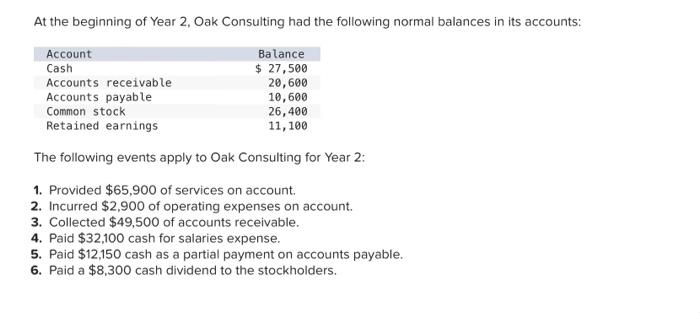

At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts: The following events apply to Oak Consulting for Year 2: 1. Provided $65,900 of services on account. 2. Incurred $2,900 of operating expenses on account. 3. Collected $49,500 of accounts receivable. 4. Paid $32,100 cash for salaries expense. 5. Paid $12,150 cash as a partial payment on accounts payable. 6. Paid a $8,300 cash dividend to the stockholders. Journal entry worksheet Provided $65,900 of services on account. Note: Enter debits before credits. Journal entry worksheet F Incurred $2,900 of operating expenses on account. Note: Enter debits before credits. Journal entry worksheet D E Collected $49,500 of accounts receivable. Note: Enter debits before credits. Journal entry worksheet B Paid $32,100 cash for salaries expense. Note: Enter debits before credits. Journal entry worksheet Paid $12,150 cash as a partial payment on accounts payable. Note: Enter debits before credits. Journal entry worksheet D Paid an $8,300 cash dividend to the stockholders. Note: Enter debits before credits. b \& d. Post the beginning balances and the transactions from Parts a and d to the appropriate accounts. Dividends \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & & \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{c|}{ Operating Expenses } \\ \hline Debit & & \multicolumn{1}{c}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline \end{tabular} At the beginning of Year 2, Oak Consulting had the following normal balances in its accounts: The following events apply to Oak Consulting for Year 2: 1. Provided $65,900 of services on account. 2. Incurred $2,900 of operating expenses on account. 3. Collected $49,500 of accounts receivable. 4. Paid $32,100 cash for salaries expense. 5. Paid $12,150 cash as a partial payment on accounts payable. 6. Paid a $8,300 cash dividend to the stockholders. Journal entry worksheet Provided $65,900 of services on account. Note: Enter debits before credits. Journal entry worksheet F Incurred $2,900 of operating expenses on account. Note: Enter debits before credits. Journal entry worksheet D E Collected $49,500 of accounts receivable. Note: Enter debits before credits. Journal entry worksheet B Paid $32,100 cash for salaries expense. Note: Enter debits before credits. Journal entry worksheet Paid $12,150 cash as a partial payment on accounts payable. Note: Enter debits before credits. Journal entry worksheet D Paid an $8,300 cash dividend to the stockholders. Note: Enter debits before credits. b \& d. Post the beginning balances and the transactions from Parts a and d to the appropriate accounts. Dividends \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & & \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{c|}{ Operating Expenses } \\ \hline Debit & & \multicolumn{1}{c}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline \end{tabular}