Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer ALL QUESTION PARTS! There are two questions with multiple parts each, please answer them all!! Pay close attention and use the CORRECT NUMBERS

Please answer ALL QUESTION PARTS! There are two questions with multiple parts each, please answer them all!! Pay close attention and use the CORRECT NUMBERS that the question provides, and please SHOW ALL WORK.

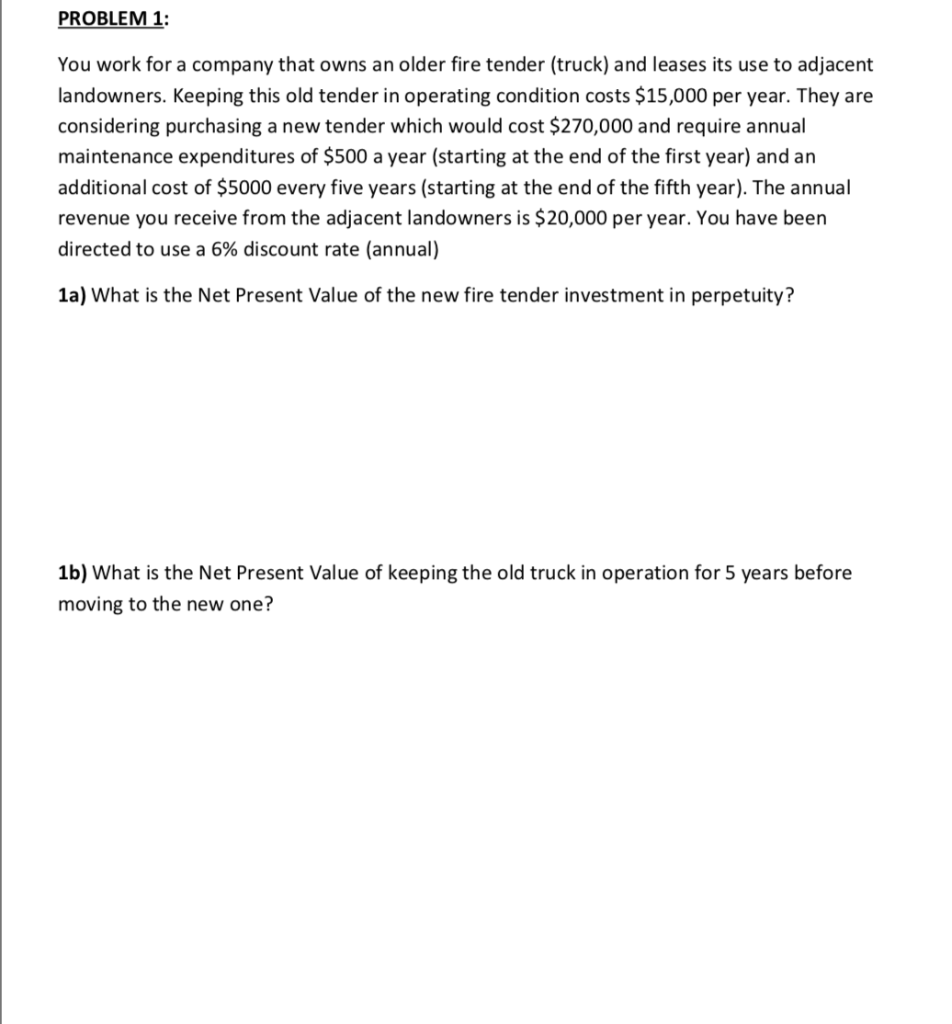

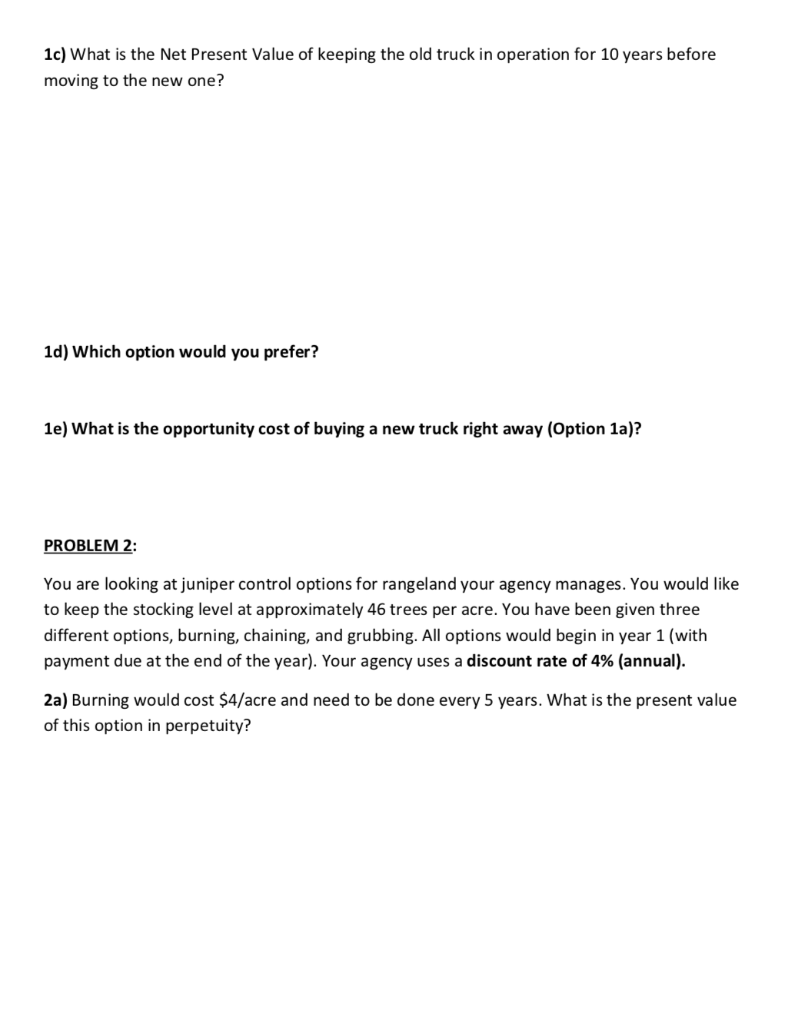

PROBLEM 1 You work for a company that owns an older fire tender (truck) and leases its use to adjacent landowners. Keeping this old tender in operating condition costs $15,000 per year. They are considering purchasing a new tender which would cost $270,000 and require annual maintenance expenditures of $500 a year (starting at the end of the first year) and an additional cost of $5000 every five years (starting at the end of the fifth year). The annual revenue you receive from the adjacent landowners is $20,000 per year. You have been directed to use a 6% discount rate (annual) 1a) What is the Net Present Value of the new fire tender investment in perpetuity? 1b) What is the Net Present Value of keeping the old truck in operation for 5 years before moving to the new one? 1c) What is the Net Present Value of keeping the old truck in operation for 10 years before moving to the new one? 1d) Which option would you prefer? 1e) What is the opportunity cost of buying a new truck right away (Option 1a)? PROBLEM You are looking at juniper control options for rangeland your agency manages. You would like to keep the stocking level at approximately 46 trees per acre. You have been given three different options, burning, chaining, and grubbing. All options would begin in year 1 (with payment due at the end of the year). Your agency uses a discount rate of 4% (annual). 2a) Burning would cost $4/acre and need to be done every 5 years. What is the present value of this option in perpetuity? 2b) Chaining would cost $17/acre and need to be done every 15 years. What is the present value of this option in perpetuity? 2c) Grubbing would cost $7/acre and need to be done every 8 years. What is the present value of this option in perpetuity? 2d) You decide to go with grubbing. What is the opportunity cost of this decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started