Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts of the question. Thanks in advance!. A discounted Certificate of Deposit with a face value of $ 120 million is issued

Please answer all parts of the question. Thanks in advance!.

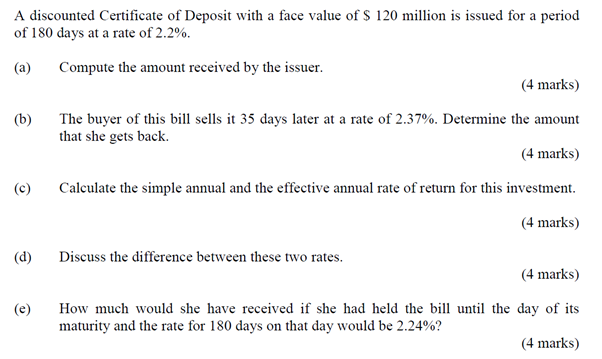

A discounted Certificate of Deposit with a face value of $ 120 million is issued for a period of 180 days at a rate of 2.2%. (a) Compute the amount received by the issuer. (4 marks) (b) The buyer of this bill sells it 35 days later at a rate of 2.37%. Determine the amount that she gets back. (4 marks) (c) Calculate the simple annual and the effective annual rate of return for this investment. (4 marks) (d) Discuss the difference between these two rates. (4 marks) (e) How much would she have received if she had held the bill until the day of its maturity and the rate for 180 days on that day would be 2.24%? (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started