Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts. Thank you. Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local

Please answer all parts. Thank you.

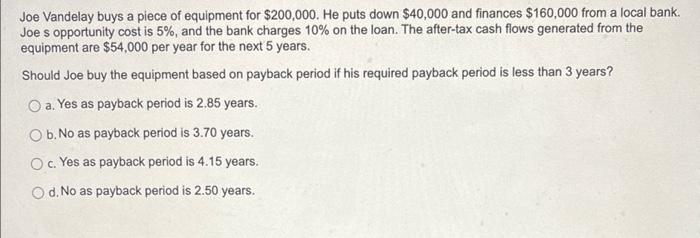

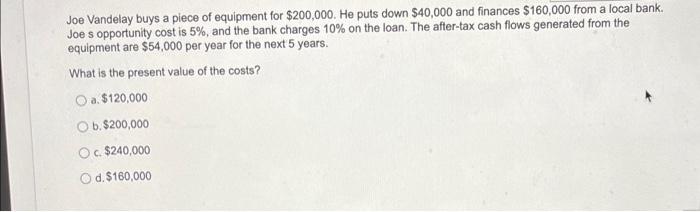

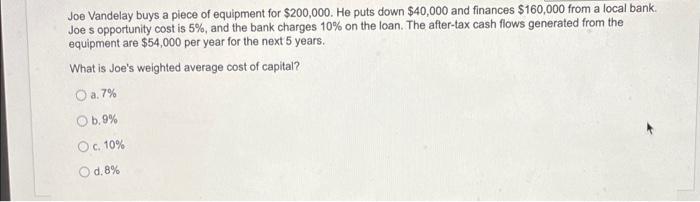

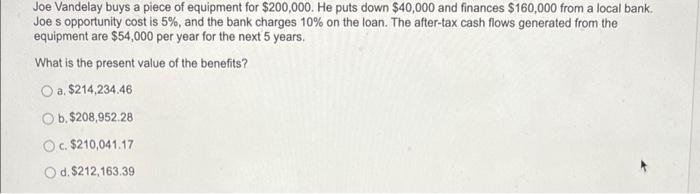

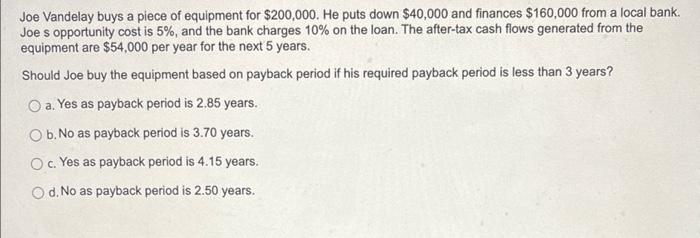

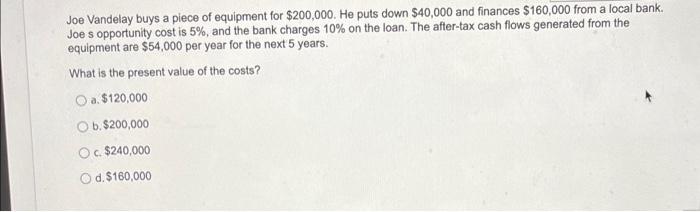

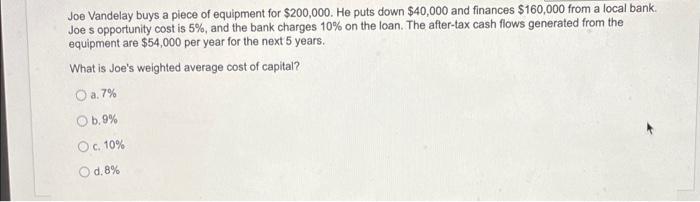

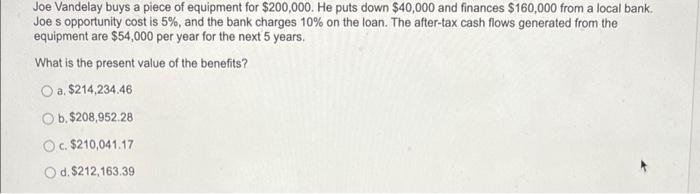

Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. Should Joe buy the equipment based on payback period if his required payback period is less than 3 years? O a. Yes as payback period is 2.85 years. O b. No as payback period is 3.70 years. O c. Yes as payback period is 4.15 years. d. No as payback period is 2.50 years. Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. What is the present value of the costs? O a. $120,000 O b. $200,000 O c. $240,000 O d. $160,000 Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. What is Joe's weighted average cost of capital? O a.7% O b.9% O c. 10% d. 8% Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. What is the present value of the benefits? O a. $214,234.46 O b. $208,952.28 c. $210,041.17 O d. $212,163.39 Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. Should Joe buy the equipment based on the NPV rule? O a. Yes as NPV is $10,041.17. O b. Yes as NPV is -$12,163.39. Oc. No as NPV is -$14,234.46. Od. No as NPV is $8,952.28. Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. What is the profitability index? O a. 0.97 O b. 1.05 O c. 0.86 O d. 1.13 Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. Should Joe buy the equipment based on the IRR rule? a. No as IRR is 8.65% less than Joe's weighted average cost of capital. O b. Yes as IRR is 10.92% greater than Joe's weighted average cost of capital. O c. Yes as IRR is 9.74% less than Joe's weighted average cost of capital. O d. No as IRR is 11.83% greater than Joe's weighted average cost of capital. Joe Vandelay buys a piece of equipment for $200,000. He puts down $40,000 and finances $160,000 from a local bank. Joe s opportunity cost is 5%, and the bank charges 10% on the loan. The after-tax cash flows generated from the equipment are $54,000 per year for the next 5 years. What is the accounting rate of return? O a. 23% O b. 29% O c. 25% O d. 27%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started