PLEASE ANSWER ALL

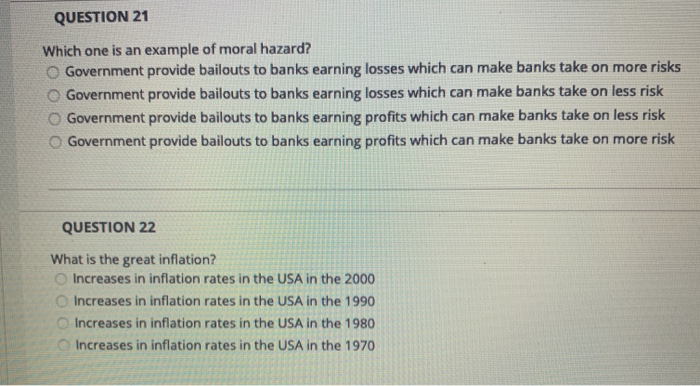

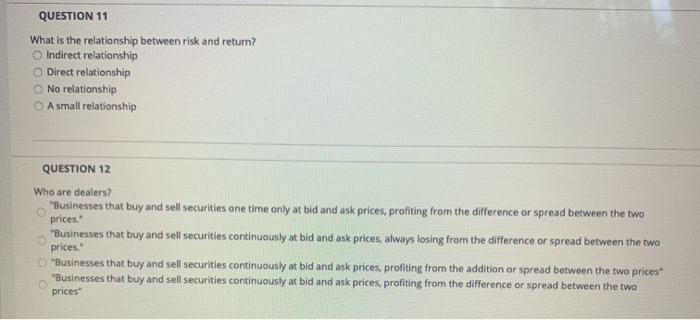

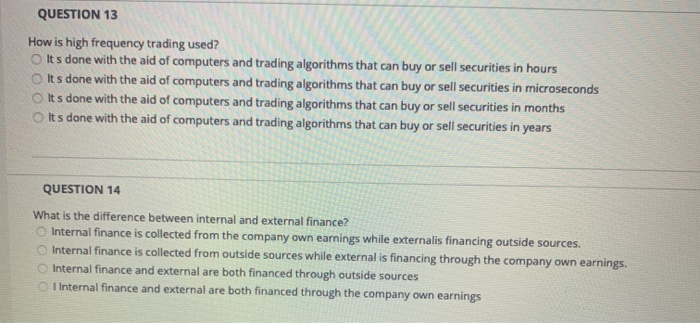

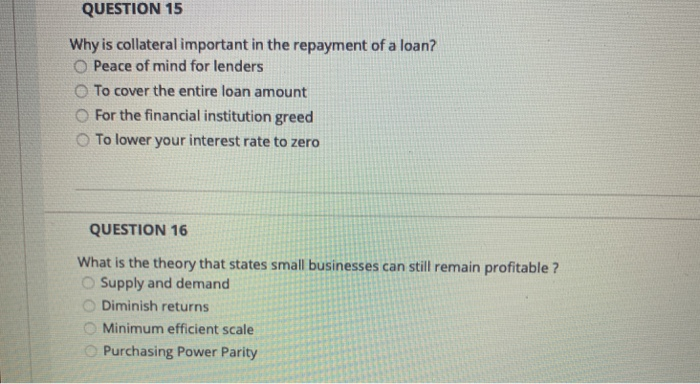

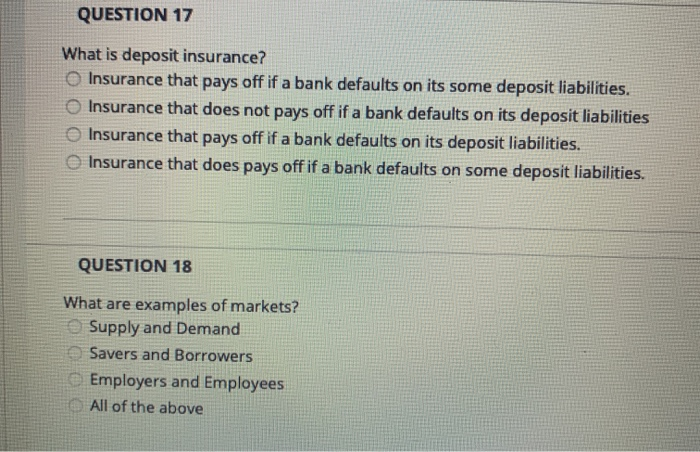

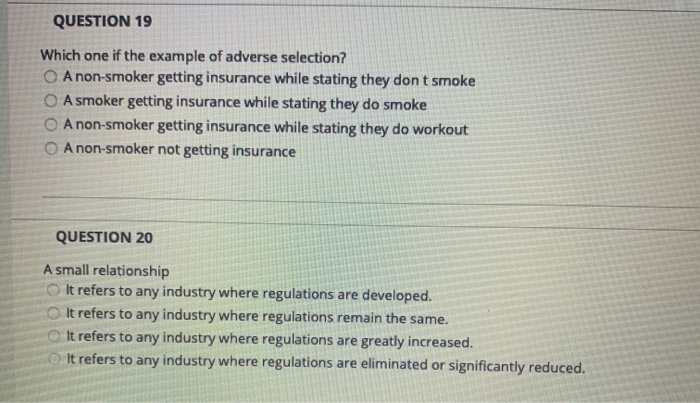

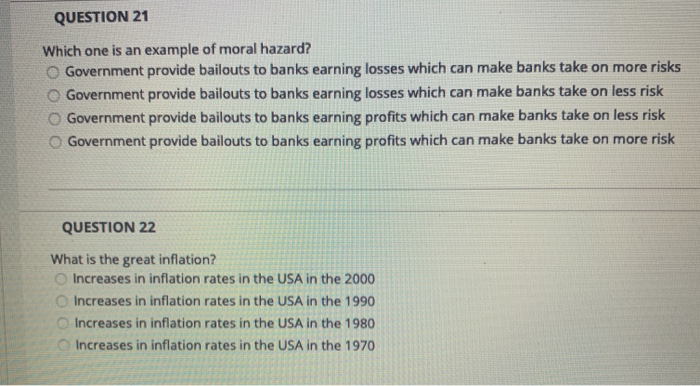

QUESTION 11 What is the relationship between risk and return? Indirect relationship Direct relationship No relationship A small relationship QUESTION 12 Who are dealers? "Businesses that buy and sell securities one time only at bid and ask prices, profiting from the difference or spread between the two prices. "Businesses that buy and sell securities continuously at bid and ask prices, always losing from the difference or spread between the two prices. O "Businesses that buy and sell securities continuously at bid and ask prices, profiting from the addition or spread between the two prices" "Businesses that buy and sell securities continuously at bid and ask prices, profiting from the difference or spread between the two prices" QUESTION 13 How is high frequency trading used? o Its done with the aid of computers and trading algorithms that can buy or sell securities in hours O its done with the aid of computers and trading algorithms that can buy or sell securities in microseconds olts done with the aid of computers and trading algorithms that can buy or sell securities in months Its done with the aid of computers and trading algorithms that can buy or sell securities in years QUESTION 14 What is the difference between internal and external finance? Internal finance is collected from the company own earnings while externalis financing outside sources. Internal finance is collected from outside sources while external is financing through the company own earnings. Internal finance and external are both financed through outside sources I Internal finance and external are both financed through the company own earnings QUESTION 15 Why is collateral important in the repayment of a loan? O Peace of mind for lenders To cover the entire loan amount For the financial institution greed To lower your interest rate to zero QUESTION 16 What is the theory that states small businesses can still remain profitable ? Supply and demand Diminish returns Minimum efficient scale Purchasing Power Parity QUESTION 17 What is deposit insurance? Insurance that pays off if a bank defaults on its some deposit liabilities. Insurance that does not pays off if a bank defaults on its deposit liabilities Insurance that pays off if a bank defaults on its deposit liabilities. Insurance that does pays off if a bank defaults on some deposit liabilities. QUESTION 18 What are examples of markets? Supply and Demand Savers and Borrowers Employers and Employees All of the above QUESTION 19 Which one if the example of adverse selection? O A non-smoker getting insurance while stating they dont smoke A smoker getting insurance while stating they do smoke O A non-smoker getting insurance while stating they do workout A non-smoker not getting insurance QUESTION 20 A small relationship It refers to any industry where regulations are developed. It refers to any industry where regulations remain the same. It refers to any industry where regulations are greatly increased. It refers to any industry where regulations are eliminated or significantly reduced. QUESTION 21 Which one is an example of moral hazard? Government provide bailouts to banks earning losses which can make banks take on more risks Government provide bailouts to banks earning losses which can make banks take on less risk Government provide bailouts to banks earning profits which can make banks take on less risk Government provide bailouts to banks earning profits which can make banks take on more risk QUESTION 22 What is the great inflation? Increases in inflation rates in the USA in the 2000 Increases in inflation rates in the USA in the 1990 Increases in inflation rates in the USA in the 1980 Increases in inflation rates in the USA in the 1970

PLEASE ANSWER ALL

PLEASE ANSWER ALL