Answered step by step

Verified Expert Solution

Question

1 Approved Answer

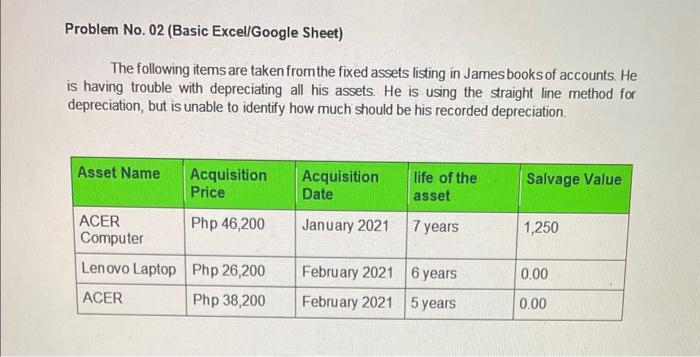

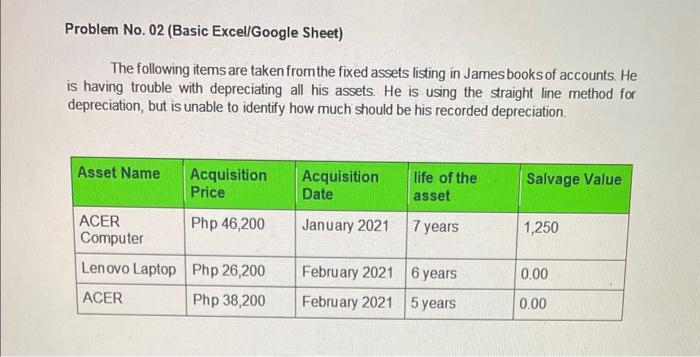

Please answer all Problem No. 02 (Basic Excel/Google Sheet) The following items are taken from the fixed assets listing in James books of accounts. He

Please answer all

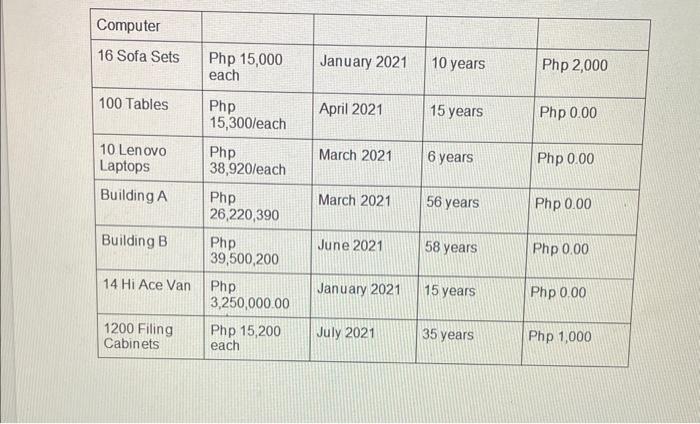

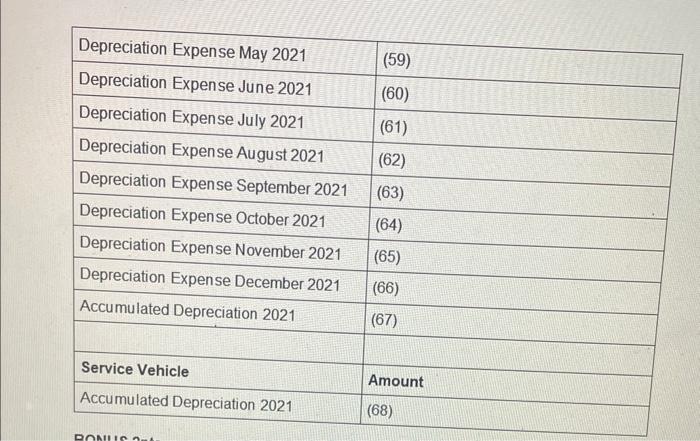

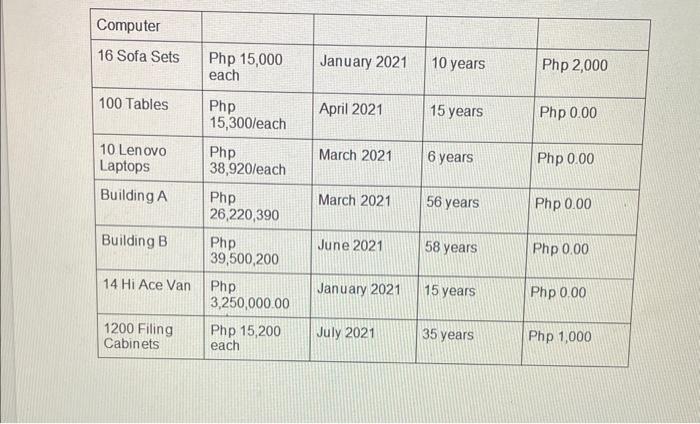

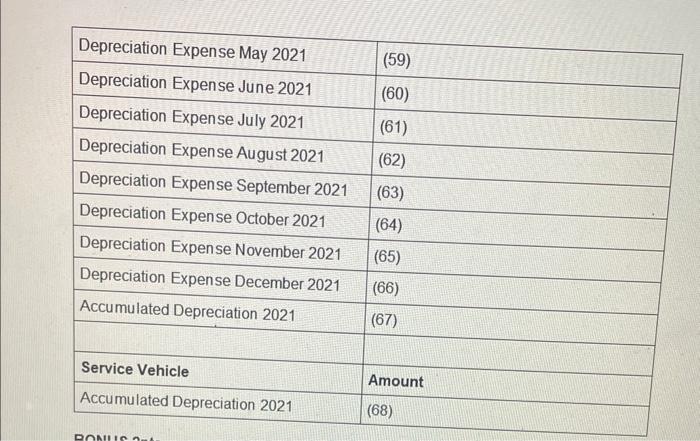

Problem No. 02 (Basic Excel/Google Sheet) The following items are taken from the fixed assets listing in James books of accounts. He is having trouble with depreciating all his assets. He is using the straight line method for depreciation, but is unable to identify how much should be his recorded depreciation. \begin{tabular}{|l|l|l|l|l|} \hline Computer & & & & \\ \hline 16 Sofa Sets & Php 15,000 each & January 2021 & 10 years & Php 2,000 \\ \hline 100 Tables & Php 15,300 leach & April 2021 & 15 years & Php 0.00 \\ \hline 10 Lenovo Laptops & Php 38,920 each & March 2021 & 6 years & Php 0.00 \\ \hline Building A & Php 26,220,390 & March 2021 & 56 years & Php 0.00 \\ \hline Building B & Php 39,500,200 & June 2021 & 58 years & Php 0.00 \\ \hline 14 Hi Ace Van & Php 3,250,000.00 & January 2021 & 15 years & Php 0.00 \\ \hline 1200 Filing Cabinets & Php 15,200 each & July 2021 & 35 years & Php 1,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Depreciation Expense May 2021 & (59) \\ \hline Depreciation Expense June 2021 & (60) \\ \hline Depreciation Expense July 2021 & (61) \\ \hline Depreciation Expense August 2021 & (62) \\ \hline Depreciation Expense September 2021 & (63) \\ \hline Depreciation Expense October 2021 & (64) \\ \hline Depreciation Expense November 2021 & (65) \\ \hline Depreciation Expense December 2021 & (66) \\ \hline Accumulated Depreciation 2021 & (67) \\ \hline & \\ \hline Service Vehicle & Amount \\ \hline Accumulated Depreciation 2021 & (68) \\ \hline \end{tabular} Problem No. 02 (Basic Excel/Google Sheet) The following items are taken from the fixed assets listing in James books of accounts. He is having trouble with depreciating all his assets. He is using the straight line method for depreciation, but is unable to identify how much should be his recorded depreciation. \begin{tabular}{|l|l|l|l|l|} \hline Computer & & & & \\ \hline 16 Sofa Sets & Php 15,000 each & January 2021 & 10 years & Php 2,000 \\ \hline 100 Tables & Php 15,300 leach & April 2021 & 15 years & Php 0.00 \\ \hline 10 Lenovo Laptops & Php 38,920 each & March 2021 & 6 years & Php 0.00 \\ \hline Building A & Php 26,220,390 & March 2021 & 56 years & Php 0.00 \\ \hline Building B & Php 39,500,200 & June 2021 & 58 years & Php 0.00 \\ \hline 14 Hi Ace Van & Php 3,250,000.00 & January 2021 & 15 years & Php 0.00 \\ \hline 1200 Filing Cabinets & Php 15,200 each & July 2021 & 35 years & Php 1,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Depreciation Expense May 2021 & (59) \\ \hline Depreciation Expense June 2021 & (60) \\ \hline Depreciation Expense July 2021 & (61) \\ \hline Depreciation Expense August 2021 & (62) \\ \hline Depreciation Expense September 2021 & (63) \\ \hline Depreciation Expense October 2021 & (64) \\ \hline Depreciation Expense November 2021 & (65) \\ \hline Depreciation Expense December 2021 & (66) \\ \hline Accumulated Depreciation 2021 & (67) \\ \hline & \\ \hline Service Vehicle & Amount \\ \hline Accumulated Depreciation 2021 & (68) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started