Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts of the question, including any workings and explanations please :) 2. 1). The spot price of oil is $80 per barrel

Please answer all parts of the question, including any workings and explanations please :)

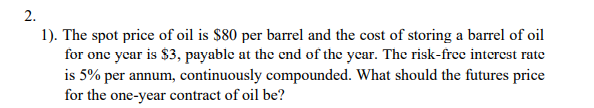

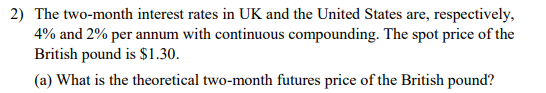

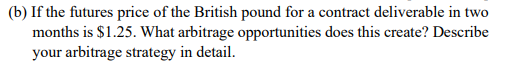

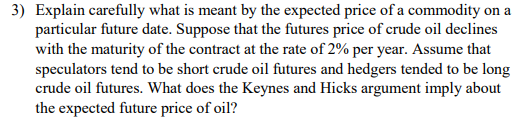

2. 1). The spot price of oil is $80 per barrel and the cost of storing a barrel of oil for one year is $3, payable at the end of the year. The risk-free interest rate is 5% per annum, continuously compounded. What should the futures price for the one-year contract of oil be? 2) The two-month interest rates in UK and the United States are, respectively, 4% and 2% per annum with continuous compounding. The spot price of the British pound is $1.30. (a) What is the theoretical two-month futures price of the British pound? (b) If the futures price of the British pound for a contract deliverable in two months is $1.25. What arbitrage opportunities does this create? Describe your arbitrage strategy in detail. 3) Explain carefully what is meant by the expected price of a commodity on a particular future date. Suppose that the futures price of crude oil declines with the maturity of the contract at the rate of 2% per year. Assume that speculators tend to be short crude oil futures and hedgers tended to be long crude oil futures. What does the Keynes and Hicks argument imply about the expected future price of oil? 2. 1). The spot price of oil is $80 per barrel and the cost of storing a barrel of oil for one year is $3, payable at the end of the year. The risk-free interest rate is 5% per annum, continuously compounded. What should the futures price for the one-year contract of oil be? 2) The two-month interest rates in UK and the United States are, respectively, 4% and 2% per annum with continuous compounding. The spot price of the British pound is $1.30. (a) What is the theoretical two-month futures price of the British pound? (b) If the futures price of the British pound for a contract deliverable in two months is $1.25. What arbitrage opportunities does this create? Describe your arbitrage strategy in detail. 3) Explain carefully what is meant by the expected price of a commodity on a particular future date. Suppose that the futures price of crude oil declines with the maturity of the contract at the rate of 2% per year. Assume that speculators tend to be short crude oil futures and hedgers tended to be long crude oil futures. What does the Keynes and Hicks argument imply about the expected future price of oilStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started