Please answer all parts.

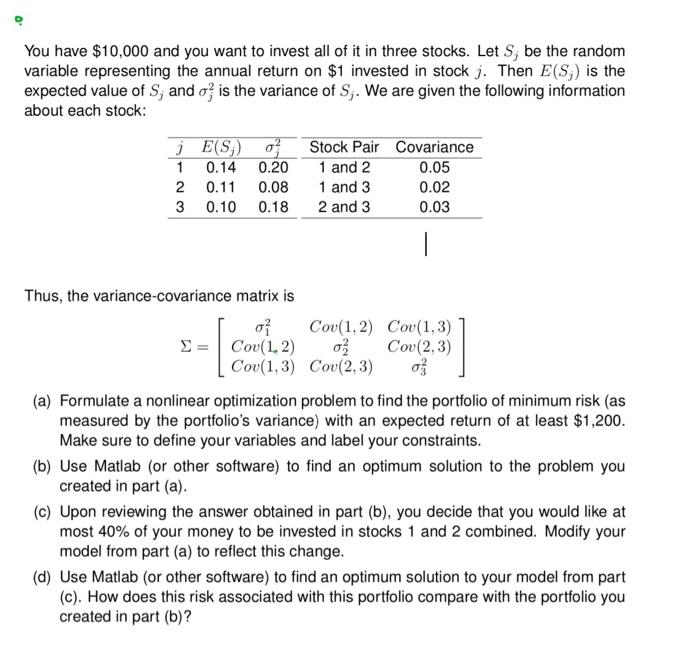

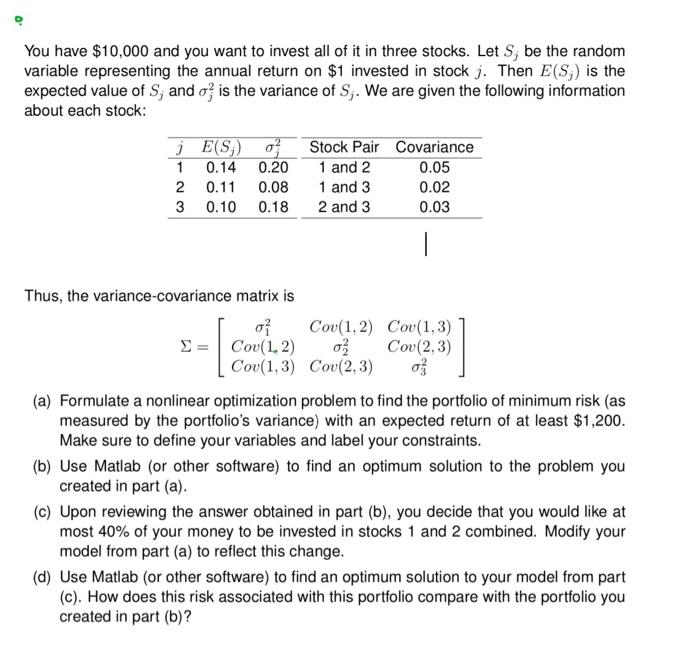

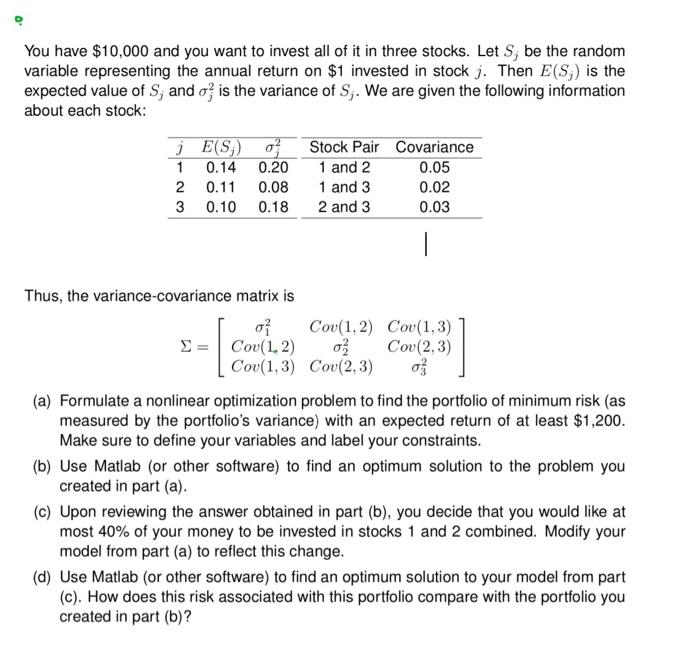

You have $10,000 and you want to invest all of it in three stocks. Let S, be the random variable representing the annual return on $1 invested in stock j. Then E(Sj) is the expected value of S, and o; is the variance of S;. We are given the following information about each stock: E(S) 0 Stock Pair Covariance 1 0.14 0.20 1 and 2 0.05 2 0.11 0.08 1 and 3 0.02 3 0.10 0.18 2 and 3 0.03 Thus, the variance covariance matrix is o Cov(1,2) Cov(1,3) S=Cou(1.2) Cov(2,3) Cov(1,3) Cov(2,3) az (a) Formulate a nonlinear optimization problem to find the portfolio of minimum risk (as measured by the portfolio's variance) with an expected return of at least $1,200. Make sure to define your variables and label your constraints. (b) Use Matlab (or other software) to find an optimum solution to the problem you created in part (a). (c) Upon reviewing the answer obtained in part (b), you decide that you would like at most 40% of your money to be invested in stocks 1 and 2 combined. Modify your model from part (a) to reflect this change. (d) Use Matlab (or other software) to find an optimum solution to your model from part (c). How does this risk associated with this portfolio compare with the portfolio you created in part (b)? You have $10,000 and you want to invest all of it in three stocks. Let S, be the random variable representing the annual return on $1 invested in stock j. Then E(Sj) is the expected value of S, and o; is the variance of S;. We are given the following information about each stock: E(S) 0 Stock Pair Covariance 1 0.14 0.20 1 and 2 0.05 2 0.11 0.08 1 and 3 0.02 3 0.10 0.18 2 and 3 0.03 Thus, the variance covariance matrix is o Cov(1,2) Cov(1,3) S=Cou(1.2) Cov(2,3) Cov(1,3) Cov(2,3) az (a) Formulate a nonlinear optimization problem to find the portfolio of minimum risk (as measured by the portfolio's variance) with an expected return of at least $1,200. Make sure to define your variables and label your constraints. (b) Use Matlab (or other software) to find an optimum solution to the problem you created in part (a). (c) Upon reviewing the answer obtained in part (b), you decide that you would like at most 40% of your money to be invested in stocks 1 and 2 combined. Modify your model from part (a) to reflect this change. (d) Use Matlab (or other software) to find an optimum solution to your model from part (c). How does this risk associated with this portfolio compare with the portfolio you created in part (b)