Answered step by step

Verified Expert Solution

Question

1 Approved Answer

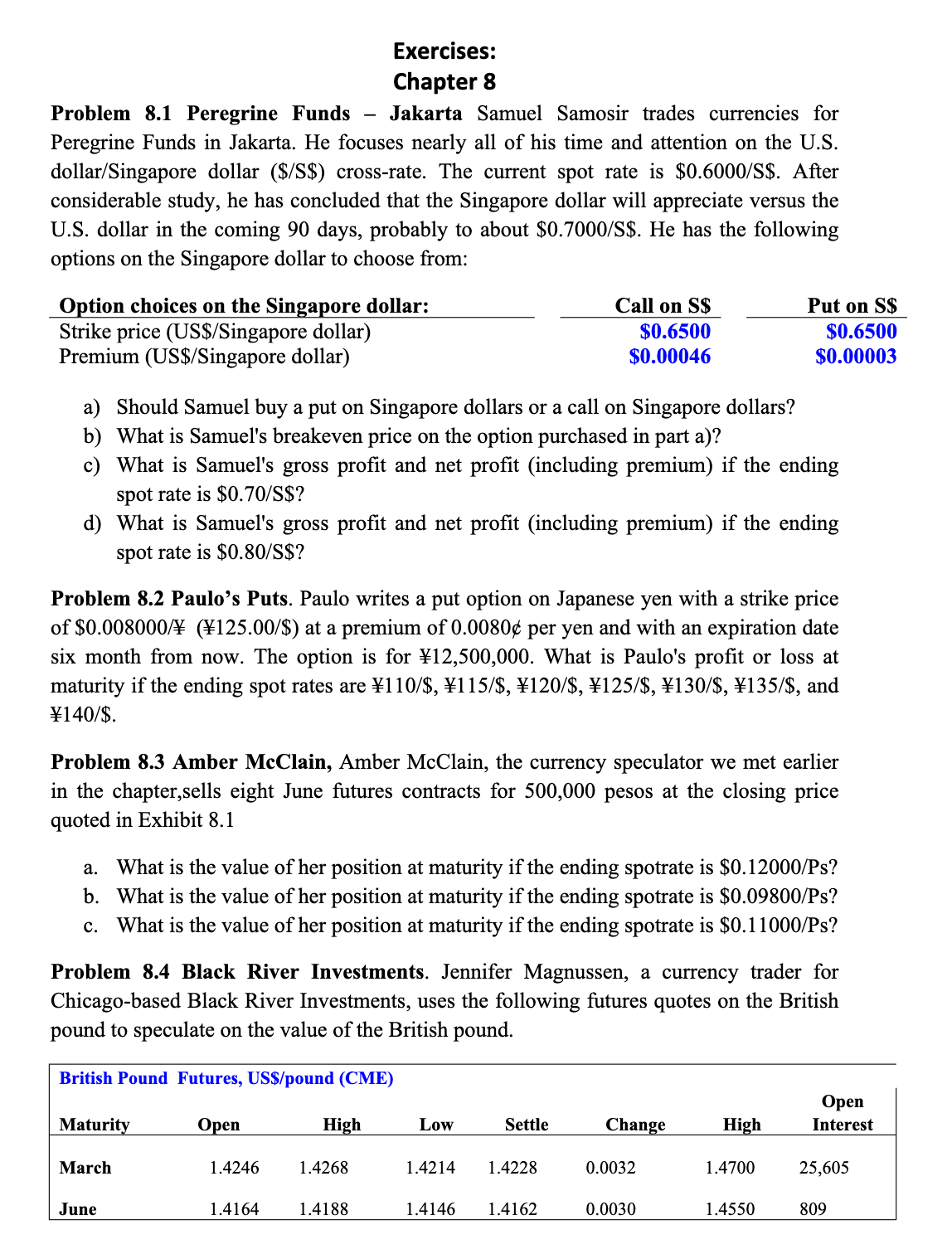

please answer all problems Exercises: Chapter 8 Problem 8 . 1 Peregrine Funds - Jakarta Samuel Samosir trades currencies for Peregrine Funds in Jakarta. He

please answer all problems Exercises:

Chapter

Problem Peregrine Funds Jakarta Samuel Samosir trades currencies for

Peregrine Funds in Jakarta. He focuses nearly all of his time and attention on the US

dollarSingapore dollar $$$ crossrate. The current spot rate is $$ After

considerable study, he has concluded that the Singapore dollar will appreciate versus the

US dollar in the coming days, probably to about $ S $ He has the following

options on the Singapore dollar to choose from:

a Should Samuel buy a put on Singapore dollars or a call on Singapore dollars?

b What is Samuel's breakeven price on the option purchased in part a

c What is Samuel's gross profit and net profit including premium if the ending

spot rate is $$

d What is Samuel's gross profit and net profit including premium if the ending

spot rate is $$

Problem Paulo's Puts. Paulo writes a put option on Japanese yen with a strike price

of at a premium of per yen and with an expiration date

six month from now. The option is for What is Paulo's profit or loss at

maturity if the ending spot rates are and

$

Problem Amber McClain, Amber McClain, the currency speculator we met earlier

in the chapter,sells eight June futures contracts for pesos at the closing price

quoted in Exhibit

a What is the value of her position at maturity if the ending spotrate is $

b What is the value of her position at maturity if the ending spotrate is $

c What is the value of her position at maturity if the ending spotrate is $

Problem Black River Investments. Jennifer Magnussen, a currency trader for

Chicagobased Black River Investments, uses the following futures quotes on the British

pound to speculate on the value of the British pound.Exercises:

Chapter

a If Jennifer buys June pound futures, and the spot rate at maturity is

$pound what is the value of her position?

b If Jennifer sells March pound futures, and the spot rate at maturity is

$ pound, what is the value of her position?

c If Jennifer buys March pound futures, and the spot rate at maturity is

$ pound, what is the value of her position?

d If Jennifer sells June pound futures, and the spot rate at maturity is

$ pound, what is the value of her position?:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started