Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts. Pine Land Company was formed when it acquired cash from the issue of common stock. The company then issued bonds at

Please answer all parts.

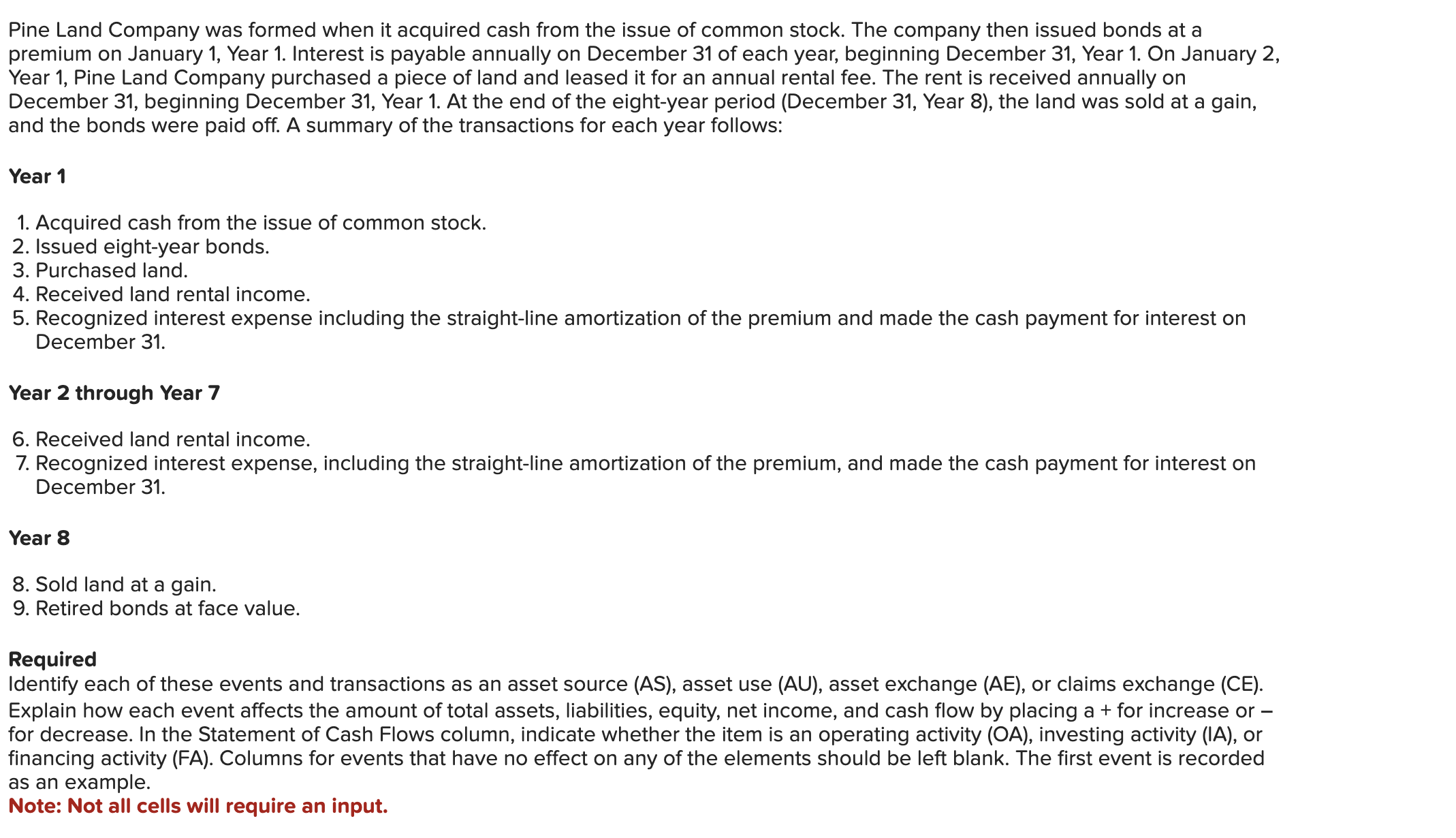

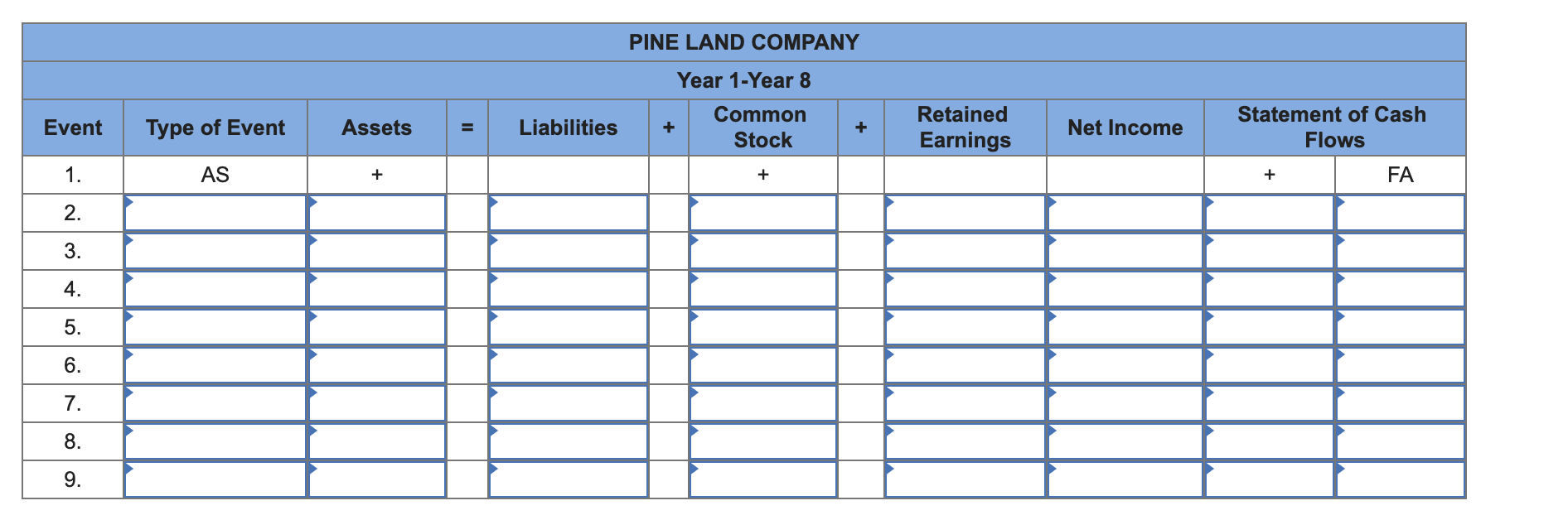

Pine Land Company was formed when it acquired cash from the issue of common stock. The company then issued bonds at a premium on January 1, Year 1. Interest is payable annually on December 31 of each year, beginning December 31, Year 1. On January 2, Year 1, Pine Land Company purchased a piece of land and leased it for an annual rental fee. The rent is received annually on December 31, beginning December 31, Year 1. At the end of the eight-year period (December 31, Year 8), the land was sold at a gain, and the bonds were paid off. A summary of the transactions for each year follows: Year 1 1. Acquired cash from the issue of common stock. 2. Issued eight-year bonds. 3. Purchased land. 4. Received land rental income. 5. Recognized interest expense including the straight-line amortization of the premium and made the cash payment for interest on December 31. Year 2 through Year 7 6. Received land rental income. 7. Recognized interest expense, including the straight-line amortization of the premium, and made the cash payment for interest on December 31. Year 8 8. Sold land at a gain. 9. Retired bonds at face value. Required Identify each of these events and transactions as an asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Explain how each event affects the amount of total assets, liabilities, equity, net income, and cash flow by placing a + for increase or for decrease. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Columns for events that have no effect on any of the elements should be left blank. The first event is recorded as an example. Note: Not all cells will require an inputStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started