Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts, show full calculations, derivations, explanations and proofs: 2. Finite difference method for Black Scholes PDE (in reflected log coordinates). Consider the

Please answer all parts, show full calculations, derivations, explanations and proofs:

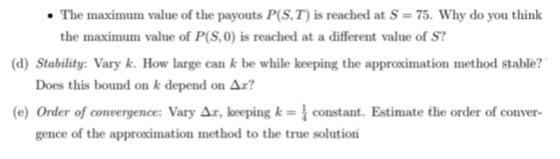

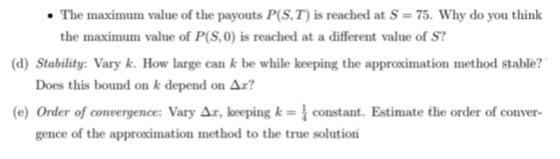

2. Finite difference method for Black Scholes PDE (in reflected log coordinates). Consider the double knock-out power option discussed in class. The underlying stock price at timet is St. The initial stock price is So (50, 100), and the option's maturity date is T = 1, measured in years. The risk-free rate is r = 0.05 per year, and the stock's volatility is o = 0.4 per year. At expiration, if the stock price lies in the interval S (50,100), and its price has never been outside of this interval between t = 0 and T the option pays out: P(S.T) = (S - 50)(100 - S). If the stock price has been outside of the interval, the payout is P(S. T) = 0, i.e., the option is worthless. Since the price path of the stock is continuous (almost surely), the event this occurs if minosest Su > 50, and maxosest S 50, and maxosest S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started