Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all parts! Thanks! Interactive Investments has one of its new clients, Jason Todd, recently sign up with the firm to manage his portfolio.

Please answer all parts! Thanks!

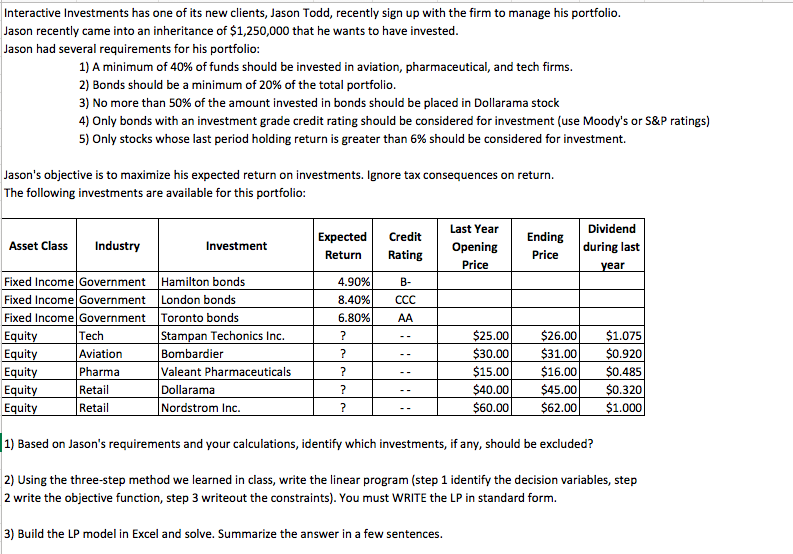

Interactive Investments has one of its new clients, Jason Todd, recently sign up with the firm to manage his portfolio. Jason recently came into an inheritance of $1,250,000 that he wants to have invested. Jason had several requirements for his portfolio: 1) A minimum of 40% of funds should be invested in aviation, pharmaceutical, and tech firms. 2) Bonds should be a minimum of 20% of the total portfolio. 3) No more than 50% of the amount invested in bonds should be placed in Dollarama stock 4) Only bonds with an investment grade credit rating should be considered for investment (use Moody's or S&P ratings) 5) Only stocks whose last period holding return is greater than 6% should be considered for investment. Jason's objective is to maximize his expected return on investments. Ignore tax consequences on return. The following investments are available for this portfolio: Asset Class Industry Investment Expected Return Credit Rating Last Year Opening Price Ending Price Dividend during last year Fixed Income Government Hamilton bonds Fixed Income Government London bonds Fixed Income Government Toronto bonds Equity Tech Stampan Techonics Inc. Equity Aviation Bombardier Equity Pharma Valeant Pharmaceuticals Equity Retail Dollarama Equity Retail Nordstrom Inc. 4.90% 8.40% 6.80% ? ? B- CCC AA ? ? ? $25.00 $30.00 $15.00 $40.00 $60.00 $26.00 $31.00 $16.00 $45.00 $62.00 $1.075 $0.920 $0.485 $0.320 $1.000 1) Based on Jason's requirements and your calculations, identify which investments, if any, should be excluded? 2) Using the three-step method we learned in class, write the linear program (step 1 identify the decision variables, step 2 write the objective function, step 3 writeout the constraints). You must WRITE the LP in standard form. 3) Build the LP model in Excel and solve. Summarize the answer in a few sentences. Interactive Investments has one of its new clients, Jason Todd, recently sign up with the firm to manage his portfolio. Jason recently came into an inheritance of $1,250,000 that he wants to have invested. Jason had several requirements for his portfolio: 1) A minimum of 40% of funds should be invested in aviation, pharmaceutical, and tech firms. 2) Bonds should be a minimum of 20% of the total portfolio. 3) No more than 50% of the amount invested in bonds should be placed in Dollarama stock 4) Only bonds with an investment grade credit rating should be considered for investment (use Moody's or S&P ratings) 5) Only stocks whose last period holding return is greater than 6% should be considered for investment. Jason's objective is to maximize his expected return on investments. Ignore tax consequences on return. The following investments are available for this portfolio: Asset Class Industry Investment Expected Return Credit Rating Last Year Opening Price Ending Price Dividend during last year Fixed Income Government Hamilton bonds Fixed Income Government London bonds Fixed Income Government Toronto bonds Equity Tech Stampan Techonics Inc. Equity Aviation Bombardier Equity Pharma Valeant Pharmaceuticals Equity Retail Dollarama Equity Retail Nordstrom Inc. 4.90% 8.40% 6.80% ? ? B- CCC AA ? ? ? $25.00 $30.00 $15.00 $40.00 $60.00 $26.00 $31.00 $16.00 $45.00 $62.00 $1.075 $0.920 $0.485 $0.320 $1.000 1) Based on Jason's requirements and your calculations, identify which investments, if any, should be excluded? 2) Using the three-step method we learned in class, write the linear program (step 1 identify the decision variables, step 2 write the objective function, step 3 writeout the constraints). You must WRITE the LP in standard form. 3) Build the LP model in Excel and solve. Summarize the answer in a few sentencesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started