please answer all parts

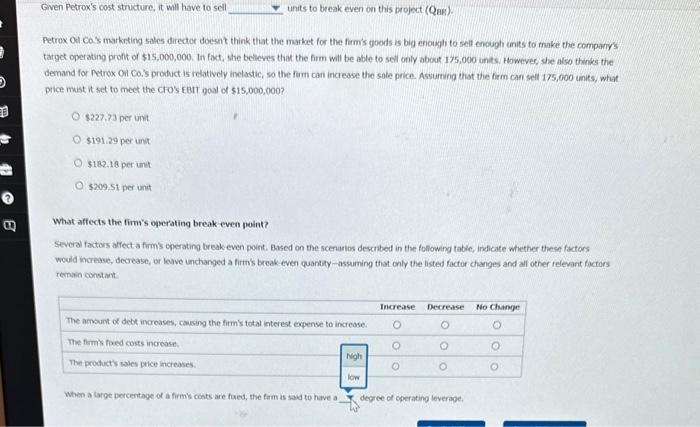

To be profitable, a firm must recover its costs. These costs indude both its fixed and its variable costs. One way that a firm evaluates at what stage it would recover the invested costs is to calculate how many units or how much in dollar sales is necessary for the firm to earn a profit. Consider the case of Petrox Oil Co.: Petrox Oil Co. is considering a project that will have fixed costs of $15,000,000. The product will be sold for $37.50 per unit, and will incur a variable cost of $10.75 per unit. Given Petrox's cost structure, it will have to sell units to break even on this project (QnB). Petrox oil co.'s marketing sales director doesnt thenk that the market for the firn's goods is big enough to sell enough units to make the compary's target operating profit of $15,000,000. In fact, she belicves that the firm will be able ta sell only about 175,000 units. However, she also thinks the demand for Petrox Oil co.'s product is relatively inelastic, so the firm can increase the sale price. Assuming that the frm can sell 175,000 units, whint pnce must it set to meet the CFO's EBI goal of $15,000,000 ? $227.73 per unit $191.29 per unit. \$182.18 per unt. \$209.51 per unit What affects the firm's operating break even point? Several factors affect a firms operating break-even point, Based on the scenanios descnbed in the following table, indicate whether these factors Would increase, decrease, or leave unchanged a firm's break even quantity-assuming that only the listed factor changes and all other relevant factors remsin constart. Given Petrox's cost structure, it will have to sell units to break even on this project (Que). Fetrox Oel Co:s markring soles director doesnt think that the market for the fam's goods is big enougli to sell enough units to make the company's target operating profit of 515,000,000. In fact, she beireves that the firm will be able to sell ouly about ry 17,000 units. However, she also thinks the demand for Petrox Oil co.,'s product is resatively inclastic, so the fom can increase the sole price. Assurring that the firm can sefl 175 , ouou units, what price mast it set to meet the Clos fBIT goal of 515,000,000? $227,73 per unt. \$191.29 per unt $182.18 per unit $209.51 per unit What affects the firm's operating break even point? Several factors affect a firms cperating break-even point. Based on the scenarios described in the following tabley indicate whecther these factors would increase, decrease, or leave uncharyed a firms break-even quantety assuming thist only the listed factor changes and all other relevant factors remain constart: When a targe porcentage of a firmis costs are foxed, the farm is said to have a 7 degree of operating leverage