Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts Q3. You plan to open a retirement account. Your employer will match 50% of your deposits up to a limit on

Please answer all parts

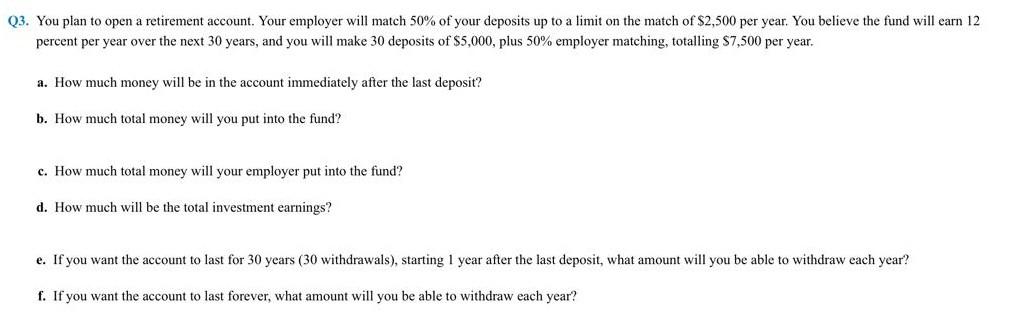

Q3. You plan to open a retirement account. Your employer will match 50% of your deposits up to a limit on the match of $2,500 per year. You believe the fund will earn 12 percent per year over the next 30 years, and you will make 30 deposits of $5,000, plus 50% employer matching, totalling S7,500 per year. a. How much money will be in the account immediately after the last deposit? b. How much total money will you put into the fund? c. How much total money will your employer put into the fund? d. How much will be the total investment earnings? e. If you want the account to last for 30 years (30 withdrawals), starting 1 year after the last deposit, what amount will you be able to withdraw each year? f. If you want the account to last forever, what amount will you be able to withdraw each yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started