Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all parts thanks Annual cash flows from two competing investment opportunities are given. Each investment opportunity will require the same initial investment. (Click

please answer all parts thanks

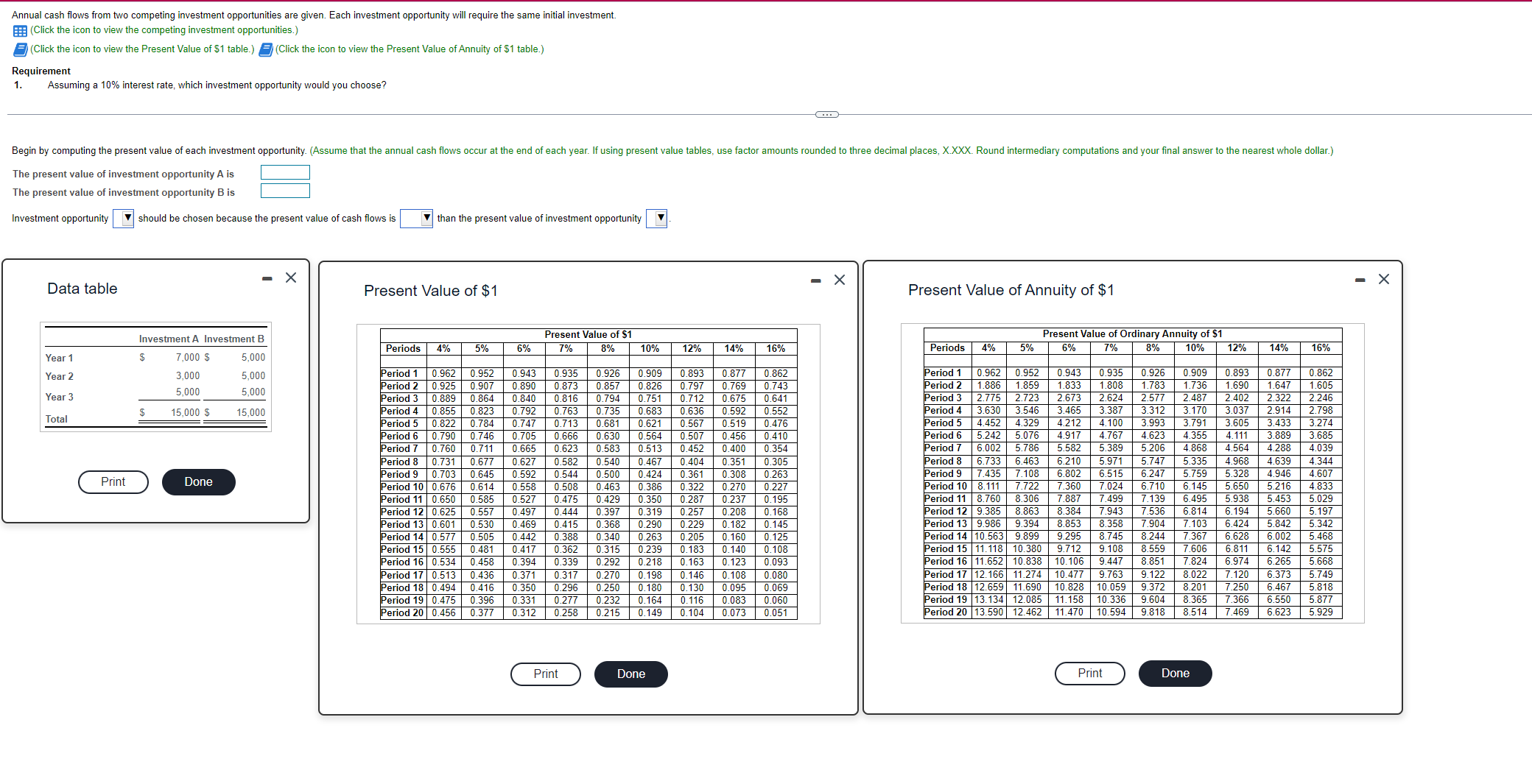

Annual cash flows from two competing investment opportunities are given. Each investment opportunity will require the same initial investment. (Click the icon to view the competing investment opportunities.) (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of Annuity of $1 table.) Requirement 1. Assuming a 10% interest rate, which investment opportunity would you choose? The present value of investment opportunity A is The present value of investment opportunity B is Investment opportunity should be chosen because the present value of cash flows is than the present value of investment opportunity Data table Present Value of $1 Present Value of Annuity of $1

Annual cash flows from two competing investment opportunities are given. Each investment opportunity will require the same initial investment. (Click the icon to view the competing investment opportunities.) (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of Annuity of $1 table.) Requirement 1. Assuming a 10% interest rate, which investment opportunity would you choose? The present value of investment opportunity A is The present value of investment opportunity B is Investment opportunity should be chosen because the present value of cash flows is than the present value of investment opportunity Data table Present Value of $1 Present Value of Annuity of $1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started