Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts of this question, it is one complete question Predetermined Overhead Rate, Overhead Variances, Journal Entries Craig Company uses a predetermined overhead

Please answer all parts of this question, it is one complete question

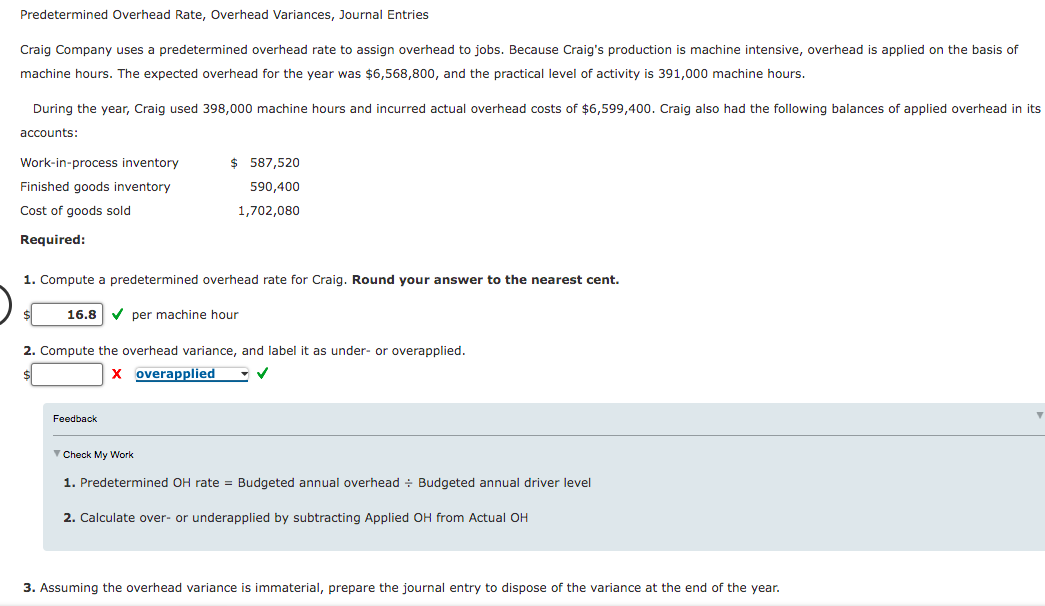

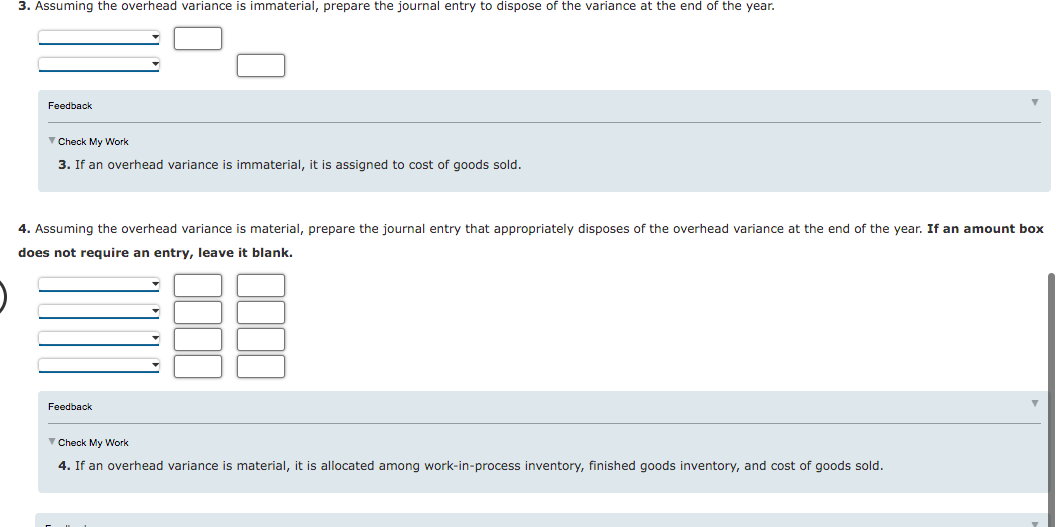

Predetermined Overhead Rate, Overhead Variances, Journal Entries Craig Company uses a predetermined overhead rate to assign overhead to jobs. Because Craig's production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $6,568,800, and the practical level of activity is 391,000 machine hours. During the year, Craig used 398,000 machine hours and incurred actual overhead costs of $6,599,400. Craig also had the following balances of applied overhead in its accounts: Work-in-process inventory Finished goods inventory $ 587,520 590,400 Cost of goods sold 1,702,080 Required: 1. Compute a predetermined overhead rate for Craig. Round your answer to the nearest cent. 16.8 per machine hour 2. Compute the overhead variance, and label it as under- or overapplied. X overapplied Feedback Check My Work 1. Predetermined OH rate = Budgeted annual overhead = Budgeted annual driver level 2. Calculate over- or underapplied by subtracting Applied OH from Actual OH 3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year. 3. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at the end of the year. Feedback Check My Work 3. If an overhead variance is immaterial, it is assigned to cost of goods sold. 4. Assuming the overhead variance is material, prepare the journal entry that appropriately disposes of the overhead variance at the end of the year. If an amount box does not require an entry, leave it blank. Feedback Check My Work 4. If an overhead variance is material, it is allocated among work-in-process inventory, finished goods inventory, and cost of goods soldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started