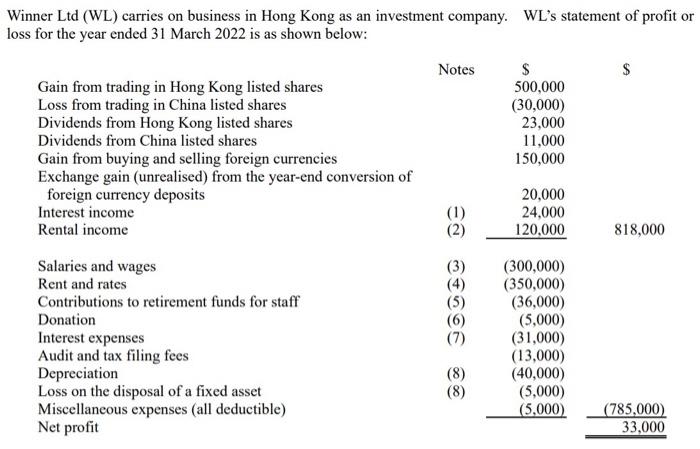

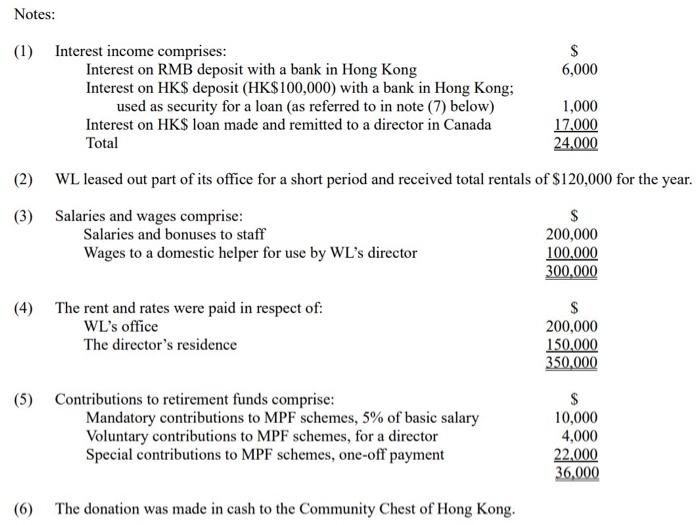

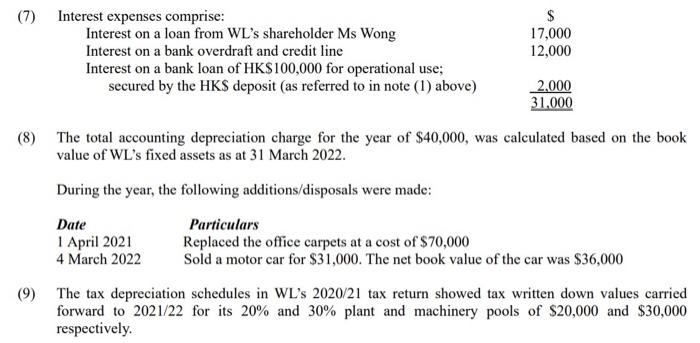

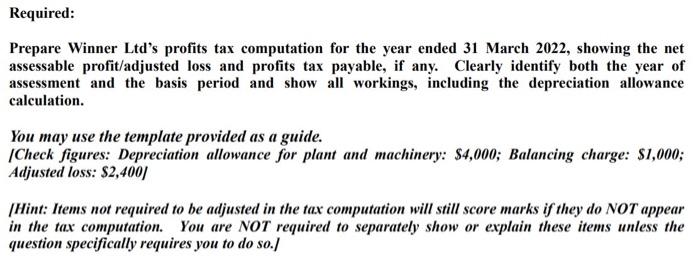

Winner Ltd (WL) carries on business in Hong Kong as an investment company. WL's statement of profit or loss for the year ended 31 March 2022 is as shown below: Notes $ $ Gain from trading in Hong Kong listed shares 500,000 Loss from trading in China listed shares (30,000) Dividends from Hong Kong listed shares 23,000 Dividends from China listed shares 11,000 Gain from buying and selling foreign currencies 150,000 Exchange gain (unrealised) from the year-end conversion of foreign currency deposits 20,000 Interest income 24,000 Rental income 120,000 818,000 (3) es 066 Salaries and wages Rent and rates Contributions to retirement funds for staff Donation Interest expenses Audit and tax filing fees Depreciation Loss on the disposal of a fixed asset Miscellaneous expenses (all deductible) Net profit (300,000) (350,000) (36,000) (5,000) (31,000) (13,000) (40,000) (5,000) (5,000) (8) (785,000) 33,000 Notes: (1) Interest income comprises: $ Interest on RMB deposit with a bank in Hong Kong 6,000 Interest on HK$ deposit (HK$100,000) with a bank in Hong Kong; used as security for a loan (as referred to in note (7) below) 1,000 Interest on HK$ loan made and remitted to a director in Canada 17,000 Total 24,000 (2) WL leased out part of its office for a short period and received total rentals of $120,000 for the year. (3) Salaries and wages comprise: $ Salaries and bonuses to staff 200,000 Wages to a domestic helper for use by WL's director 100,000 300.000 (4) The rent and rates were paid in respect of: $ WL's office 200,000 The director's residence 150,000 350,000 (5) Contributions to retirement funds comprise: Mandatory contributions to MPF schemes, 5% of basic salary Voluntary contributions to MPF schemes, for a director Special contributions to MPF schemes, one-off payment $ 10,000 4,000 22,000 36,000 (6) The donation was made in cash to the Community Chest of Hong Kong. (7) $ Interest expenses comprise: Interest on a loan from WL's shareholder Ms Wong Interest on a bank overdraft and credit line Interest on a bank loan of HK$100,000 for operational use; secured by the HKS deposit (as referred to in note (1) above) $ 17,000 12,000 2.000 31.000 (8) The total accounting depreciation charge for the year of $40,000, was calculated based on the book value of WL's fixed assets as at 31 March 2022. During the year, the following additions/disposals were made: Date Particulars 1 April 2021 Replaced the office carpets at a cost of $70,000 4 March 2022 Sold a motor car for $31,000. The net book value of the car was $36,000 The tax depreciation schedules in WL's 2020/21 tax return showed tax written down values carried forward to 2021/22 for its 20% and 30% plant and machinery pools of $20,000 and $30,000 respectively. (9) Required: Prepare Winner Ltd's profits tax computation for the year ended 31 March 2022, showing the net assessable profit/adjusted loss and profits tax payable, if any. Clearly identify both the year of assessment and the basis period and show all workings, including the depreciation allowance calculation. You may use the template provided as a guide. Check figures: Depreciation allowance for plant and machinery: $4,000; Balancing charge: $1,000; Adjusted loss: $2,4001 (Hint: Items not required to be adjusted in the tax computation will still score marks if they do NOT appear in the tax computation. You are NOT required to separately show or explain these items unless the question specifically requires you to do so./