Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts of the question please answer all parts Janice and Terry Van Dyke have decided to establish an ordinary annuity for retirement.

please answer all parts of the question

please answer all parts

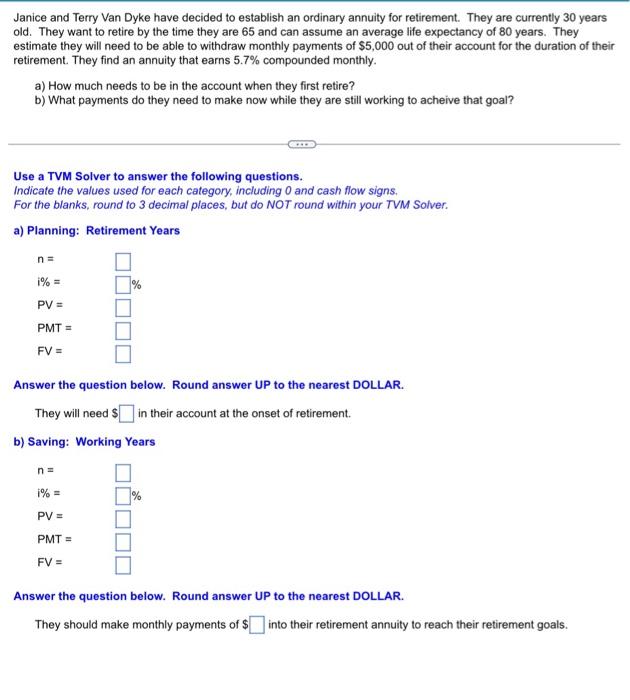

Janice and Terry Van Dyke have decided to establish an ordinary annuity for retirement. They are currently 30 years old. They want to retire by the time they are 65 and can assume an average life expectancy of 80 years. They estimate they will need to be able to withdraw monthly payments of $5,000 out of their account for the duration of their retirement. They find an annuity that earns 5.7% compounded monthly. a) How much needs to be in the account when they first retire? b) What payments do they need to make now while they are still working to acheive that goal? Use a TVM Solver to answer the following questions. Indicate the values used for each category, including 0 and cash flow signs. For the blanks, round to 3 decimal places, but do NOT round within your TVM Solver. a) Planning: Retirement Years n=i%=PV=PMT=FV= Answer the question below. Round answer UP to the nearest DOLLAR. They will need $ in their account at the onset of retirement. b) Saving: Working Years n=i%=PV=PMT=FV= Answer the question below. Round answer UP to the nearest DOLLAR. They should make monthly payments of $ into their retirement annuity to reach their retirement goals Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started