Answered step by step

Verified Expert Solution

Question

1 Approved Answer

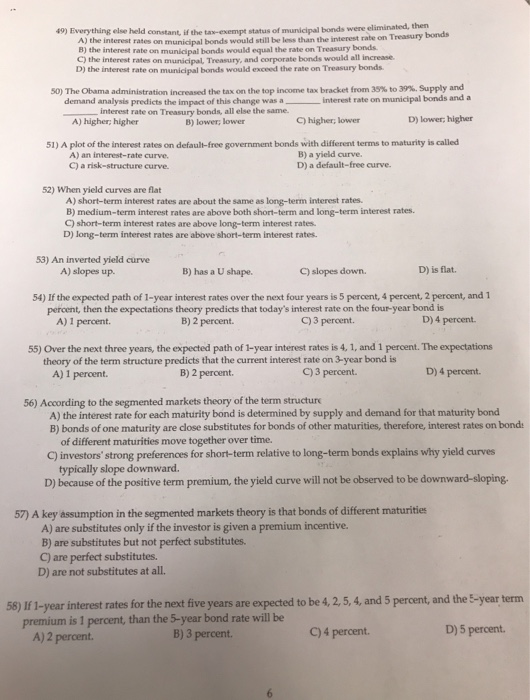

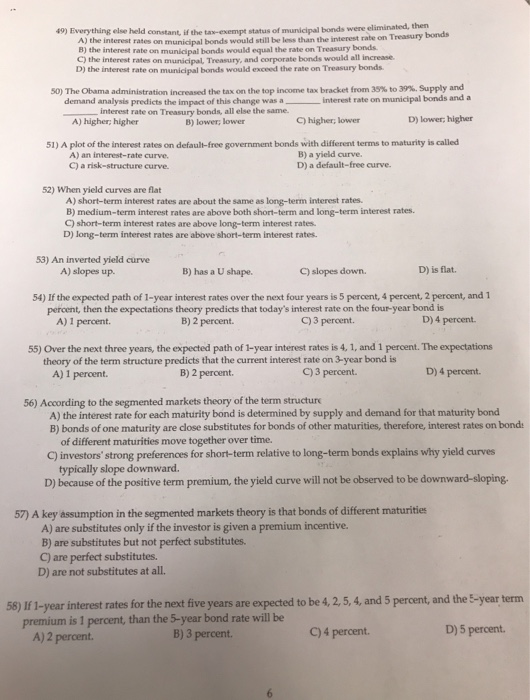

Please answer all questions. 49 liverything else held constant. the exempt status of municipal bonds were eliminated, then A) the interest rates on municipal bonds

Please answer all questions.

49 liverything else held constant. the exempt status of municipal bonds were eliminated, then A) the interest rates on municipal bonds would still be less than the interest rate on Treasury bonds B) the interest rate on municipal bands would equal the rate on Treasury bonds C) the interest rates on municipal Treasury, and corporate bonds would all increase D) the interest rate on municipal bonds would exceed the rate on Treasury bonds 50) The Obama administration increased the tax on the top income tax bracket from 39% to 9%. Supply and demand analysis predicts the impact of this change was a _Interest rate on municipal bonds and a interest rate on Treasury bonds, all else the same. A) higher; higher B) lower lower C) higher; lower D) lower; higher 51) A plot of the interest rates on default-free government bonds with different terms to maturity is called A) an interest rate curve B) a yield curve C) a risk-structure curve D) a default-free curve 52) When yield curves are flat A) short-term interest rates are about the same as long-term interest rates B) medium-term interest rates are above both short-term and long-term interest rates. short-term interest rates are above long-term interest rates D) long-term interest rates are above short-term interest rates 53) An inverted yield curve A) slopes up B) has a U shape. C) slopes down. D) is flat 54) If the expected path of 1-year interest rates over the next four years is 5 percent, 4 percent, 2 percent, and 1 percent, then the expectations theory predicts that today's interest rate on the four-year bond is A) 1 percent. B) 2 percent. C) 3 percent. D) 4 percent 55) Over the next three years, the expected path of 1-year interest rates is 4, 1, and 1 percent. The expectations theory of the term structure predicts that the current interest rate on 3-year bond is A) 1 percent. B) 2 percent. C) 3 percent. D) 4 percent 56) According to the segmented markets theory of the term structure A) the interest rate for each maturity bond is determined by supply and demand for that maturity bond B) bonds of one maturity are close substitutes for bonds of other maturities, therefore, interest rates on bonde of different maturities move together over time. C) investors' strong preferences for short-term relative to long-term bonds explains why yield curves typically slope downward. D) because of the positive term premium, the yield curve will not be observed to be downward-sloping 57) A key assumption in the segmented markets theory is that bonds of different maturities A) are substitutes only if the investor is given a premium incentive B) are substitutes but not perfect substitutes. C) are perfect substitutes. D) are not substitutes at all. 58) If 1-year interest rates for the next five years are expected to be 4, 2, 5, 4, and 5 percent, and the 5-year term premium is 1 percent, than the 5-year bond rate will be A) 2 percent B) 3 percent C) 4 percent D) 5 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started