Answered step by step

Verified Expert Solution

Question

1 Approved Answer

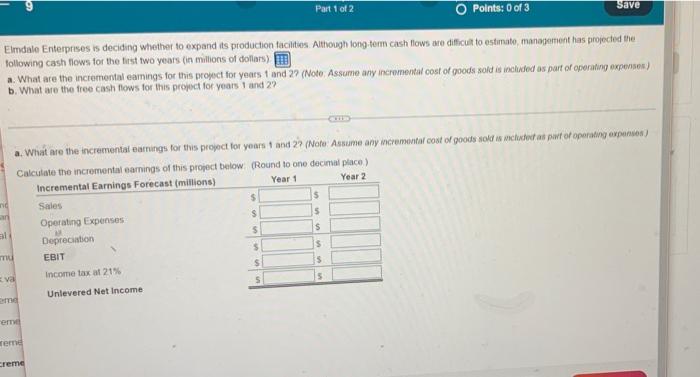

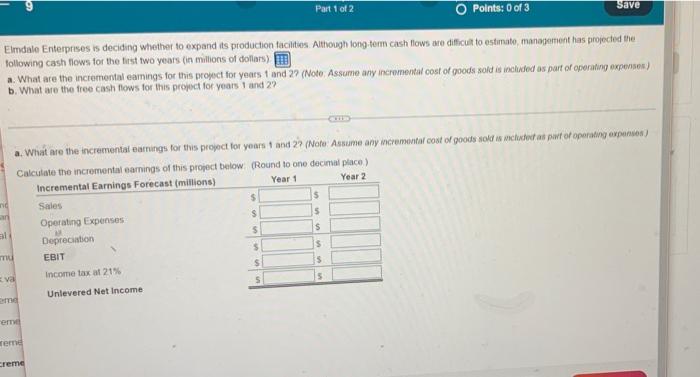

please answer all parts of the question for a thumbs up Part 1 of 2 Points: 0 of 3 Save Elmdale Enterprises is deciding whether

please answer all parts of the question for a thumbs up

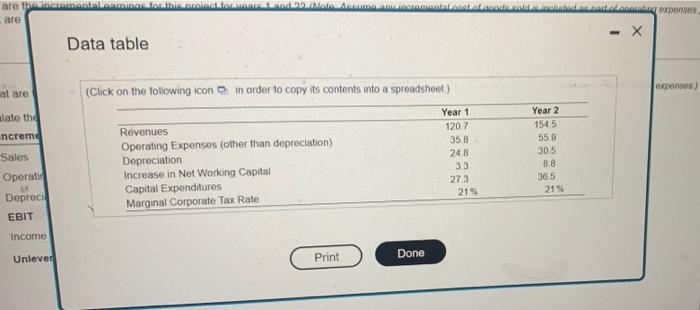

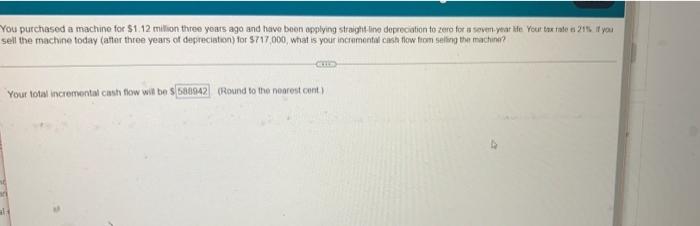

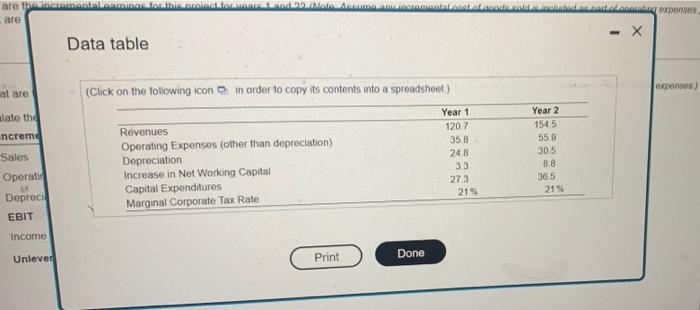

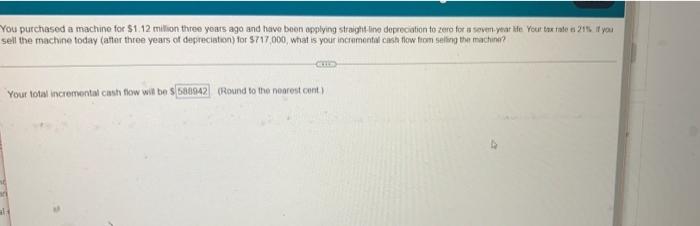

Part 1 of 2 Points: 0 of 3 Save Elmdale Enterprises is deciding whether to expand its production facilities. Although tong-term cash flows are difficult to estimate management has projected the following cash flows for the first two years in millions of dollars) a. What are the incremental earnings for this project for years 1 and 29 (Noto Assume any incremental cost of goods sold is included as part of operating experien) b. What are the free cash flows for this project for years 1 and 2? a. What are the incrementalesings for this project for years and 2? (NoteAssume any incremental cost of goods sold is mcluded as part of operating expenses) Calculate the incremental earnings of this project below (Round to one decimal place) Incremental Earnings Forecast (millions) Year 1 Year 2 Sales $ $ S 5 Operating Expenses al $ $ Depreciation 5 mu $ EBIT $ 15 va Income tax at 21% 5 5 Unlevered Net Income eme reme Creme are the MADALI in this occurrant.dood are geoxponos Data table curposes) at are (Click on the following icon in order to copy its contents into a spreadsheet) alate the ncreme Year 1 1207 358 248 33 273 21% Revenues Operating Expenses (other than depreciation) Depreciation Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate Year 2 1545 559 30.5 88 365 215 Sales Operatin Depreci EBIT Income Unlever Print Done You purchased a machine for $1.12 million three years ago and have been opplying straight line depreciation to zero for a seven-yeat He Your box tales 2015 f you sell the machine today after three years of depreciation) for $717.000, what is your incremental cash flow from selling the machine? Your total incremental cash flow wit be $580942(Round to the nearest cont al

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started