Please answer all parts with explanations! Thank you :)

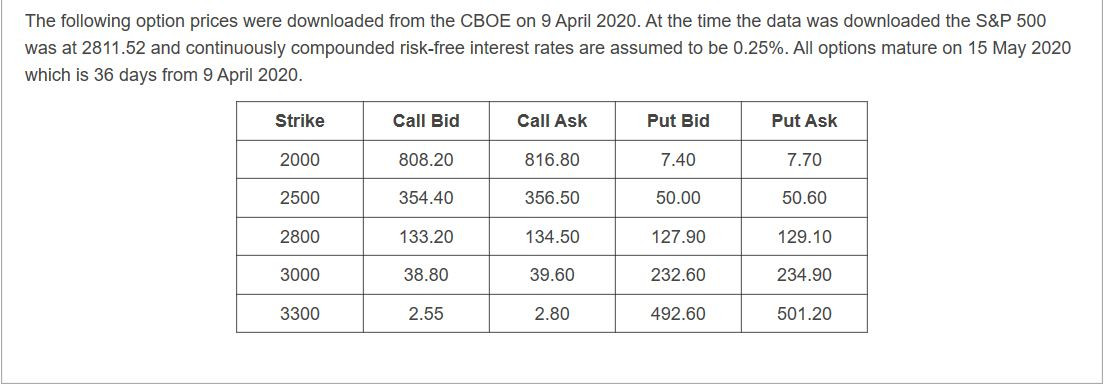

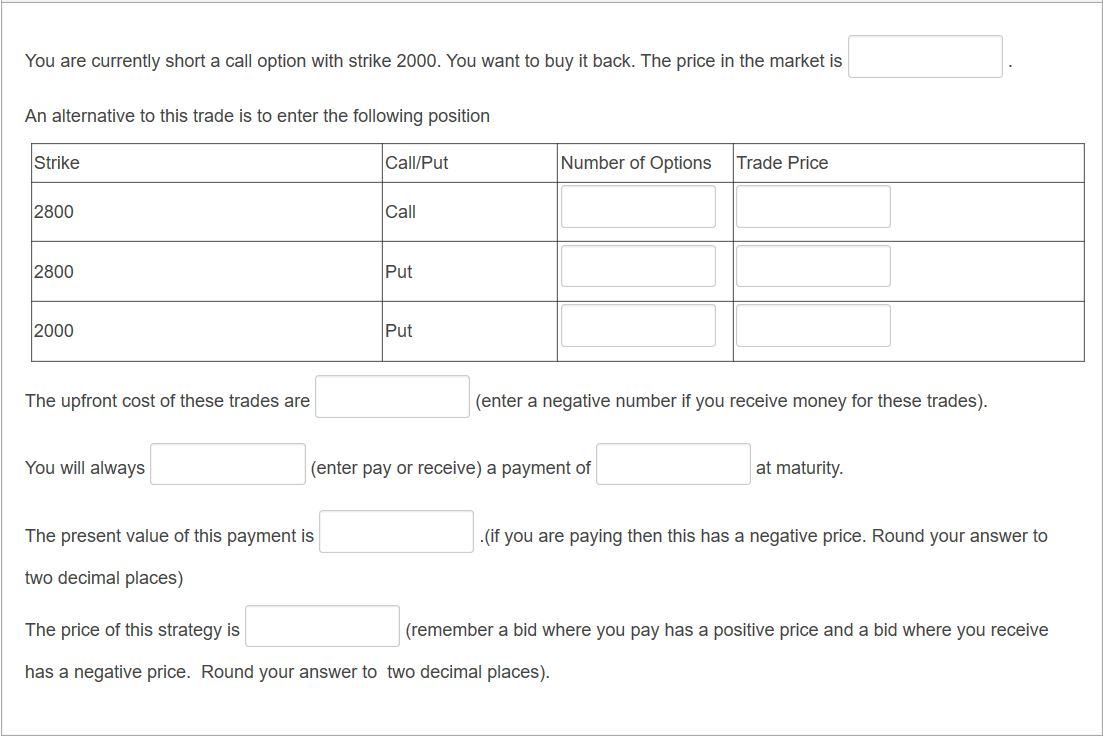

The following option prices were downloaded from the CBOE on 9 April 2020. At the time the data was downloaded the S&P 500 was at 2811.52 and continuously compounded risk-free interest rates are assumed to be 0.25%. All options mature on 15 May 2020 which is 36 days from 9 April 2020. Strike Call Bid Call Ask Put Bid Put Ask 2000 808.20 816.80 7.40 7.70 2500 354.40 356.50 50.00 50.60 2800 133.20 134.50 127.90 129.10 3000 38.80 39.60 232.60 234.90 3300 2.55 2.80 492.60 501.20 .OU You are currently short a call option with strike 2000. You want to buy it back. The price in the market is An alternative to this trade is to enter the following position Strike Call/Put Number of Options Trade Price 2800 Call 2800 Put 2000 Put The upfront cost of these trades are (enter a negative number if you receive money for these trades). You will always (enter pay or receive) a payment of at maturity. The present value of this payment is (if you are paying then this has a negative price. Round your answer to two decimal places) The price of this strategy is (remember a bid where you pay has a positive price and a bid where you receive has a negative price. Round your answer to two decimal places). The following option prices were downloaded from the CBOE on 9 April 2020. At the time the data was downloaded the S&P 500 was at 2811.52 and continuously compounded risk-free interest rates are assumed to be 0.25%. All options mature on 15 May 2020 which is 36 days from 9 April 2020. Strike Call Bid Call Ask Put Bid Put Ask 2000 808.20 816.80 7.40 7.70 2500 354.40 356.50 50.00 50.60 2800 133.20 134.50 127.90 129.10 3000 38.80 39.60 232.60 234.90 3300 2.55 2.80 492.60 501.20 .OU You are currently short a call option with strike 2000. You want to buy it back. The price in the market is An alternative to this trade is to enter the following position Strike Call/Put Number of Options Trade Price 2800 Call 2800 Put 2000 Put The upfront cost of these trades are (enter a negative number if you receive money for these trades). You will always (enter pay or receive) a payment of at maturity. The present value of this payment is (if you are paying then this has a negative price. Round your answer to two decimal places) The price of this strategy is (remember a bid where you pay has a positive price and a bid where you receive has a negative price. Round your answer to two decimal places)