please answer all parts (:

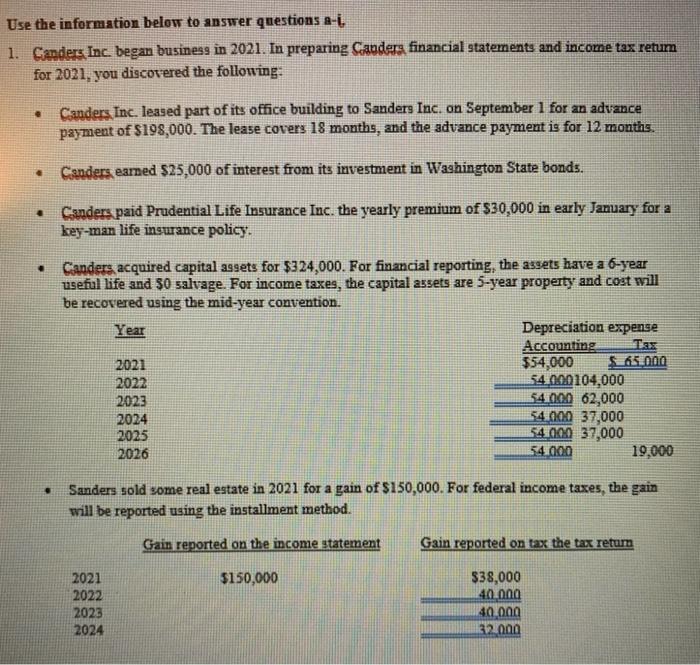

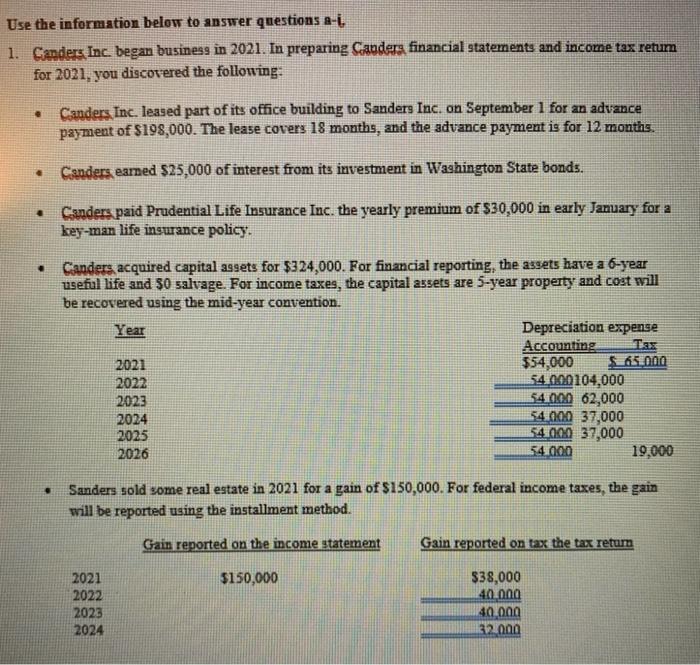

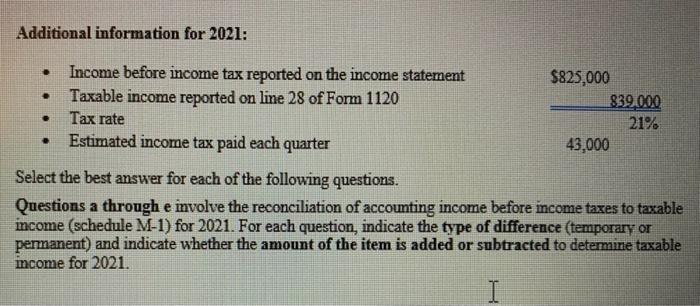

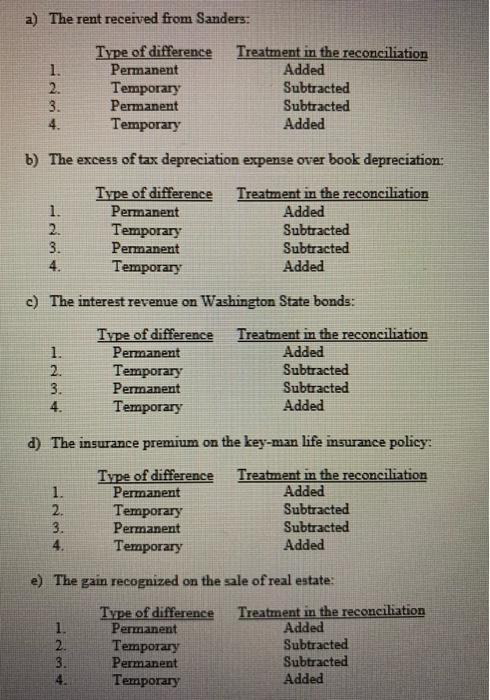

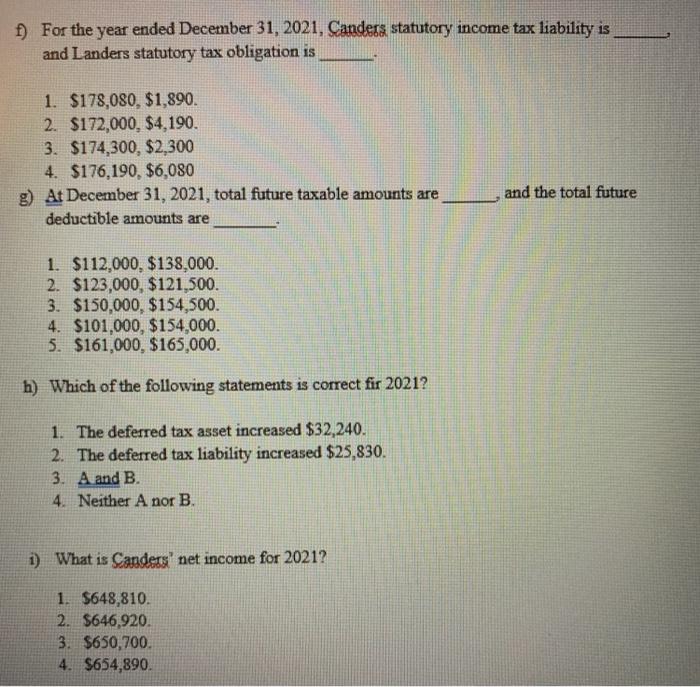

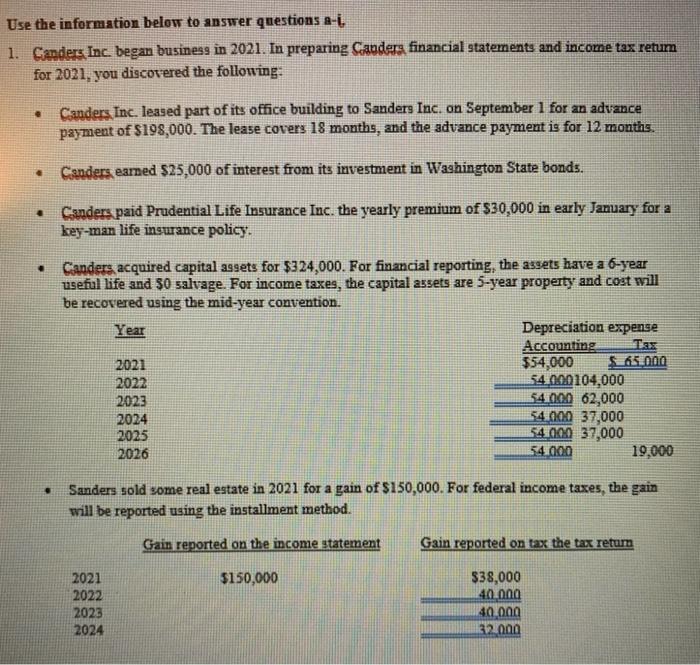

Use the information below to answer questions a-i. 1. Canders Inc. began business in 2021. In preparing Sanders financial statements and income tax retum for 2021, you discovered the following: Canders Inc. leased part of its office building to Sanders Inc. on September 1 for an advance payment of $198,000. The lease covers 18 months, and the advance payment is for 12 months. Cenders earned $25,000 of interest from its investment in Washington State bonds. . Canders paid Prudential Life Insurance Inc. the yearly premium of $30,000 in early January for a key-man life insurance policy. Canders acquired capital aggets for $324,000. For financial reporting, the assets have a 6-year useful life and $0 salvage. For income taxes, the capital assets are 5-year property and cost will be recovered using the mid-year convention. Year Depreciation expense Accounting Tas 2021 $54,000 65.000 2022 54.000104,000 2023 54.000 62,000 2024 54.000 37,000 2025 54 000 37,000 2026 54.000 19.000 Sanders sold some real estate in 2021 for a gain of $150,000. For federal income taxes, the gain will be reported using the installment method. Gain reported on the income statement Gain reported on tax the tax retum $150,000 2021 2022 2023 2024 $38,000 40.000 40.000 32.000 Additional information for 2021: . . . . Income before income tax reported on the income statement $825,000 Taxable income reported on line 28 of Form 1120 839.000 Tax rate 21% Estimated income tax paid each quarter 43,000 Select the best answer for each of the following questions. Questions a through e involve the reconciliation of accounting income before income taxes to taxable income (schedule M-1) for 2021. For each question, indicate the type of difference (temporary or permanent) and indicate whether the amount of the item is added or subtracted to determine taxable income for 2021. I a) The rent received from Sanders: 1. 2. 3. 4. Type of difference Permanent Temporary Permanent Temporary Treatment in the reconciliation Added Subtracted Subtracted Added b) The excess of tax depreciation expense over book depreciation: 1. 2. 3. 4. Type of difference Permanent Temporary Permanent Temporary Treatment in the reconciliation Added Subtracted Subtracted Added c) The interest revenue on Washington State bonds: Type of difference Treatment in the reconciliation 1. Permanent Added 2. Temporary Subtracted 3. Permanent Subtracted 4. Temporary Added d) The insurance premium on the key-man life insurance policy: 1. 2. 3. 4. Type of difference Permanent Temporary Permanent Temporary Treatment in the reconciliation Added Subtracted Subtracted Added e) The gain recognized on the sale of real estate: 1. 2. 3. 4. Type of difference Permanent Temporary Permanent Temporary Treatment in the reconciliation Added Subtracted Subtracted Added 1) For the year ended December 31, 2021, Canders statutory income tax liability is and Landers statutory tax obligation is 1. $178,080, $1,890. 2. $172,000, $4,190. 3. $174,300, $2,300 4. $176,190, $6,080 g) At December 31, 2021, total future taxable amounts are deductible amounts are and the total future 1. $112,000, $138,000. 2. $123,000, $121,500. 3. $150,000, $154,500. 4. $101,000, $154,000. 5. $161,000, $165,000. h) Which of the following statements is correct fir 2021? 1. The deferred tax asset increased $32,240. 2. The deferred tax liability increased $25,830. 3. A and B. 4. Neither Anor B. 1) What is Sanders' net income for 2021? 1. $648,810. 2. $646,920. 3. $650,700. 4. $654,890