Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions 3,4&5 3. (20 points) Acadia Inc. manufactures sail boats and fishing boats, Acadia uses a specialized equipment ta produce the fiberglass

Please answer all questions 3,4&5

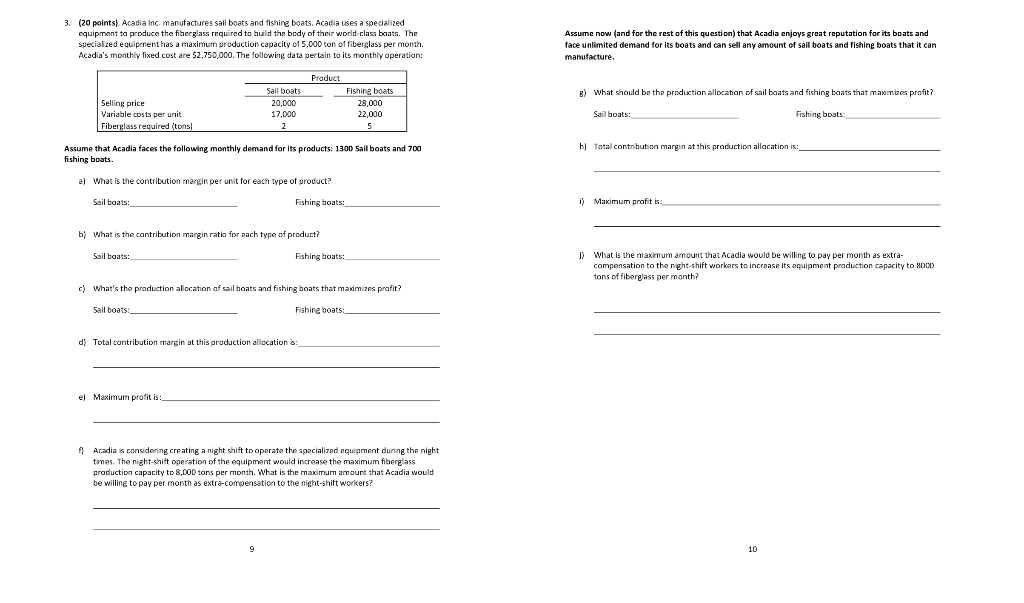

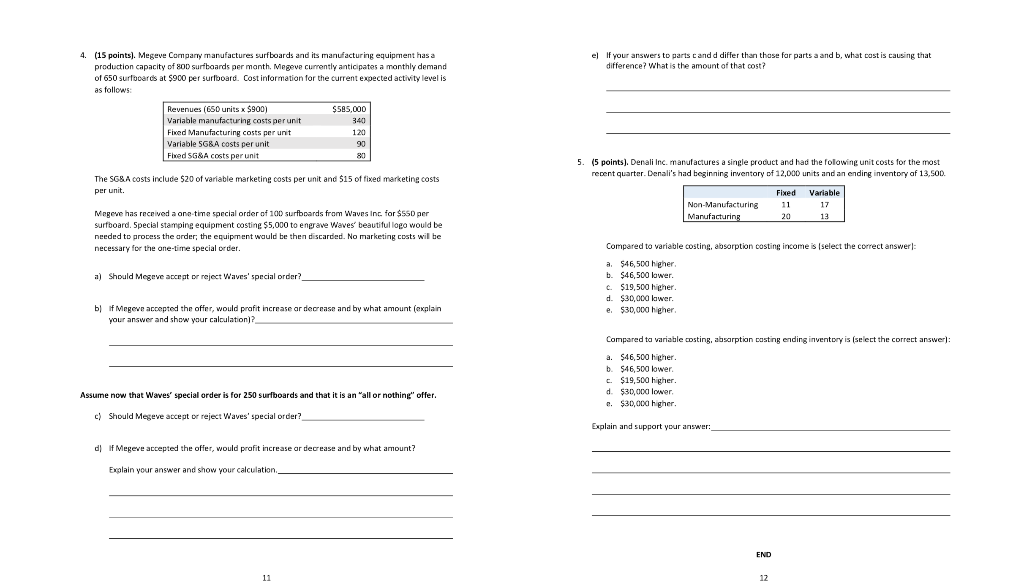

3. (20 points) Acadia Inc. manufactures sail boats and fishing boats, Acadia uses a specialized equipment ta produce the fiberglass required to build the body of their world class boats. The specialized equipment has a maximum production capacity of 5.000 ton of fiberglass per month. Acadia's monthly fixed cost are $2,750,000. The following data pertain to its monthly operation: Assume now (and for the rest of this question) that Acadia enjoys great reputation for its boats and face unlimited demand for its boats and can sell any amount of sail boats and fishing boats that it can manufacture. Product B) What should be the production allocation of sail baats and fishing boats that maximizes profit? Selling price Variable costs per unit Fiberglass required (tons! Sailboats 20,000 17,000 2 Fishine boats 28,000 22,000 5 Sailboats: Fishing boats: h] Tatal contribution margin at this production allocation is Assume that Acadla faces the following monthly demand for its products: 1300 Sailboats and 700 fishing boats. a) What is the contribution margin per unit for each type of product? Sailboats: Fishing boats: i) Maximum profit is: b) What is the contribution margin ratia for each type of product? Sailboats: Fishing boats: i) What is the maximum amount that Acadia would be willing to pay per month as extra- compensation to the night-shift workers to increase its equipment production capacity to 8000 tons of fiberglass per month? c) What's the production allocation of sail boats and fishing boats that maximizes prafit? Sailboats: Fishing boats d) Total contribution margin at this production allocation is el Maximum profit is: f] Acadia is considering creating a night shift to operate the specialized equipment during the night times. The night-shift operation of the equipment would increase the maximum fiberglass production capacity to 8,000 tons per month. What is the maximum amount that Acadia would be willing to pay per month as extra-compensation to the night-shift workers? 9 10 el If your answers to parts cand d differ than those far parts a and b, what cost is causing that difference? What is the amount of that cost? 4. (15 points). Megeve Company manufactures surfboards and its manufacturing equipment has a production capacity of 80D surfboards per month. Megeve currently anticipates a monthly demand of 650 surfboards at $900 per surfboard. Cost information for the current expected activity level is as follows Revenues (650 units x $900) Variable manufacturing costs per unit Fixed Manufacturing costs per unit Variable 5G&A costs per unit Fixed SG&A costs per unit $585,000 340 120 90 80 The SG&A costs include $20 of variable marketing costs per unit and $15 of fixed marketing costs per unit 5. (5 points). Denali Inc. manufactures a single product and had the following unit costs for the most recent quarter. Denali's had beginning inventory of 12,000 units and an ending inventory of 13,500. Fixed Variable Non-Manufacturing 11 17 Manufacturing 20 13 Megeve has received a one time special order of 100 surfboards from Waves Inc. for $50 per surfboard. Special stamping equipment costing $5,000 to engrave Waves' beautiful logo would be needed to process the order; the equipment would be then discarded. No marketing costs will be necessary for the one-time special order. a) should Megeve acceat or reject Waves' special order? Compared to variable costing, absorption costing income is select the correct answer): a. $46,500 higher b. $46,500 lower. c. $19,500 higher d. $30,000 lower e. $30,000 higher bl if Megeve accepted the offer, would profit increase ar decrease and by what amount (explain your answer and show your calculation? Compared ta variable costing, absorption casting ending inventory is (select the correct answer): a. $46,500 higher b. $46,500 lower C. $19,500 higher d. $30,000 lower c. $30,000 higher Assume now that Waves' special order is for 250 surfboards and that it is an "all or nothing" offer. c) Should Megeve accept or reject Waves' special order? Explain and support your answer: d! If Megeve accepted the offer, would profit increase ar decrease and by what amount? Explain your answer and show your calculation END 11 12 3. (20 points) Acadia Inc. manufactures sail boats and fishing boats, Acadia uses a specialized equipment ta produce the fiberglass required to build the body of their world class boats. The specialized equipment has a maximum production capacity of 5.000 ton of fiberglass per month. Acadia's monthly fixed cost are $2,750,000. The following data pertain to its monthly operation: Assume now (and for the rest of this question) that Acadia enjoys great reputation for its boats and face unlimited demand for its boats and can sell any amount of sail boats and fishing boats that it can manufacture. Product B) What should be the production allocation of sail baats and fishing boats that maximizes profit? Selling price Variable costs per unit Fiberglass required (tons! Sailboats 20,000 17,000 2 Fishine boats 28,000 22,000 5 Sailboats: Fishing boats: h] Tatal contribution margin at this production allocation is Assume that Acadla faces the following monthly demand for its products: 1300 Sailboats and 700 fishing boats. a) What is the contribution margin per unit for each type of product? Sailboats: Fishing boats: i) Maximum profit is: b) What is the contribution margin ratia for each type of product? Sailboats: Fishing boats: i) What is the maximum amount that Acadia would be willing to pay per month as extra- compensation to the night-shift workers to increase its equipment production capacity to 8000 tons of fiberglass per month? c) What's the production allocation of sail boats and fishing boats that maximizes prafit? Sailboats: Fishing boats d) Total contribution margin at this production allocation is el Maximum profit is: f] Acadia is considering creating a night shift to operate the specialized equipment during the night times. The night-shift operation of the equipment would increase the maximum fiberglass production capacity to 8,000 tons per month. What is the maximum amount that Acadia would be willing to pay per month as extra-compensation to the night-shift workers? 9 10 el If your answers to parts cand d differ than those far parts a and b, what cost is causing that difference? What is the amount of that cost? 4. (15 points). Megeve Company manufactures surfboards and its manufacturing equipment has a production capacity of 80D surfboards per month. Megeve currently anticipates a monthly demand of 650 surfboards at $900 per surfboard. Cost information for the current expected activity level is as follows Revenues (650 units x $900) Variable manufacturing costs per unit Fixed Manufacturing costs per unit Variable 5G&A costs per unit Fixed SG&A costs per unit $585,000 340 120 90 80 The SG&A costs include $20 of variable marketing costs per unit and $15 of fixed marketing costs per unit 5. (5 points). Denali Inc. manufactures a single product and had the following unit costs for the most recent quarter. Denali's had beginning inventory of 12,000 units and an ending inventory of 13,500. Fixed Variable Non-Manufacturing 11 17 Manufacturing 20 13 Megeve has received a one time special order of 100 surfboards from Waves Inc. for $50 per surfboard. Special stamping equipment costing $5,000 to engrave Waves' beautiful logo would be needed to process the order; the equipment would be then discarded. No marketing costs will be necessary for the one-time special order. a) should Megeve acceat or reject Waves' special order? Compared to variable costing, absorption costing income is select the correct answer): a. $46,500 higher b. $46,500 lower. c. $19,500 higher d. $30,000 lower e. $30,000 higher bl if Megeve accepted the offer, would profit increase ar decrease and by what amount (explain your answer and show your calculation? Compared ta variable costing, absorption casting ending inventory is (select the correct answer): a. $46,500 higher b. $46,500 lower C. $19,500 higher d. $30,000 lower c. $30,000 higher Assume now that Waves' special order is for 250 surfboards and that it is an "all or nothing" offer. c) Should Megeve accept or reject Waves' special order? Explain and support your answer: d! If Megeve accepted the offer, would profit increase ar decrease and by what amount? Explain your answer and show your calculation END 11 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started