Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all question would rate thank you In practice, when firms make significant investments, calculating the NPV or IRR is only the first step

please answer all question would rate thank you

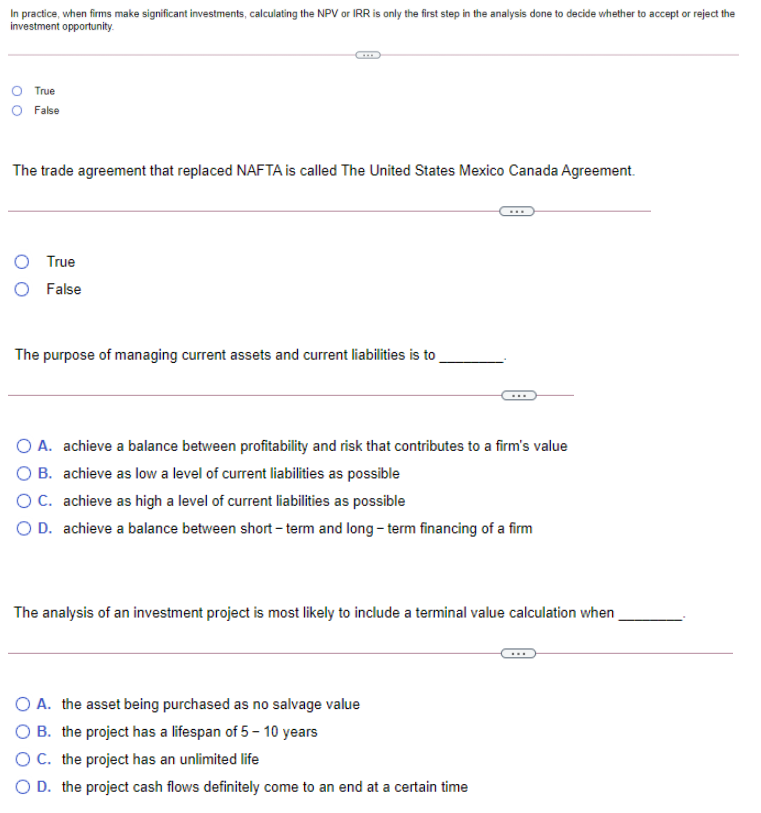

In practice, when firms make significant investments, calculating the NPV or IRR is only the first step in the analysis done to decide whether to accept or reject the investment opportunity True False The trade agreement that replaced NAFTA is called The United States Mexico Canada Agreement. True O False The purpose of managing current assets and current liabilities is to O A. achieve a balance between profitability and risk that contributes to a firm's value OB. achieve as low a level of current liabilities as possible OC. achieve as high a level of current liabilities as possible OD. achieve a balance between short-term and long-term financing of a firm The analysis of an investment project is most likely to include a terminal value calculation when O A. the asset being purchased as no salvage value OB. the project has a lifespan of 5 - 10 years OC. the project has an unlimited life OD. the project cash flows definitely come to an end at a certain timeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started