Answered step by step

Verified Expert Solution

Question

1 Approved Answer

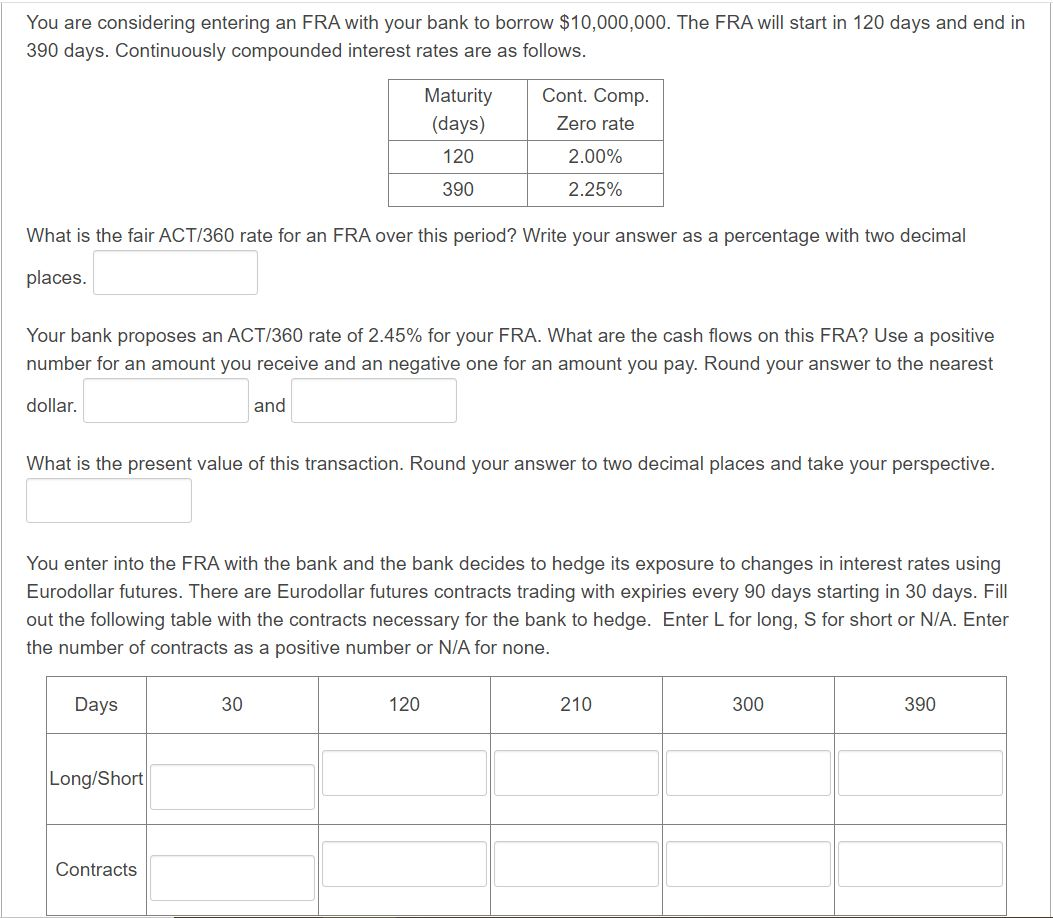

Please answer all parts with through explanations, thank you!!! You are considering entering an FRA with your bank to borrow $10,000,000. The FRA will start

Please answer all parts with through explanations, thank you!!!

You are considering entering an FRA with your bank to borrow $10,000,000. The FRA will start in 120 days and end in 390 days. Continuously compounded interest rates are as follows. Maturity (days) 120 390 Cont. Comp. Zero rate 2.00% 2.25% What is the fair ACT/360 rate for an FRA over this period? Write your answer as a percentage with two decimal places. Your bank proposes an ACT/360 rate of 2.45% for your FRA. What are the cash flows on this FRA? Use a positive number for an amount you receive and an negative one for an amount you pay. Round your answer to the nearest dollar. and What is the present value of this transaction. Round your answer to two decimal places and take your perspective. You enter into the FRA with the bank and the bank decides to hedge its exposure to changes in interest rates using Eurodollar futures. There are Eurodollar futures contracts trading with expiries every 90 days starting in 30 days. Fill out the following table with the contracts necessary for the bank to hedge. Enter L for long, S for short or N/A. Enter the number of contracts as a positive number or N/A for none. Days 30 120 210 300 390 Long/Short Contracts You are considering entering an FRA with your bank to borrow $10,000,000. The FRA will start in 120 days and end in 390 days. Continuously compounded interest rates are as follows. Maturity (days) 120 390 Cont. Comp. Zero rate 2.00% 2.25% What is the fair ACT/360 rate for an FRA over this period? Write your answer as a percentage with two decimal places. Your bank proposes an ACT/360 rate of 2.45% for your FRA. What are the cash flows on this FRA? Use a positive number for an amount you receive and an negative one for an amount you pay. Round your answer to the nearest dollar. and What is the present value of this transaction. Round your answer to two decimal places and take your perspective. You enter into the FRA with the bank and the bank decides to hedge its exposure to changes in interest rates using Eurodollar futures. There are Eurodollar futures contracts trading with expiries every 90 days starting in 30 days. Fill out the following table with the contracts necessary for the bank to hedge. Enter L for long, S for short or N/A. Enter the number of contracts as a positive number or N/A for none. Days 30 120 210 300 390 Long/Short Contracts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started