Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts of this question, it is only one question just with myltiple parts. I rate well! thank you so much 25) general

please answer all parts of this question, it is only one question just with myltiple parts. I rate well! thank you so much

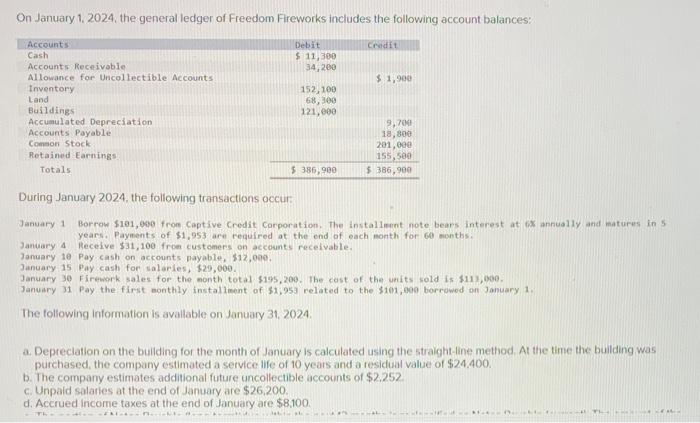

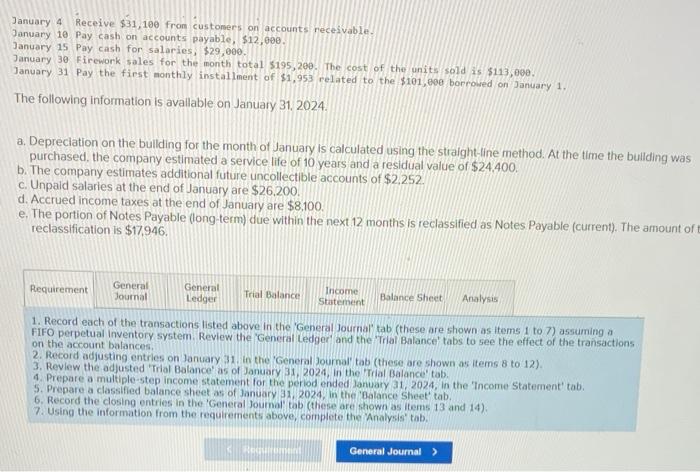

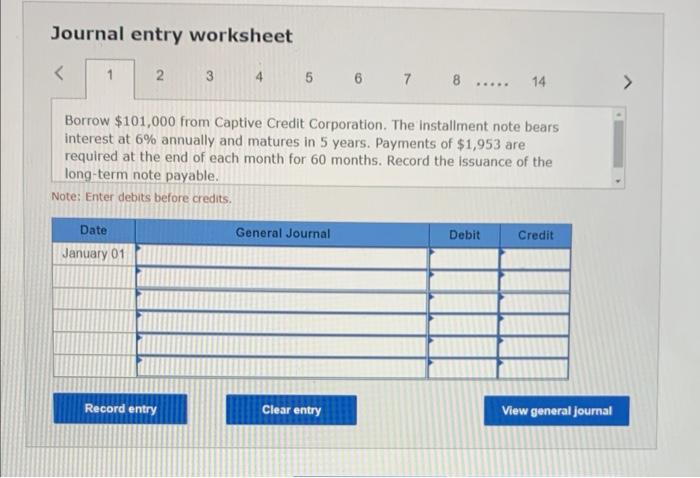

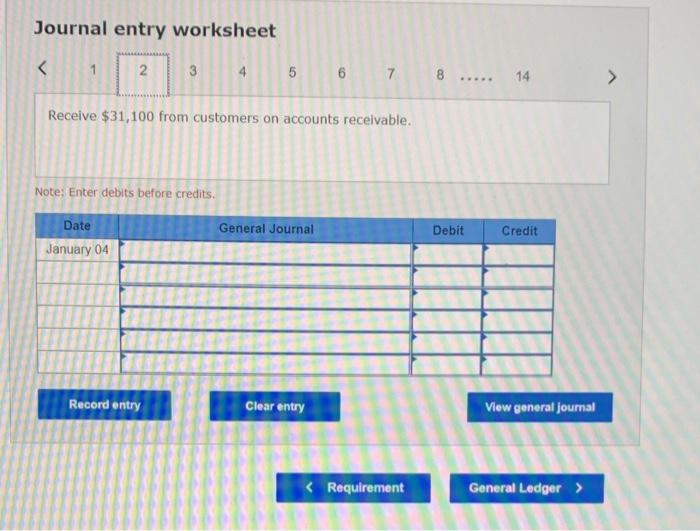

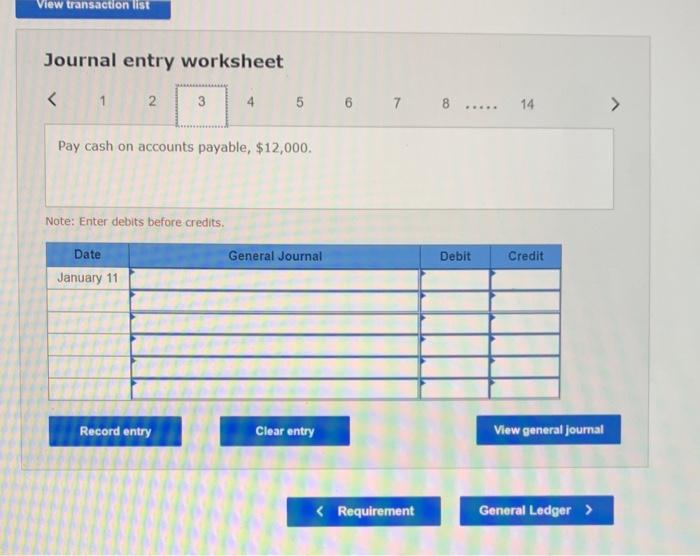

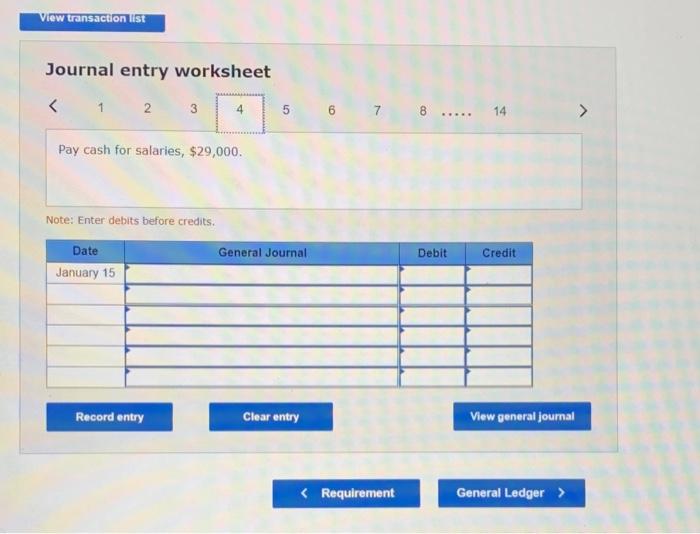

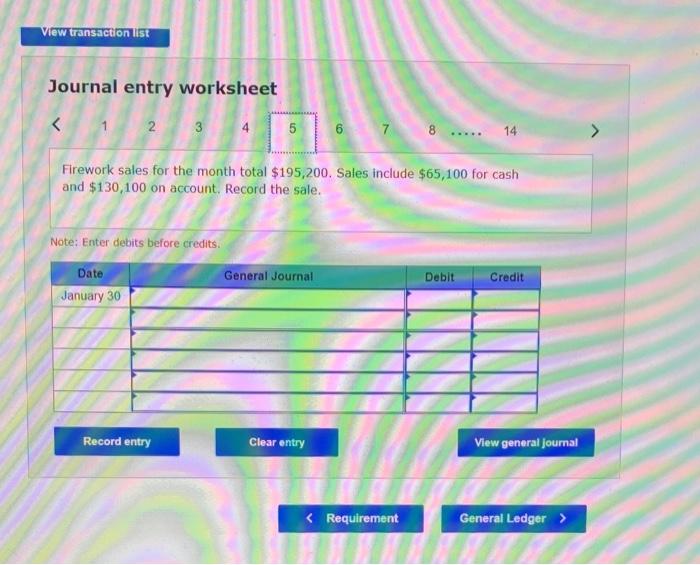

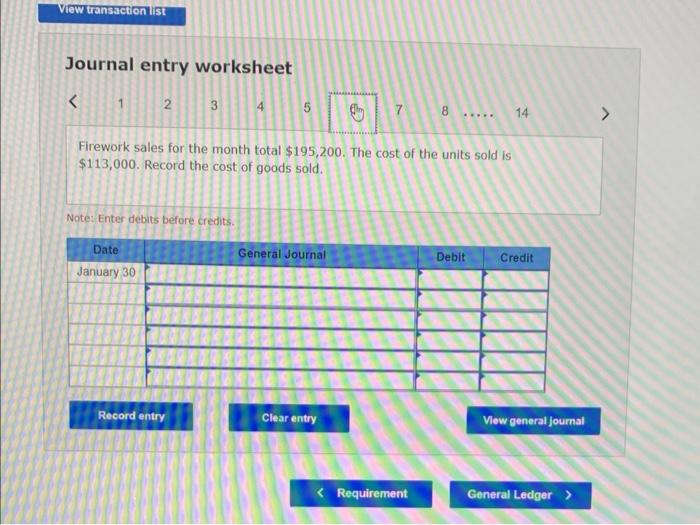

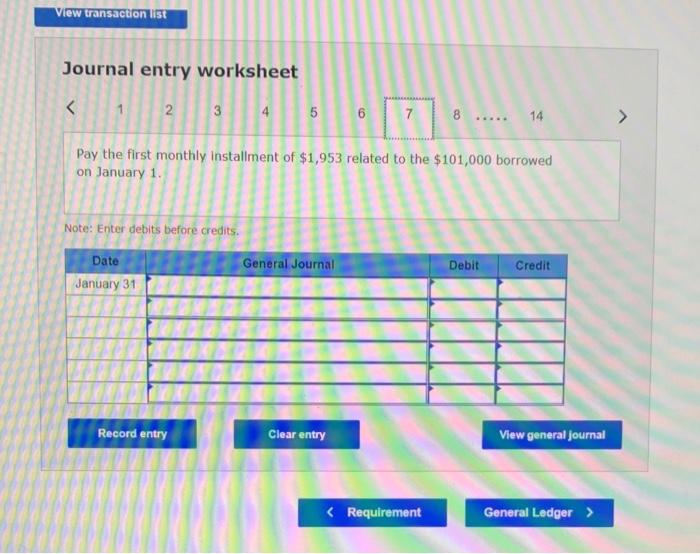

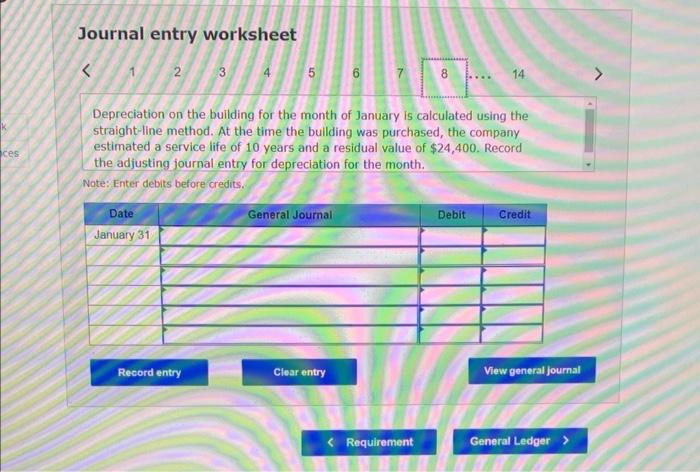

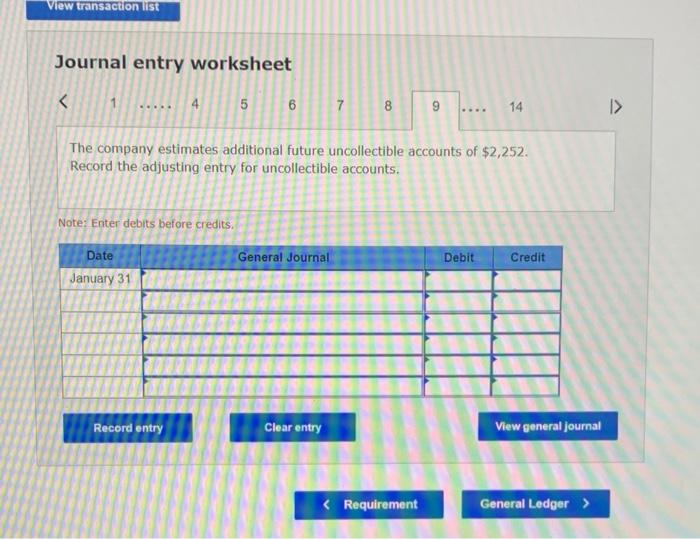

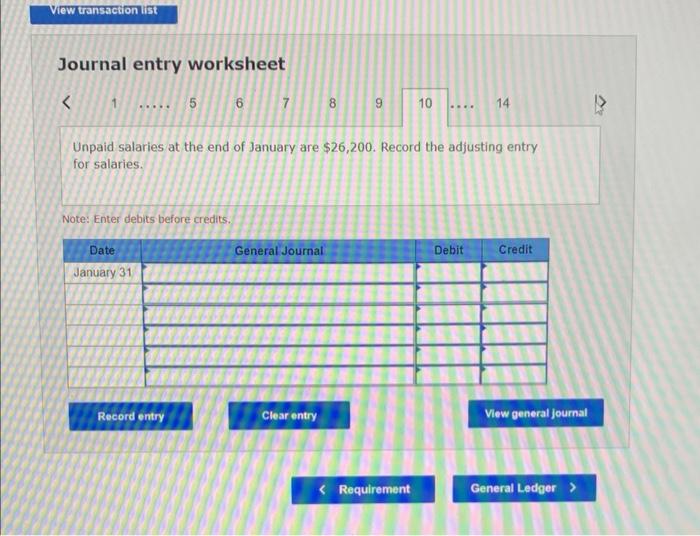

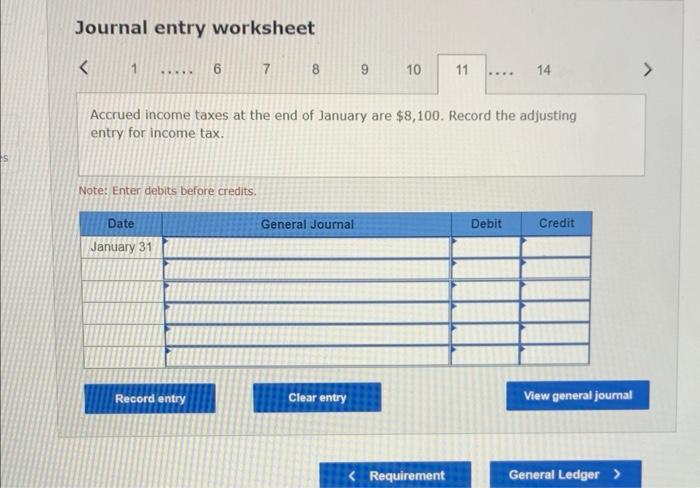

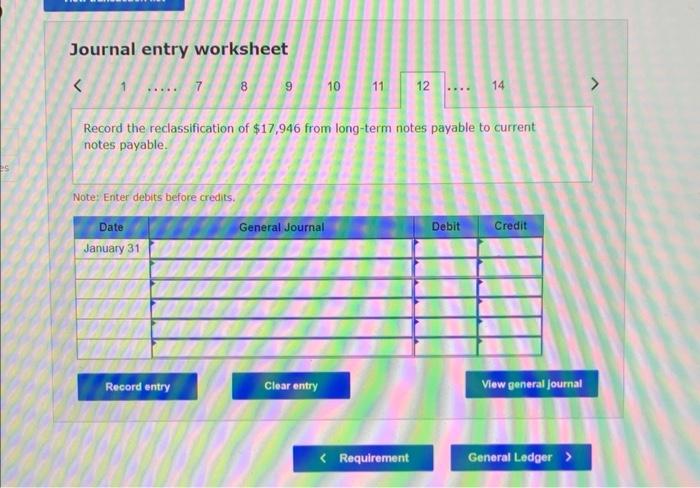

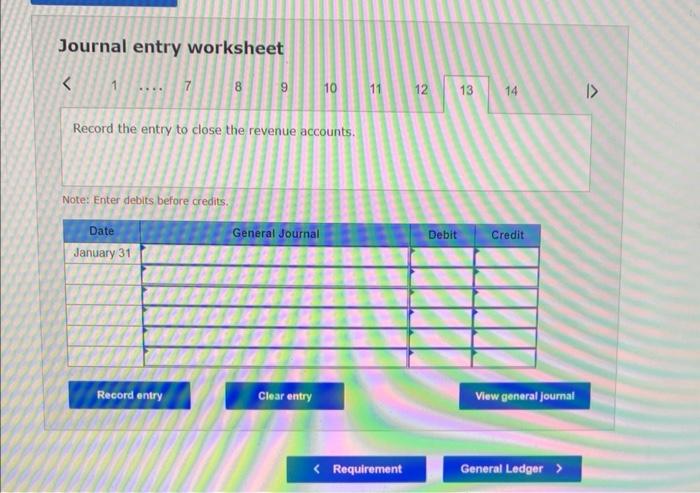

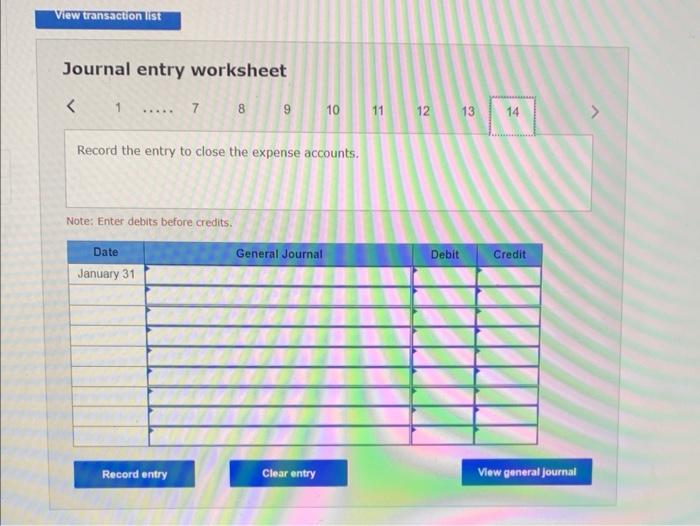

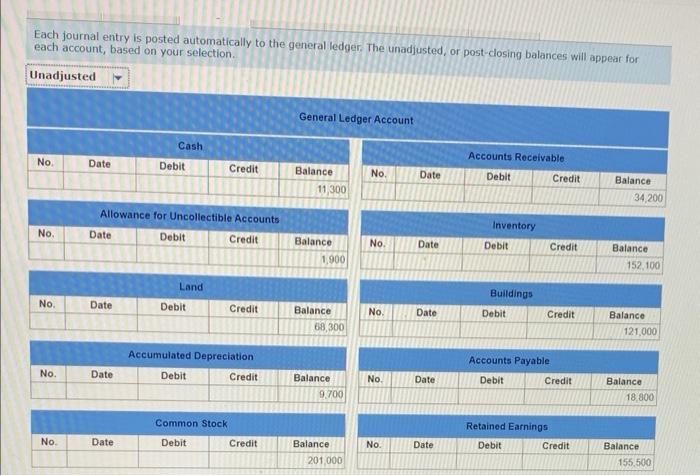

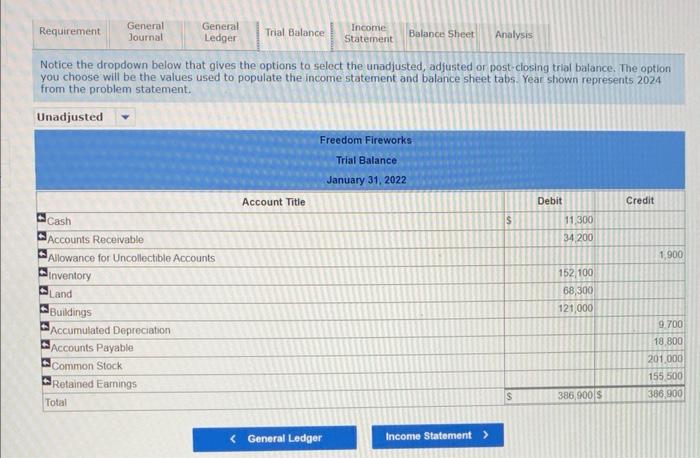

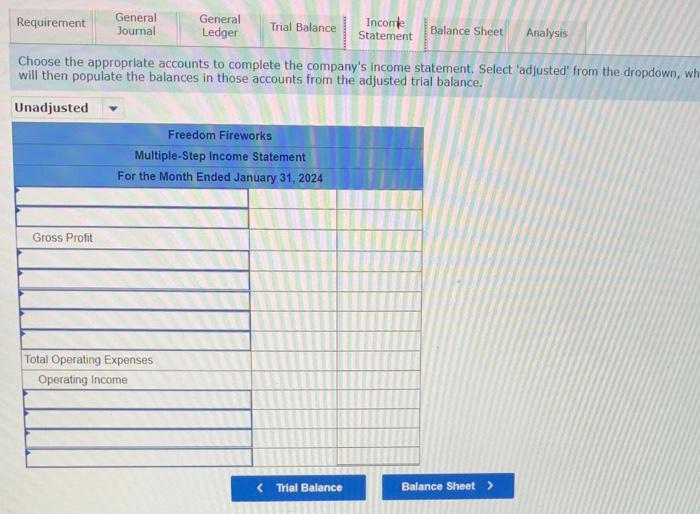

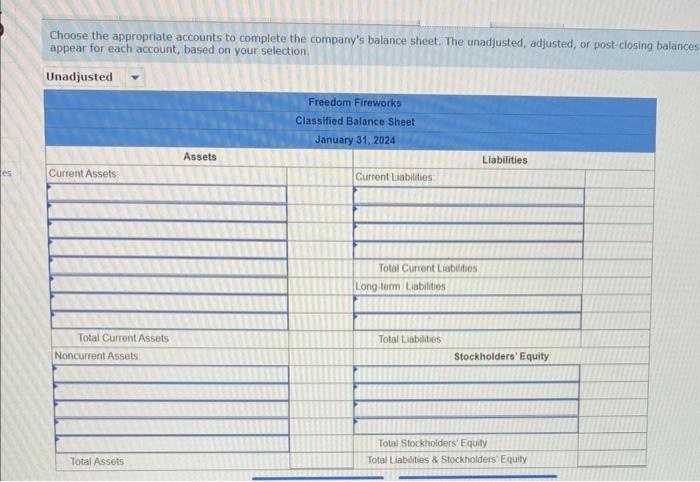

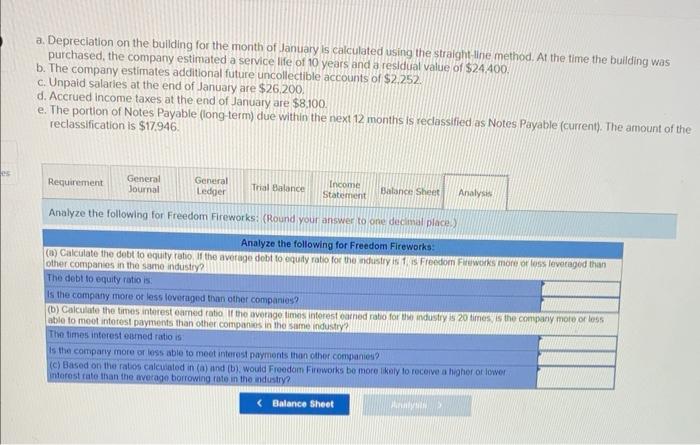

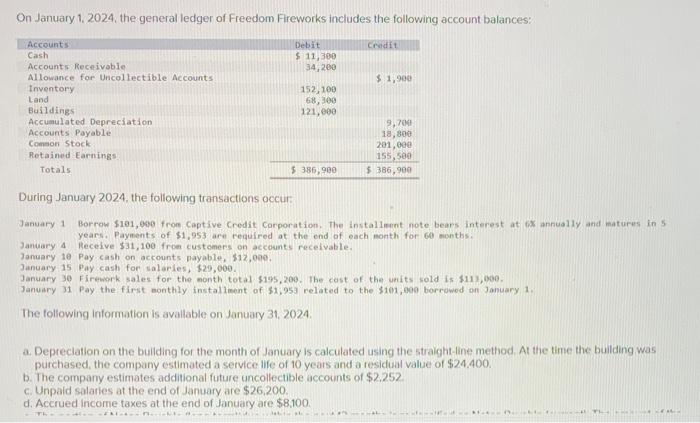

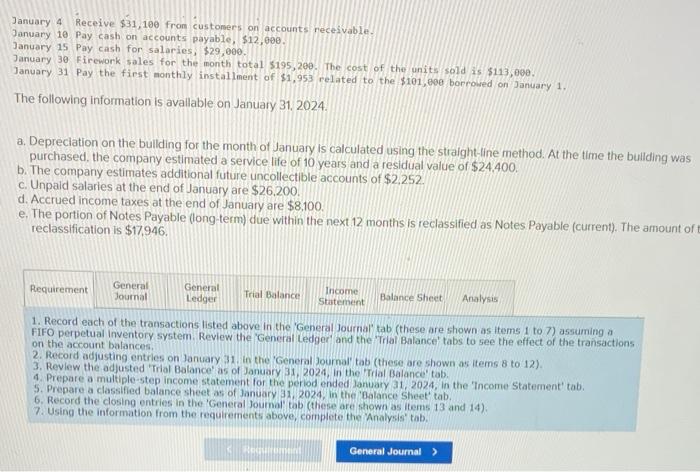

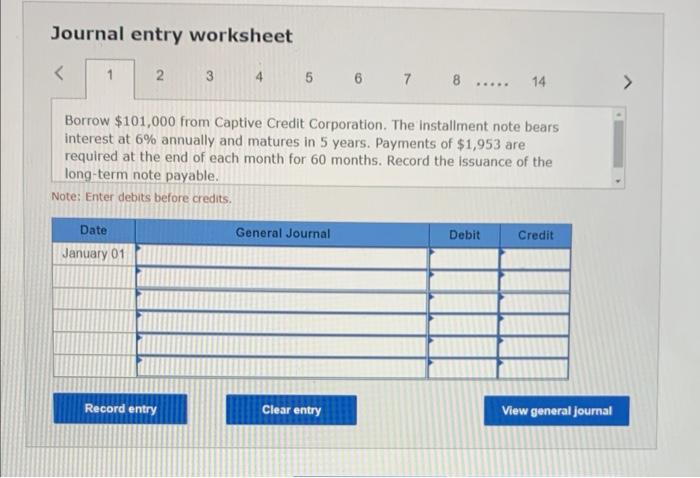

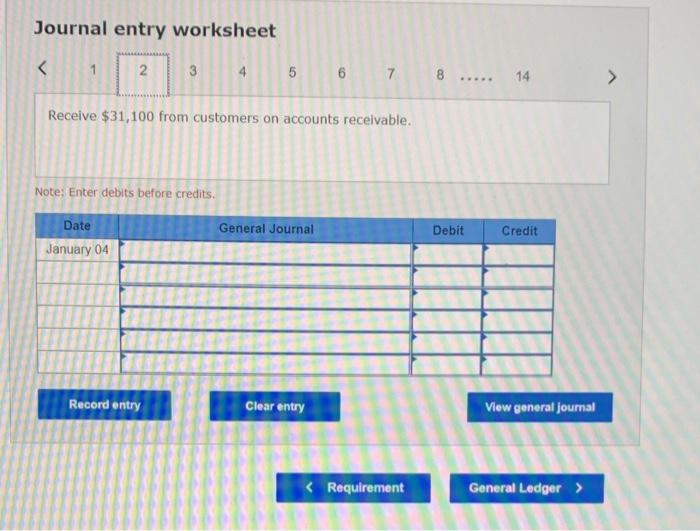

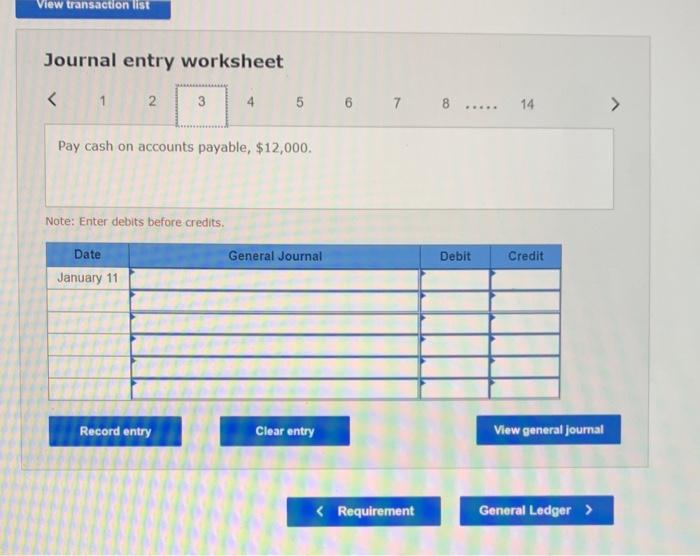

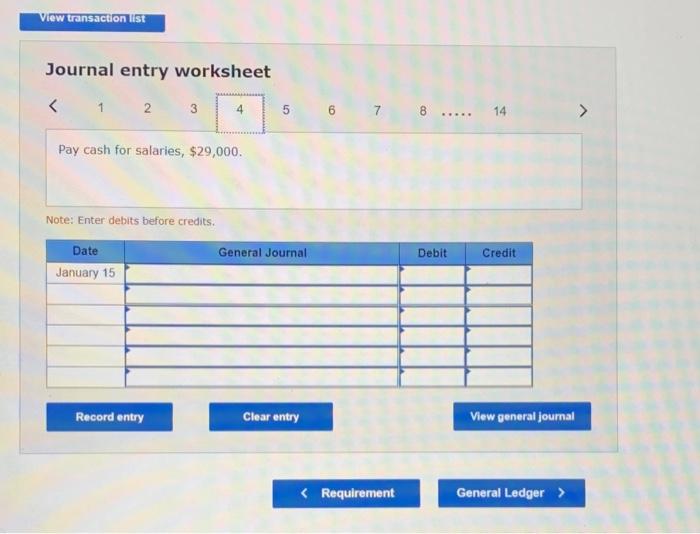

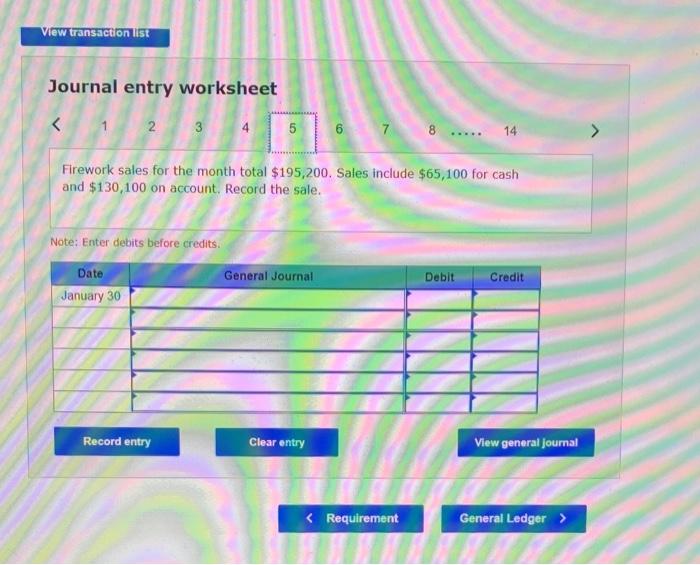

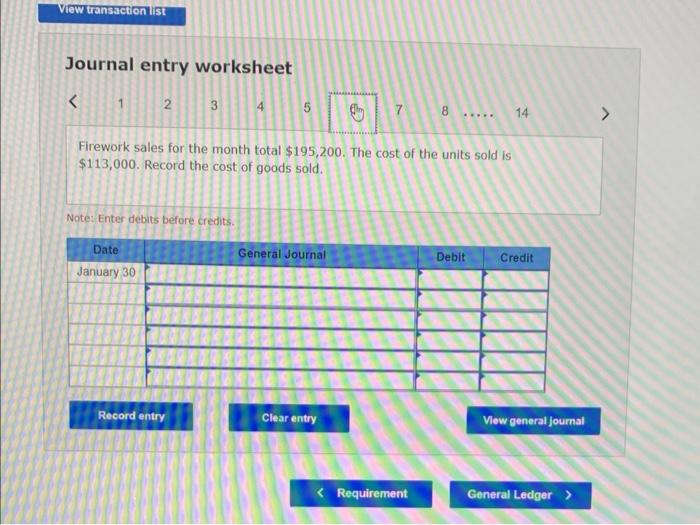

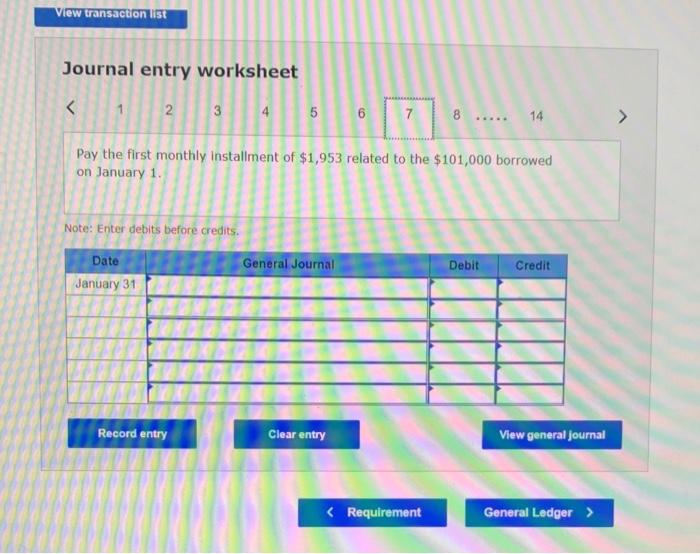

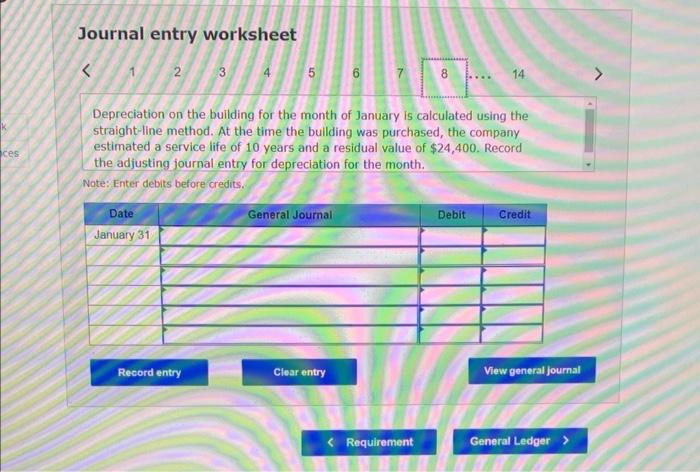

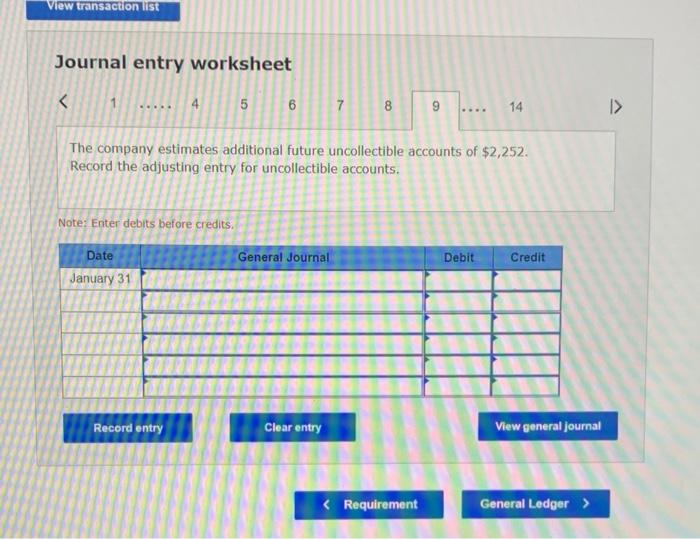

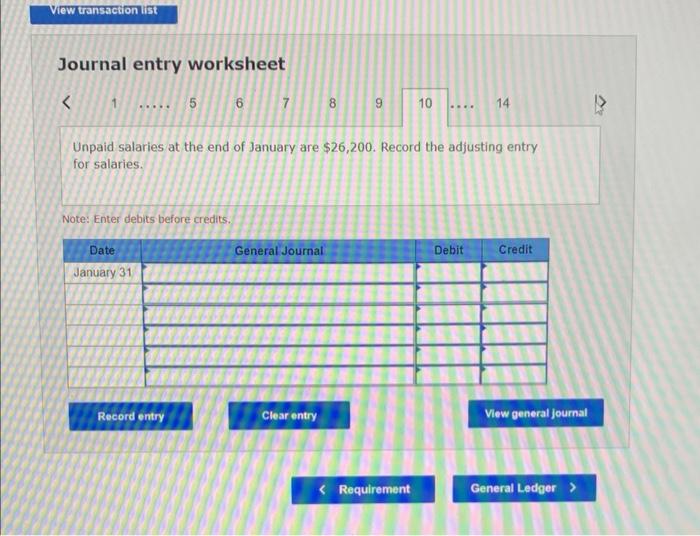

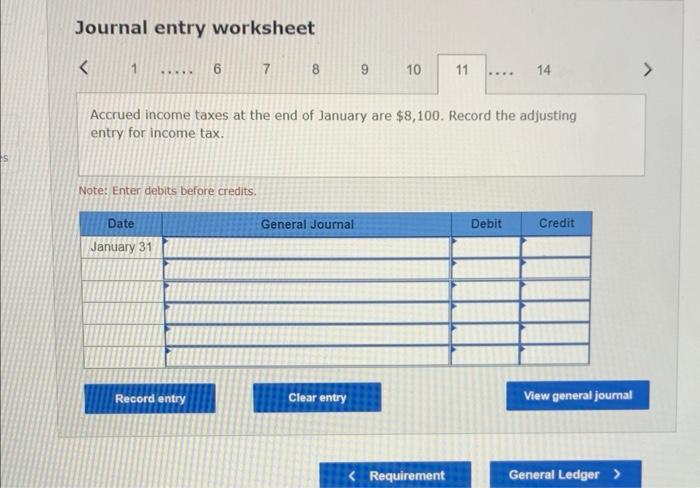

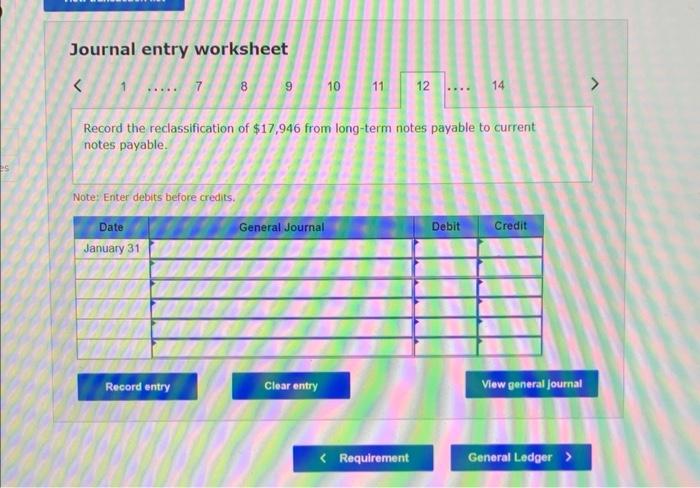

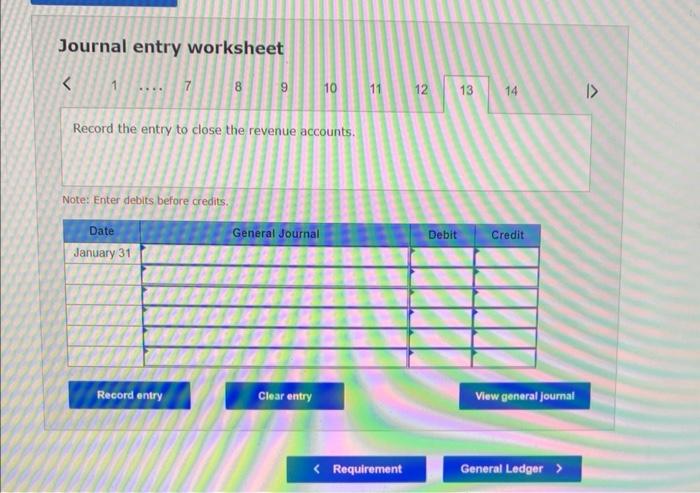

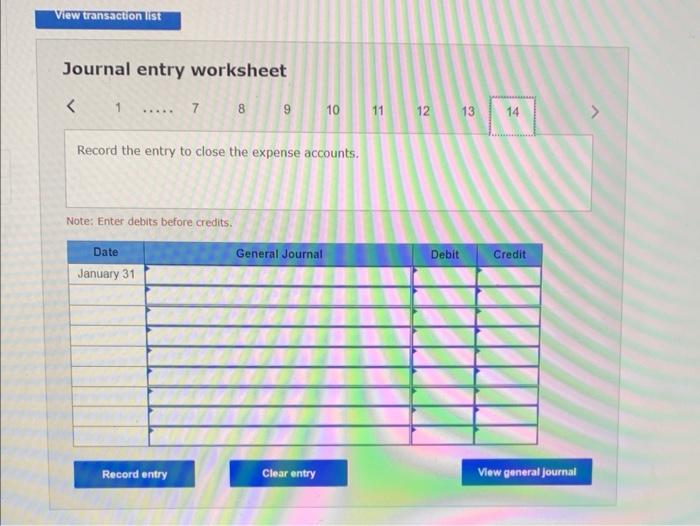

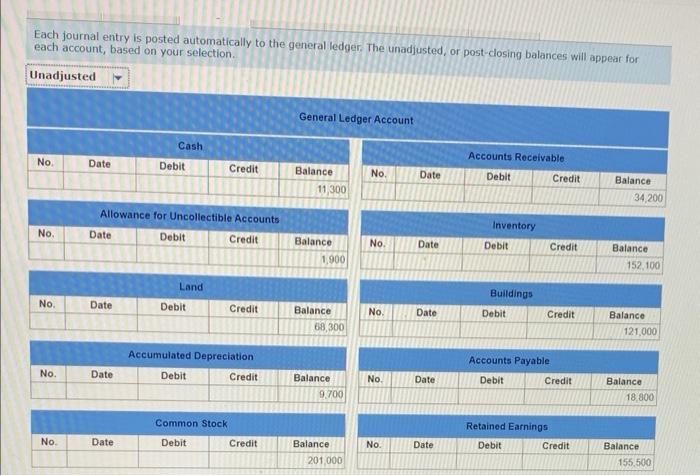

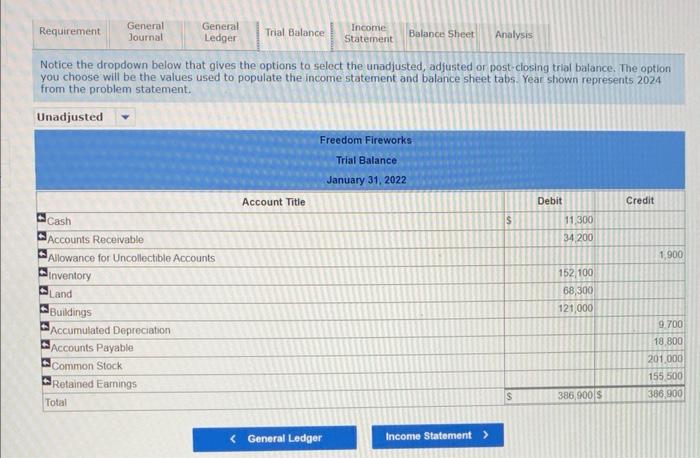

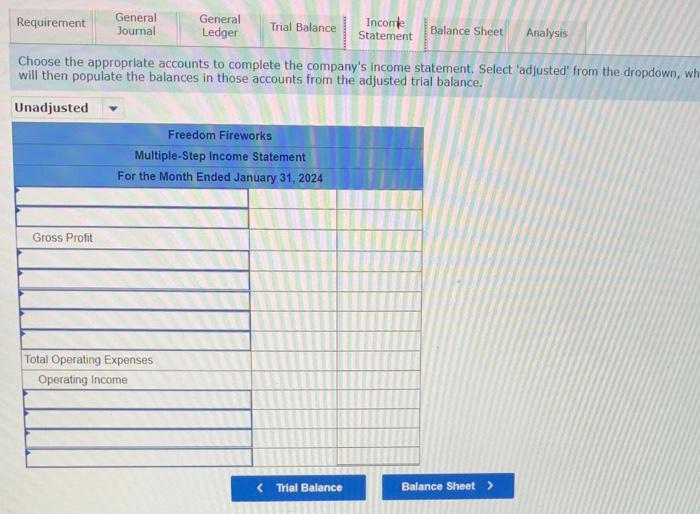

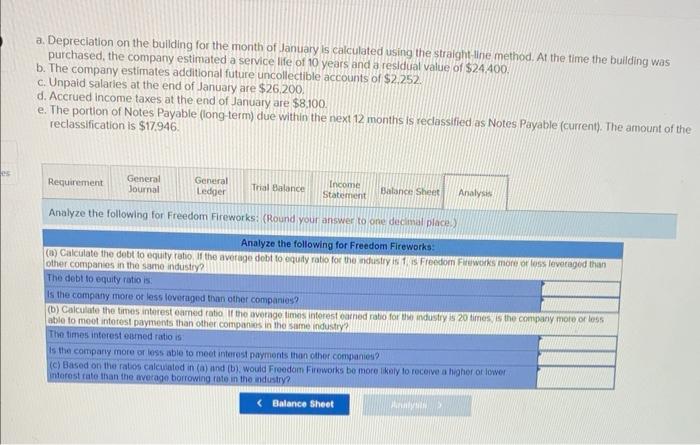

On January 1. 2024, the general ledger of Freedom Freworks includes the following account balances: During January 2024 , the following transactions occur: January 1 Borrow $101,090 froe Captive Credit Corporation. The installennt note bears interest at 6x annually and matures in 5 years. Payments of $1,953 arn required at the end of each nonth for 60 sonths. January 4 Receive $31,100 from customers on accounts recelvable. January 10 Pay cash on accounts nayable, \$12,00e. January 15 Pay cash for salaries, $20,000. January 30 Frirework sales for the month total \$195, 200. The cast of the wnits sold is \$113,900. January 31 Pay the first monthly installiment of $1,953 related to the $101,000 borrowod on january 1. The following information is avallable on January 31, 2024. a. Depreclation on the building for the month of January is calculated using the straight-fine method. At the time the building was purchased, the company estimated a service life of 10 years and a residital value of $24.400. b. The company estimates additional future uncollectible accounts of $2.252 c. Unpaid salaries at the end of January are $26,200. d. Accrued income taxes at the end of January are $8.100. January 4 Receive $31,109 fron custoners on accounts receivable. January 10 Pay cash on accounts payable, $12,000. January 15 Pay cash for salaries, $29,000. January 30 Firework sales for the month total 5195,200 . The cost of the units 501d is $113,000. January 31 Pay the fiest monthly installiment of $1,953 related to the $101, gae borrowed on January 1 . The following information is avallable on January 31, 2024. a. Depreciation on the bullding for the month of January is calculated using the straight-line method. At the time the bullding was purchased, the company estimated a service life of 10 years and a residual value of $24,400. b. The company estimates additional future uncollectible accounts of \$2,252. c. Unpald salaries at the end of January are $26,200. d. Accrued income taxes at the end of January are $8,100. e. The portion of Notes Payable (long-term) due within the next 12 monthis is reclassified as Notes Payable (current). The amount of reclassification is $17,946. 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7 ) assuming a FIFO perpetual inventory system. Review the 'General Ledger' and the 'Trlal Balance' tabs to see the effect of the transactions on the account balances. 2. Record adjusting entries on lanuary 31 . in the' 'General journal' tab (these are shown as items 8 to 12 ). 3. Review the adjusted 'Trial Balance' as of January 31,2024 , in the 'Trial Balance' tab. 4. Prepare a multiple-step income statement for the period ended lanuary 31,2024 , in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of January 31, 2024. in the 'Balance Sheet'tab. 6. Record the closing entries in the 'General Journit tab (these are shown as items 13 and 14 ). 7. Using the information from the requirementi above, complete the Analysis' tab. Journal entry worksheet 567814 Borrow $101,000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments of $1,953 are required at the end of each month for 60 months. Record the issuance of the long-term note payable. Note: Enter debits before credits. Journal entry worksheet 67 Receive $31,100 from customers on accounts receivable. Note: Enter debits before credits. Journal entry worksheet Tvute: cmter dedits Derore creaits. Journal entry worksheet Journal entry worksheet 25)

general journal

General Ledger (Unadjusted, Adjusted, and Post-Closing)

Trial Balance

income statement

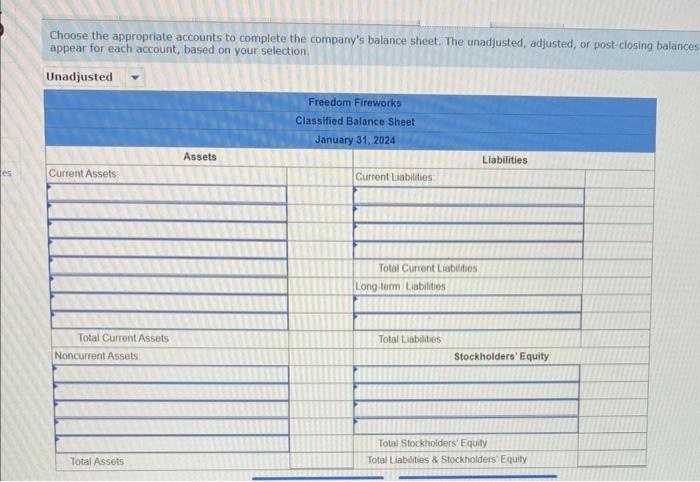

balance sheet

analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started