Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL QUESTIONS 1-4 (For questions 1-2, use the exhibit 8 picture for the question) Present Value of Amounts Due Tommy John is going

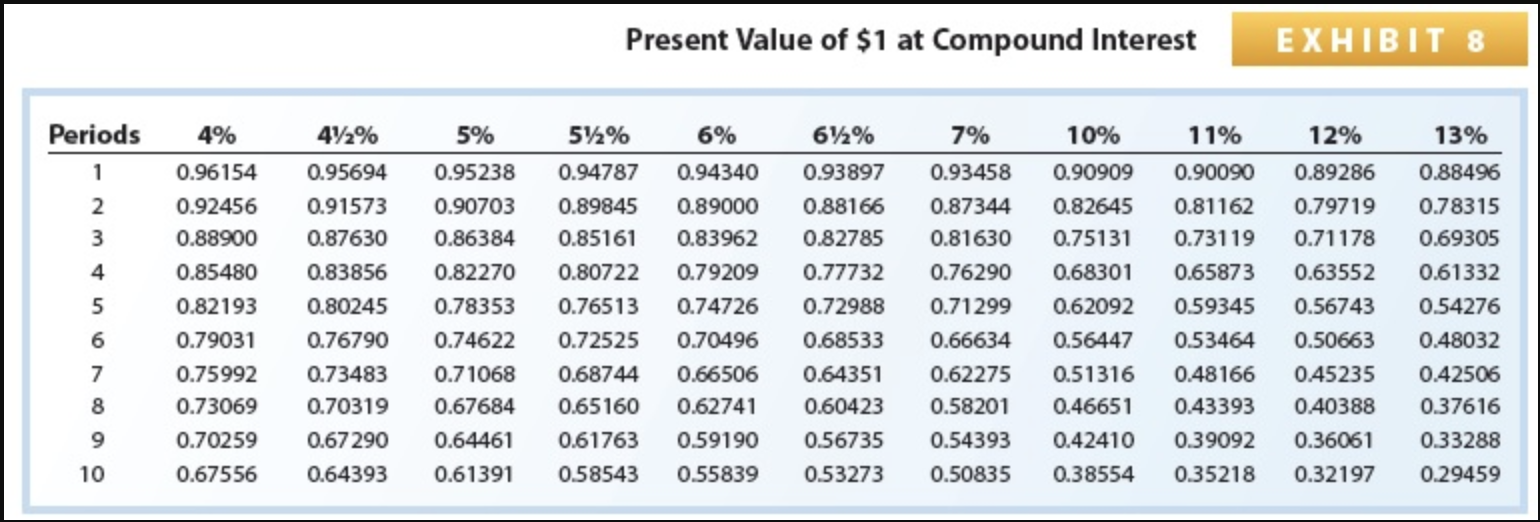

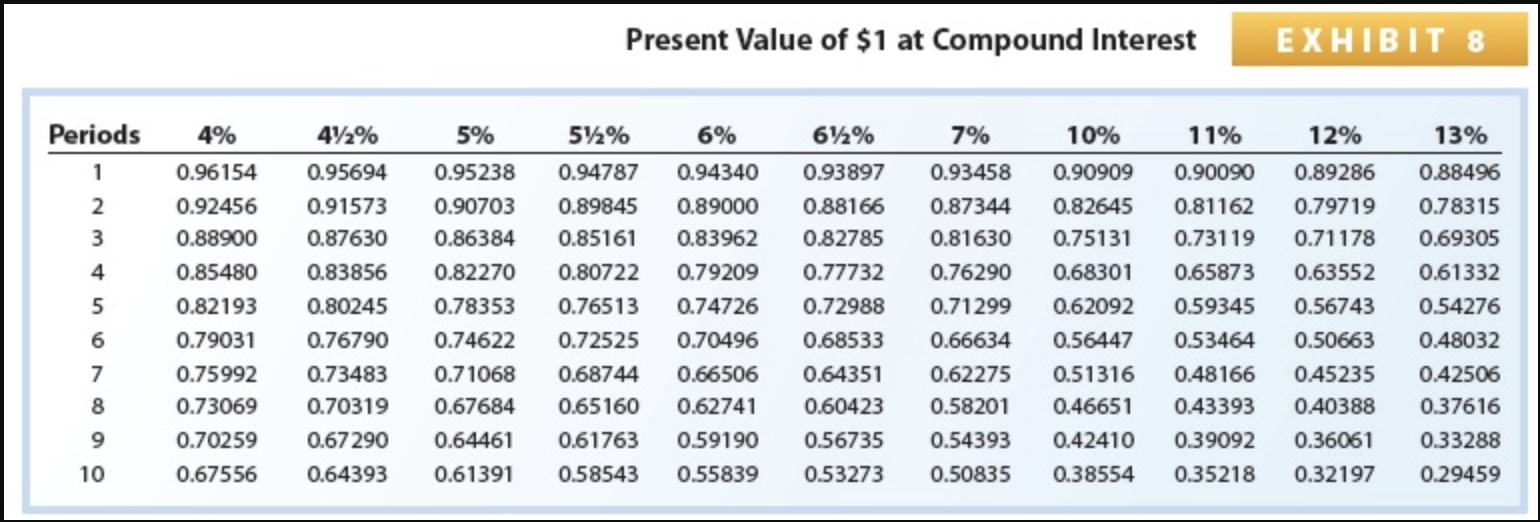

PLEASE ANSWER ALL QUESTIONS 1-4 (For questions 1-2, use the exhibit 8 picture for the question)

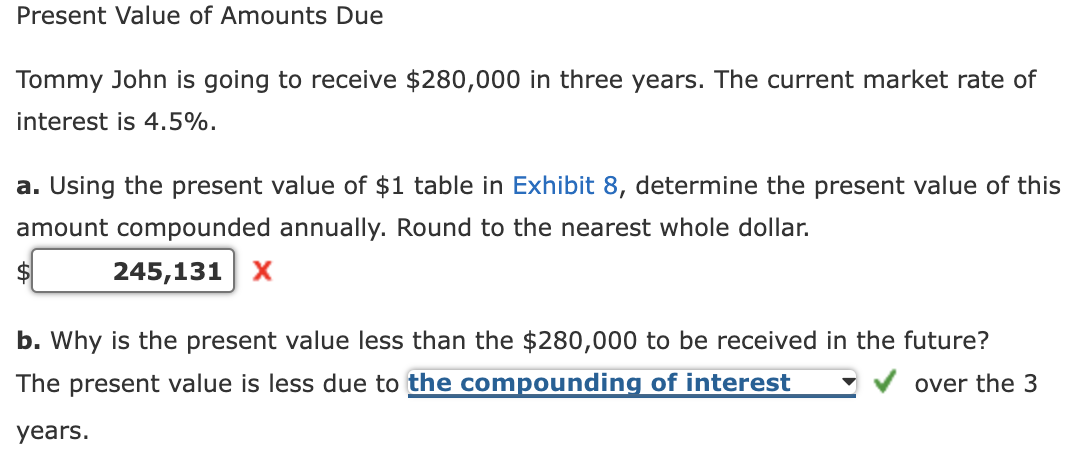

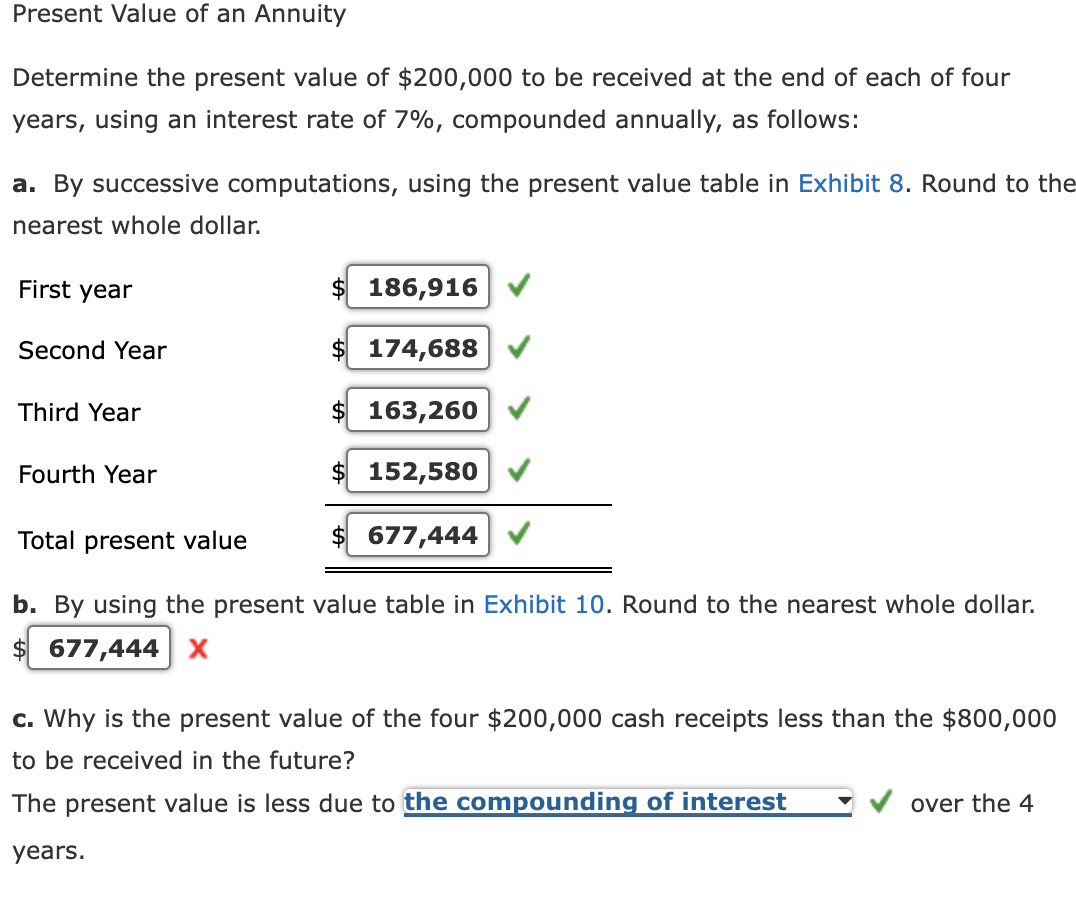

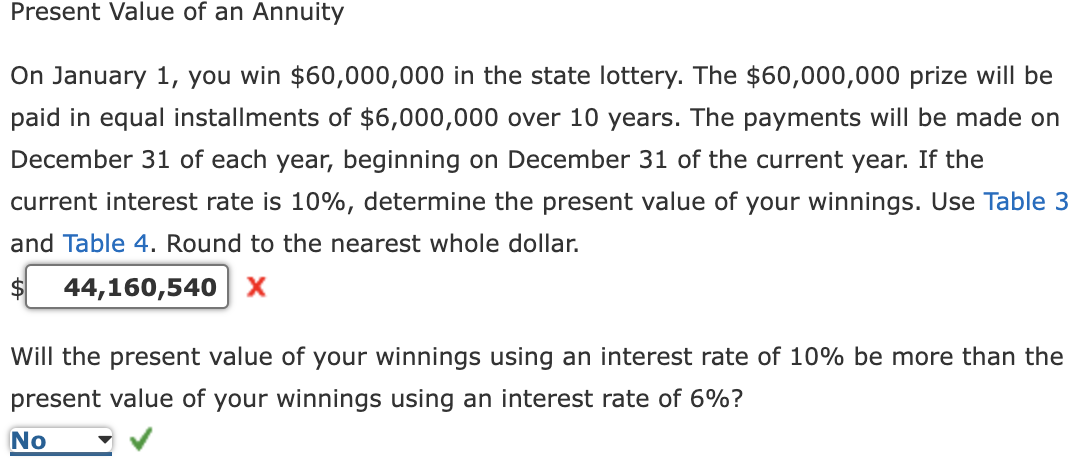

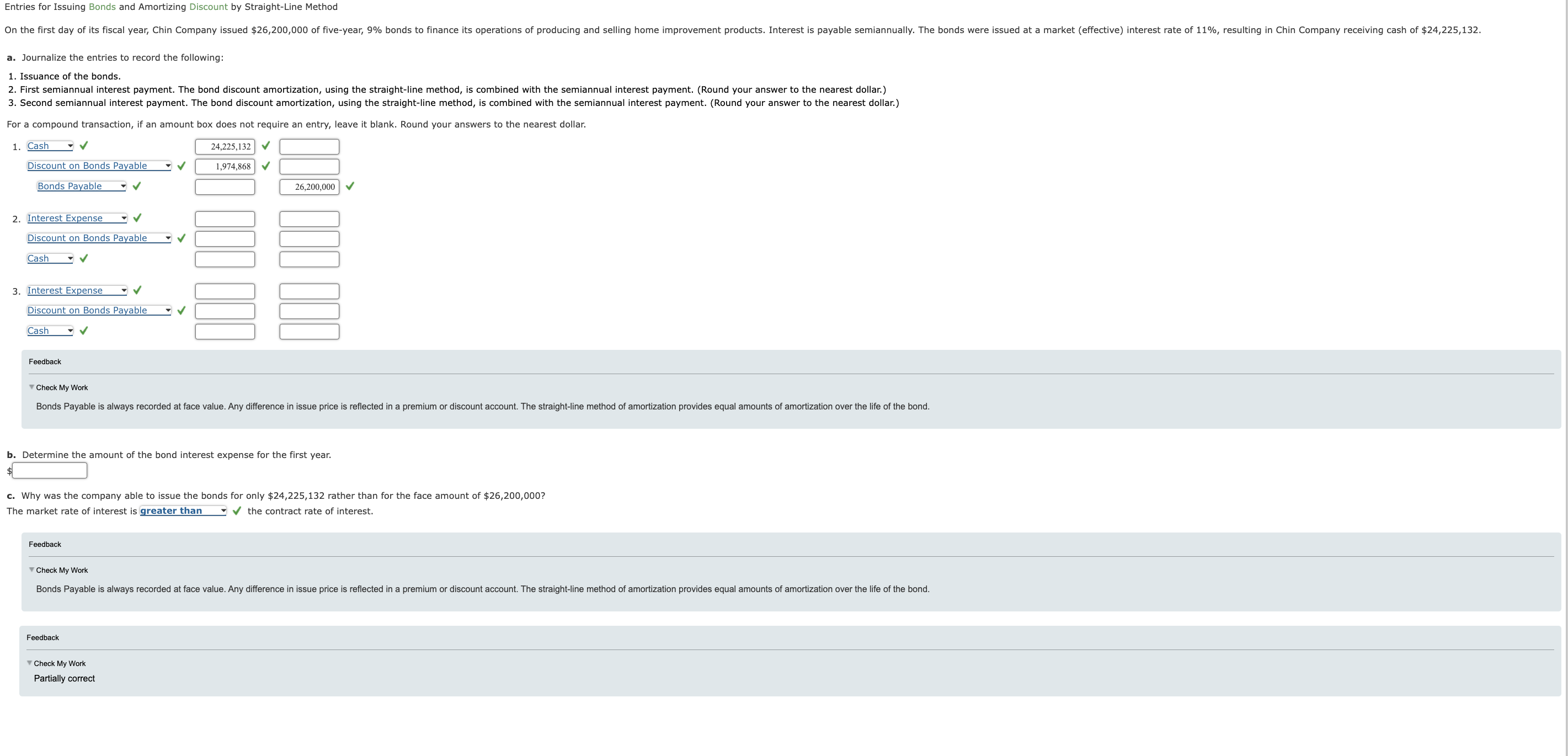

Present Value of Amounts Due Tommy John is going to receive $280,000 in three years. The current market rate of interest is 4.5%. a. Using the present value of $1 table in Exhibit 8, determine the present value of this amount compounded annually. Round to the nearest whole dollar. $ X b. Why is the present value less than the $280,000 to be received in the future? The present value is less due to : over the 3 years. Present Value of $1 at Compound Interest Present Value of an Annuity Determine the present value of $200,000 to be received at the end of each of four years, using an interest rate of 7%, compounded annually, as follows: a. By successive computations, using the present value table in Exhibit 8 . Round to the nearest whole dollar. = b. By using the present value table in Exhibit 10. Round to the nearest whole dollar. $X c. Why is the present value of the four $200,000 cash receipts less than the $800,000 to be received in the future? The present value is less due to over the 4 years. Present Value of $1 at Compound Interest On January 1 , you win $60,000,000 in the state lottery. The $60,000,000 prize will be paid in equal installments of $6,000,000 over 10 years. The payments will be made on December 31 of each year, beginning on December 31 of the current year. If the current interest rate is 10%, determine the present value of your winnings. Use Table 3 and Table 4. Round to the nearest whole dollar. $ X Will the present value of your winnings using an interest rate of 10% be more than the present value of your winnings using an interest rate of 6% ? a. Journalize the entries to record the following: 1. Issuance of the bonds. For a compound transaction, if an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar. Feedback Check My Work h. Determine the amount of the bond interest expense for the first year. c. Why was the company able to issue the bonds for only $24,225,132 rather than for the face amount of $26,200,000 ? The market rate of interest is the contract rate of interest. Feedback Check My WorkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started