Answered step by step

Verified Expert Solution

Question

1 Approved Answer

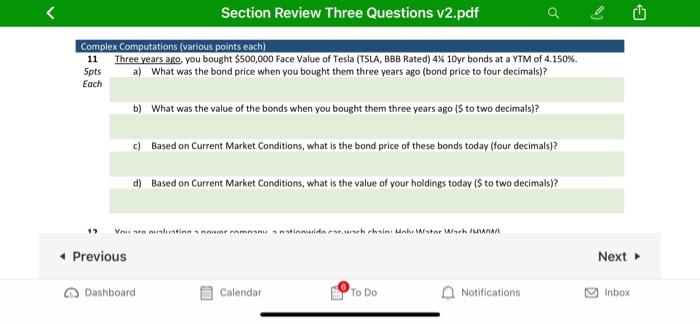

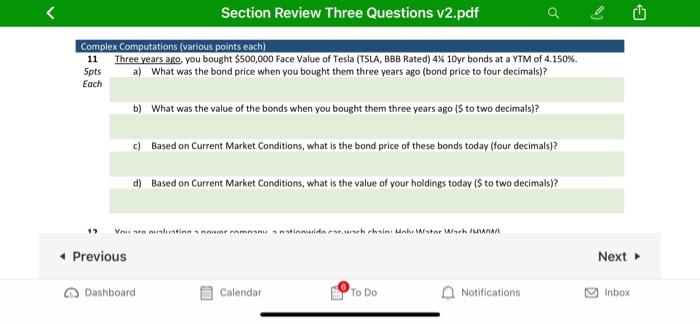

please answer all parts Section Review Three Questions v2.pdf o Complex Computations (various points each) 11 Three years ago, you bought $500,000 Face Value of

please answer all parts

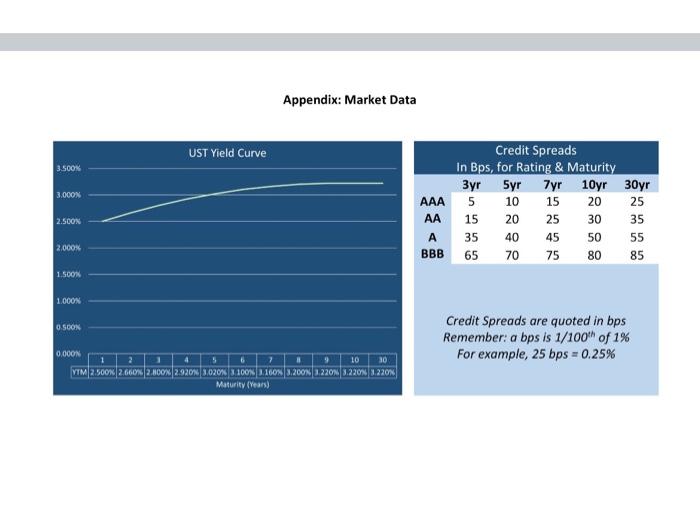

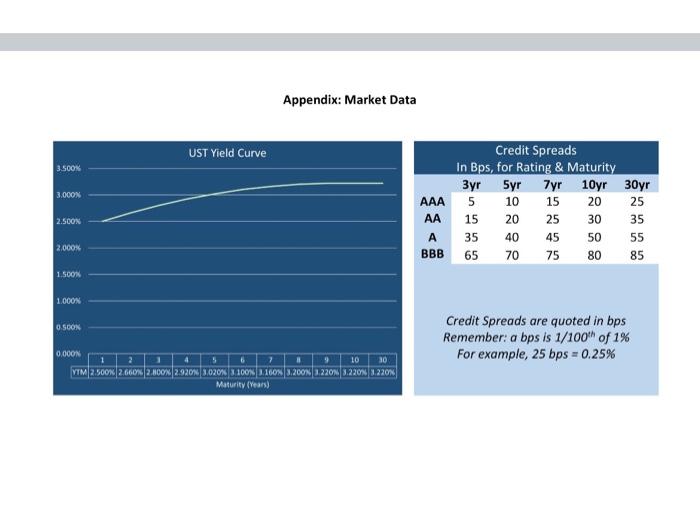

Section Review Three Questions v2.pdf o Complex Computations (various points each) 11 Three years ago, you bought $500,000 Face Value of Tesla (TSLA, BBB Rated) 4% 10yr bonds at a YTM of 4.150% 5pts a) What was the bond price when you bought them three years ago (bond price to four decimals)? Each b) What was the value of the bonds when you bought them three years ago (5 to two decimals)? c) Based on Current Market Conditions, what is the bond price of these bonds today (four decimals)? d) Based on Current Market Conditions, what is the value of your holdings today (s to two decimals)? 17 VA Stinnan manu antimidarchhain Make Martor och an Previous Next Dashboard Calendar To Do Notifications Inbox Appendix: Market Data UST Yield Curve 3.500 3.000N AAA AA Credit Spreads In Bps, for Rating & Maturity 3yr Fyr Fyr 10yr 5 10 15 20 15 20 25 30 35 40 45 50 65 70 75 80 2.500N 30yr 25 35 55 85 2.000% A BBB 1.500 1.000N O SOON Credit Spreads are quoted in bps Remember: a bps is 1/100 of 1% For example, 25 bps = 0.25% 0.000 2 10 30 VTM 2.500 2.660 2.000 2.920, 3,020 3.100% 1003.200 1.220x3.2.2013.2.2018 Maturity (years)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started