Answered step by step

Verified Expert Solution

Question

1 Approved Answer

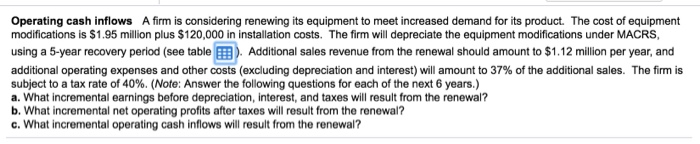

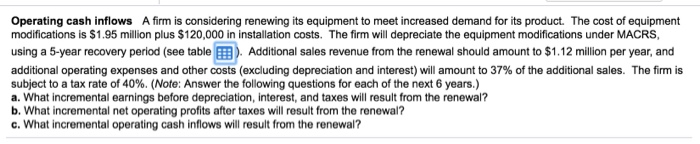

Please answer all parts to the question and round to nearest dollar for part a. Operating cash inflows A firm is considering renewing its equipment

Please answer all parts to the question and round to nearest dollar for part a.

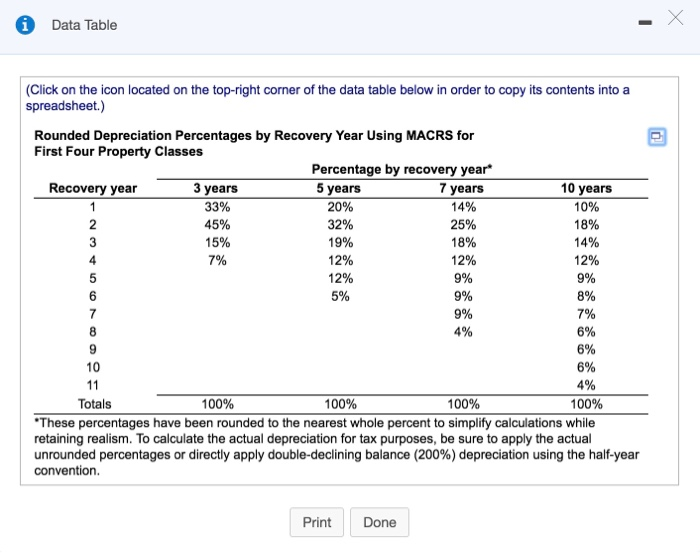

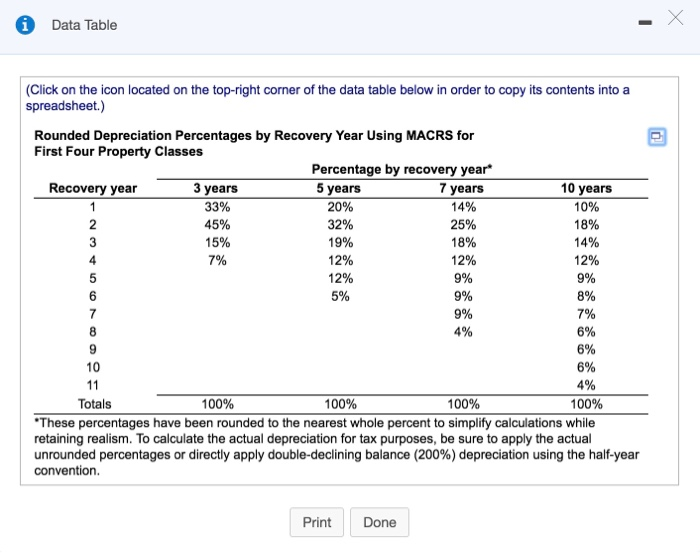

Operating cash inflows A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is $1.95 million plus $120,000 in installation costs. The firm will depreciate the equipment modifications under MACRS using a 5-year recovery period (see table EB). Additional sales revenue from the renewal should amount to $1.12 million per year, and additional operating expenses and other costs (excluding depreciation and interest) will amount to 37% of the additional sales. The firm is subject to a tax rate of 40%. (Note: Answer the following questions for each of the next 6 years.) a. What incremental earnings before depreciation, interest, and taxes will result from the renewal? b. What incremental net operating profits after taxes will result from the renewal? c. What incremental operating cash inflows will result from the renewal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started