Answered step by step

Verified Expert Solution

Question

1 Approved Answer

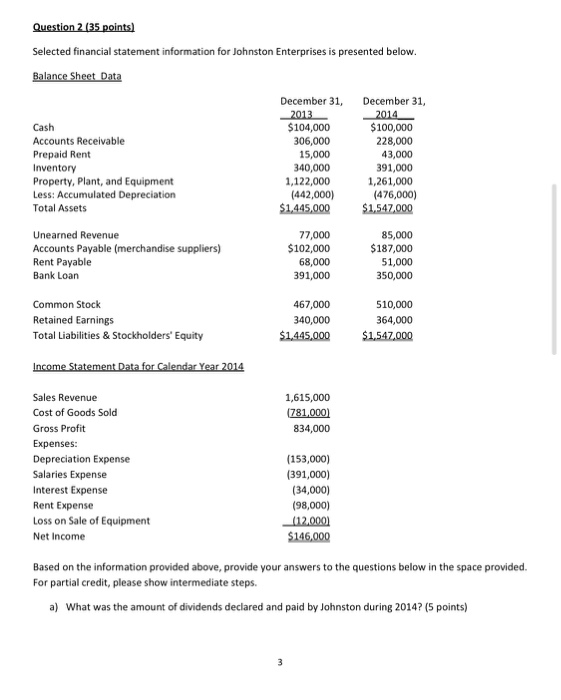

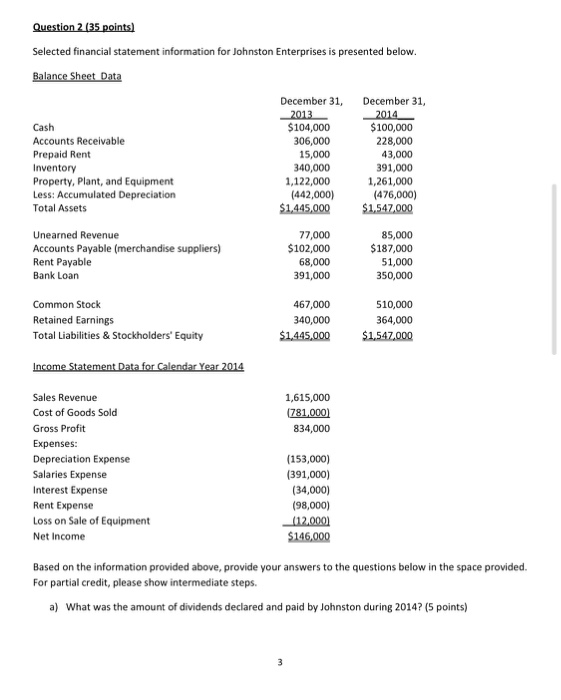

please answer all parts to the question Question 2 (35 points) Selected financial statement information for Johnston Enterprises is presented below. Balance Sheet Data December

please answer all parts to the question

Question 2 (35 points) Selected financial statement information for Johnston Enterprises is presented below. Balance Sheet Data December 31, December 31, 2013 2014 Cash $104,000 $100,000 Accounts Receivable 306,000 228,000 Prepaid Rent 15,000 43,000 Inventory 340,000 391,000 Property, Plant, and Equipment 1,122,000 1,261,000 Less: Accumulated Depreciation (442,000) (476,000) Total Assets $1,445,000 $1,547,000 Unearned Revenue 77,000 85,000 Accounts Payable (merchandise suppliers) $102,000 $187,000 Rent Payable 68,000 51,000 Bank Loan 391,000 350,000 Common Stock Retained Earnings Total Liabilities & Stockholders' Equity 467,000 340,000 $1,445,000 510,000 364,000 $1.547.000 Income Statement Data for Calendar Year 2014 1,615,000 (781,000) 834,000 Sales Revenue Cost of Goods Sold Gross Profit Expenses: Depreciation Expense Salaries Expense Interest Expense Rent Expense Loss on Sale of Equipment Net Income (153,000) (391,000) (34,000) (98,000) (12.000) $146,000 Based on the information provided above, provide your answers to the questions below in the space provided. For partial credit, please show intermediate steps. a) What was the amount of dividends declared and paid by Johnston during 2014? (5 points) 3 b) What was the amount of cash collected from customers by Johnston during 2014? (10 points) c) What was the amount of rent paid by Johnston during 2014? (10 points) (d) What was the amount of cash paid to suppliers of merchandise by Johnson during 2014? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started